Find the Best Personal Instalment Loans in Hong Kong

Updated: 6 Aug 2025

Personal Installment Loans

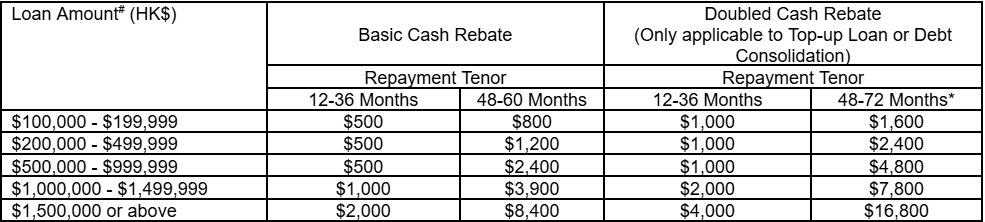

- Online application with 24/7 instant approval and loan disbursement

- No income proof is required

- Repayment terms up to 72 months

- No handling fee, no early settlement fee

- Only applicable to eligible customers. For more loan and offer details, please visit the PrimeCredit website

- All examples and information of interest rate are for reference only, and final approval is subject to actual circumstances of individual personal loan applicant

(1) HKID Card

(2) Proof of address: such as utility bills, bank statements, etc., which need to show your name and most recent address.

(3) (Optional) Proof of income can be waived (subject to meeting credit record requirements)

- Warning: You have to repay your loans. Don't pay any intermediaries

- Enquiry and Complaint Hotline: 2111 2999

- Money Lender's Licence No.: 647/2025

- Open a Mox Account successfully with the invitation code "MHCASH10", successfully apply for Mox Instant Loan via MoneyHero from now till 1 September 2025, after successful approval to enjoy up to HK$4,500 MoneyHero Exclusive Offer.

- Existing Mox customers can also earn HK$1,000 upon a successful loan application of HK$70,000 or above !

- The APR in app is "What you see what you get ", which means we are very transparent of the rate we can offer, compared to other banks that need to wait few hours or days to get the quotation.

- A guranteed 3.33% apr for all instant loan 500k, regardless of tenor

- Convenient to apply - in app, 24/7. Get your application result instantly, Get the cash as quick as one second to your Mox Account upon approval

- HKD 0 handling fee, receive the loan for the exact amount you apply for

- A flexible repayment period from 3 to 60 months

- Live chat available in the app if they want to know more

- Min to Max loan amount is 5k-2M

- No extra documents required apart from HKID. No extra documents required to top up instant loan. Complete the loan application in 5 mins!

- For an Instant Loan of HKD100,000 split into 60 monthly instalments, the Annualised Percentage Rate (APR) is 4.46%. With interest calculated on 365 days per year, the estimated daily interest amount is HKD6.31 (rounded to the nearest whole number).

- The fees for Instant Loan will be reviewed from time to time. General terms and conditions (in particular, Part B: Instant Loan of Schedule 3) and the Instant Loan Key Facts Statement apply. Details are available in the ‘Legal documents’ section of our website.

HKID

- You need to have a Mox Credit account. Your maximum loan amount depends on your available credit limit.

- Instant Loan Cash Reward Promotion Terms and Conditions apply. For an Instant Loan on a Mox Credit transaction of HKD500,000 spilt into 60 monthly instalments, the Annualised Percentage Rate (APR) is as low as 2.90% (which includes the cash reward of HKD6,888 which will be credited to your Mox Account on or before 31 July 2025), while the APR excluding cash rewards of Instant Loan Cash Reward Promotion is as low as 3.47%. If you apply to top up your active Instant Loan(s), the Eligible Instant Loan Amount applicable for this promotion will be additionally borrowed principal amount on top of the outstanding principal amount of your active Instant Loan(s)

- The fees for Instant Loan will be reviewed from time to time. General terms and conditions (in particular, Part B: Instant Loan of Schedule 3) and the Instant Loan Key Facts Statement apply. Details are available in the ‘Legal documents’ section of our website.

- The actual turnaround time may vary depending on the actual circumstances of individual applications.

- Terms and conditions apply, please refer to Mox website or Mox app for details.

- To borrow or not to borrow? Borrow only if you can repay!

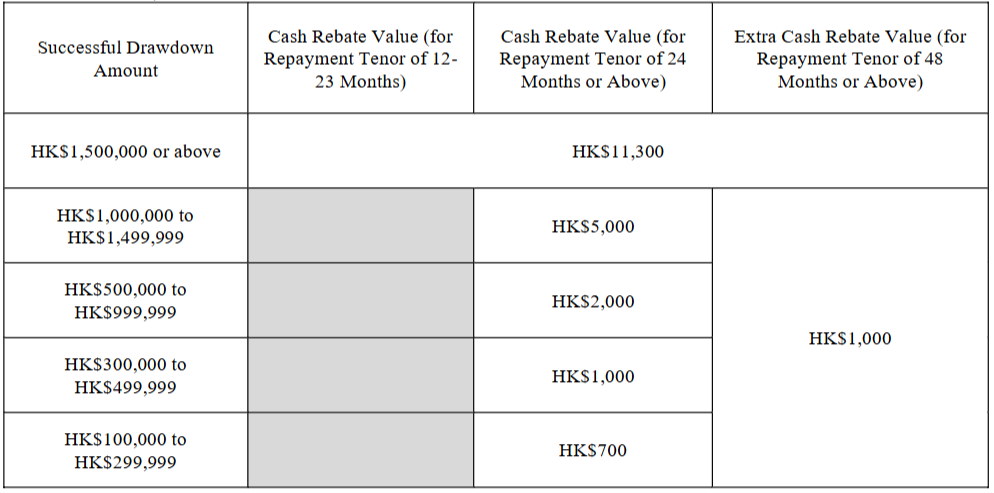

- Enjoy Cash Reward up to HK$33,800 upon successfully draw down

- Accurately calculate the customer's income and repayment ability using A.I. and big data

- Income and address proof waiver when borrowing HK$300,000 or below

- A.I. fully automated loan with simplified loan process; from application, approval to disbursement, all done online.

- A.I. processes loan quickly, cash is transferred automatically and instantly once the loan is confirmed.

- Utilizing A.I. big data to calculate personalized quotations, ensuring the loan amount based on your needs.

- WeScore new credit indicator, assist you to restore long term financial health by using 400 million sets of data!

(1) HKID Card

(2) Mobile phone

(3) ATM card

Parts of the cash rebate will be distributed by WeLab Bank, all cash rebate is subject to the terms & conditions.

- The above interest rates and repayment information are for reference only. The final terms will be determined based on the customer's application information and personal credit records.

- WELEND LIMITED reserves its absolute right on any loan approval decision and any disputes.

- Warning: You have to repay your loans. Don’t pay any intermediaries.

- Customer Service/ Complaint Hotline: 3590 6396

- Money Lender's License: 0900/2025

- Monthly flat rate as low as 0.11% (Annualised percentage rate: 6.38%)

- The Loan Set Up Fee is 2% of the loan amount. The Loan Set Up Fee shall be calculated by reference to the principal amount of the loan at the rate specified by the Bank from time to time and shall be deducted from the loan principal amount upon drawdown of the loan and is non-refundable

- High loan amount up to HK$2,000,000 or 21x monthly salary (whichever is lower)

- Flexible repayment period of up to 84 months

- Reduce interest expense by up to 93%

- No income proof is required

1. HKID card

2. Latest 3 months’ income proof

3. Address proof (issue date within 6 months)

4. Practicing certificate issued by relevant association, if you are a professional (e.g. medical doctor, accountant, lawyer or engineer)

5. Banking statement / passbook showing your name and account number

- APR is calculated in accordance with the guideline issued in respect of the Code of Banking Practice and is rounded to the nearest two decimal places. An APR is a reference rate, which includes all applicable interest rates, fees and charges of the product, expressed as an annualized rate. The APR in the above table has included Loan Set Up Fee of 2% in the calculation. Loan Set Up Fee shall be deducted from the loan principal amount upon draw down of the loan and is non-refundable

- Terms and conditions apply. For details, please visit DBS website

- The above information is for reference only, the final approved interest rate, loan amount and instalment period are subject to the financial condition of customers.

- To borrow or not to borrow? Borrow only if you can repay!

- Relevant fee applies if a customer early pays off the Loan. For details, please refer to the Personal Instalment Loan Terms and Conditions.

- APR as low as 1.88%

- Loan amount up to HK$2,000,000 or 20X of your monthly salary (whichever is lower)

- Repayment tenor up to 60 months

- Personal Identification Document: HKID card or passport

- Income Proof: Recent pay slip, your bank statement or bank book (with your name and account number) showing your recent income, your recent income tax bill, proof of your last MPF contribution, employment letter or contract, etc.

- Address Proof: Recent bank statement, credit card statement, water bill, telephone bill etc. If your address is shown on your income proof, you will be exempted from submitting the address proof.

- Other documents (if necessary)

- For more details, please click here

- APR is calculated according to the method set out in the relevant guidelines under the Code of Banking Practice issued by the Hong Kong Association of Banks as the basis.

- If the loan amount is $1,500,000, the monthly flat rate for 12 months is 0.063%, if the loan is approved finally by the Company, the APR for 12 months is 3.30%, with a handling fee of 1% per annum included, the total loan repayment amount is HK$1,511,340.

- Example is for reference only, APR may differ with different loan amounts and tenors.

- For enquiries, please refer to OCBC Bank (Hong Kong) Limited - Personal Loan website.

- To borrow or not to borrow? Borrow only if you can repay!

- APR as low as 1.5%

- Handling fee wavier

- Loan amount up to HK$3,000,000 or 12 times of monthly salary (whichever is lower)

- APR 1.50% is only applicable to Private Banking or Private Wealth customers of the Bank whose latest Credit Score of TransUnion is within AA grade, loan amount of HK$3,000,000 with 6 months repayment period, and holding a valid HK$ Savings Account / Checking Account in the Bank as repayment account

- The APR is calculated according to the standard of Hong Kong Association of Banks and rounded to two decimal places. An APR is a reference rate which includes the basic interest rates and other applicable fees and charges of the product expressed as an annualized rate. Interest is charged daily and calculated on the basis of 365 days per year

- For Personal Installment Loan amount of HK$100,000 with 12 months repayment period, the monthly flat rate is 0.27% (APR 6.11%), and the total loan repayment amount is HK$103,248 (handling fee is waived). The above example is for reference only. The loan application and terms of the loan are subject to the Bank's approval. The actual APR may vary for individual customer and the final interest rate will be subject to credit condition of the customer

- China Construction Bank (Asia) Corporation Limited reserves the right of final decision on the interest rate and approval result

- To borrow or not to borrow? Borrow only if you can repay!

- The above example is for reference only. The actual APR, total interest and repayment amount may vary for individual customer and subject to the loan amount, repayment period and credit condition of the customer, please contact the staff of the Bank for details.

- Loan amount as high as HK$2,000,000 or 21 times of your monthly salary (whichever is lower)

- Loan tenor as long as 72 months with personalized interest rate

1. HKID card / passport / other identification document

2. Bank statement or passbook showing your latest 1-month income proof (including the copy of front cover page of your passbook which shows your name and account number) or any type of income proof.

Please provide the latest 2-month income proof if you are commission based income earner

3. If you are self-employed, please provide Business registration certificate and the latest profits tax demand note, and

the latest 3-month company account statements

4. Residential address proof showing your name issued within the latest 3 months (e.g. electricity bills or bank statements)

5. Proof of professional qualification (For professionals only)

6. If you are not holder of Hong Kong permanent identity card, please submit passport/ Exit/ Entry Permit for Travelling to and from Hong Kong and Macau/ identity card of place of origin and working visa issued by the Hong Kong SAR Government

7. Full copy of the front cover page of passbook / bank statement of the loan disbursement account

8. Autopay authorization form

9. Loan confirmation letter(s) or latest 1-month statement(s) (showing your name and account number) of credit

card(s) and loan(s) that you wish to transfer to $martPlus Debt Consolidation

- The APR is calculated in accordance with the practices and methods set out in the relevant guidelines issued by the Hong Kong Association of Banks. An APR is a reference rate which includes the basic interest rate and other applicable fees and charges expressed as an annualized rate. The respective APRs are rounded to the nearest two decimal places.

- Monthly flat rate as low as 0.20% (Annualized percentage rate is 6.46% with repayment tenor of 12 months and include 1% handling fee per annum).

- The examples are for reference only. The APR will be determined based on the customer's credit rating and other relevant loan approval factors, and the bank reserves the final discretion to approve the loan application and to determine the applicable interest rate and handling fee.

- Terms and conditions apply. To borrow or not to borrow? Borrow only if you can repay! Please visit the website

- Annualised Percentage Rate as low as 5.91%; APR includes the handling fee 2%

- Handling fee refers to the loan setup fee. The Loan Set Up Fee is 2% of the loan amount. The Loan Set Up Fee shall be calculated by reference to the principal amount of the loan at the rate specified by the Bank from time to time and shall be deducted from the loan principal amount upon drawdown of the loan and is non-refundable.

- Loan amount up to HK$2,000,000 or 20x monthly salary (whichever is lower), flexible repayment period of up to 60 months

- No income proof is required

- Anytime to redraw your repaid principal

1. HKID card

2. Latest 3 months’ income proof

3. Address proof (issue date within 6 months)

4. Practicing certificate issued by relevant association, if you are a professional (e.g. medical doctor, accountant, lawyer or engineer)

5. Banking statement / passbook showing your name and account number

- Minimum salary requirement: fixed annual income of HK$80,000 or above

- APR as low as 5.91%: The APR of 5.91% is calculated based on the loan amount of HK$1,500,000, a monthly flat rate of 0.09%, and instalment period of 12 months, including a Loan Set Up Fee of 2%.

- Rewards are subject to Terms and Conditions, please refer to DBS website for details

- The Annualized Percentage Rate (“APR”) is calculated in accordance with the guideline issued in respect of the Code of Banking Practice and is rounded to the nearest two decimal places. An APR is a reference rate, which includes all applicable interest rates, fees and charges of the product, expressed as an annualized rate. The APR in the above table has included Loan Set Up Fee of 2% in the calculation. Loan Set Up Fee shall be deducted from the loan principal amount upon draw down of the loan and is non-refundable

- The monthly flat rate here is for reference only. The interest rate applicable to a customer is subject to his/her financial condition and is solely determined by DBS. Terms and conditions apply. For details, please visit DBS website

- Relevant fee applies if a customer early pays off the Loan. For details, please refer to the Personal Instalment Loan Terms and Conditions.

- To borrow or not to borrow? Borrow only if you can repay!

- MoneyHero exclusive promotion code "MHPL"

- 24/7 App application, same day approval

- Loan Amount up to HK$1,000,000

- Flexible Repayment Period (From 6 to 72 months)

- All Credit Rating are accepted

- No handling fee

- No hidden charges

- No penalty for early repayment

- Hong Kong Identity Card

- 2 months proof of income

- Actual annual interest rate is from 1.15% to 48% as the maximum

- Final approval is subject to the actual situation and financial condition of the customer.

- Warning: You have to repay your loans. Don't pay any intermediaries.

- Money Lender’s Licence No.: 0666/2025

- Enquiry and Complaint Hotline: 2531 0333

- Warning: You have to repay your loans. Don't pay any intermediaries.

- Apply using the coupon from entering the promo code to receive up to HKD 20,888 cash reward

- Clear all your credit card bills, loans, and card instalments at once

- Get approved 24 x 7

- Enjoy a 7-day Cooling-off Period

- During the promotion period, users can input the promotion code [MONEYHERO] to get 3 Loan Cash Coupons applicable to different loan amounts. Upon successful drawdown of Debt Changer with a loan amount of HK$200,000 – HK$399,999, HK$400,000 – HK$799,999, and HK$800,000 – HK$1,500,000 and a tenor of 24 months or above and with the coupon, the user can get an HK$1,888, HK$6,888, and HK$20,888 cash reward respectively after the completion of the 7-day Cooling-off Period. The coupons are valid for 14 days after the user enters the code during the loan application.

- The terms of usage, including validity period, applicable products, loan amount, tenor, amount of cash reward and other terms, are listed on each cash coupon. For the details of the cash coupon and the relevant terms and conditions, users can refer to the ZA Bank App > “Explore” > “My Coupon” within the validity period.

- To earn the cash reward listed on the cash coupon, users must use the cash coupon to apply and draw down designated Debt Changer within its validity period according to the terms listed on the coupon, and must not early settle the loan within the 7-day Cooling-off Period.

- Only one cash coupon can be used in a loan application. Each cash coupon can be used once only. The coupon will be written off after successful drawdown of the loan.

- * The final approved loan amount, interest rate and tenor may vary depending on the individual circumstances and the final assessment of the bank.

- APR as low as 1.99% (monthly flat rate as low as 0.11%); HK$0 handling fee

- 1-minute approval; no income proof is required if you have maintained an auto payroll account with HSBC for one month or above

- Borrow up to HK$3,000,000 or 23 times your monthly salary, whichever is lower

- Flexible repayment period from 6 months to 60 months

- Cash withdrawal from over 1,000 HSBC's ATMs and branches

-

The promotional period for the offers is from 7 August 2025 to 2 September 2025. Only applicable to selected Payroll customers who successfully apply for and draw down an approved loan of HK$1,500,000 or above during the promotional period. For a repayment period of 12 months, the monthly flat rate is 0.11%, the Annualised Percentage Rate (APR) is 2.47% (without any cash rebate and RewardCash) or 1.99% (taking into account HK$2,500 cash rebate and $1,300 RewardCash). The APR is calculated using method specified in relevant guidelines issued by The Hong Kong Association of Banks, and is rounded up or down to the nearest two decimal places. An APR is a reference rate, which includes all applicable interest rates, fees and charges of the product, expressed as an annualised rate. For your eligible rates, please call our hotline 2748 8080, log on to HSBC Online Banking or the HSBC HK App for details.

-

It comprises the total sum of up to HK$12,000 cash rebate and $4,000 RewardCash under the Successful Application Offer. Payroll customers who successfully apply for and draw down an approved loan of HK$1,500,000 or above with a repayment period of 60 months during the promotional period will be eligible for a total sum of up to $16,000 rebate. Terms and conditions apply.

- Processing time may vary in some cases depending on the actual circumstances of individual applications

- Minimum redraw is HK$3,000 and you must have had a Personal Instalment Loan account for at least 3 months. The Bank reserves the final right of allowing customers to redraw or not and has sole discretion to determine the redrawn amount and tenor

- Applications have to be submitted during the Bank’s service hours (Monday to Friday: 9 am - 8 pm, Saturday: 9 am - 5 pm, Sunday and public holidays: 12 noon - 12 midnight, or individual branch’s opening hours) with all required information (including without limitation a valid HSBC banking account number) and documents. The actual turnaround time starts when all the required information is successfully inputted into the Bank’s application evaluation system and the Bank may provide the instant application result and fund disbursement. Processing time may vary in some cases depending on the actual circumstances of individual applications.

- The actual repayment amount is subject to final approval

- Offer examples above are for reference only.

- Terms and conditions apply. For details, please refer to HSBC’s website. The monthly repayment amount, monthly flat rate, Annualised Percentage Rate (APR) and total interest amount shown are for indication only and are not meant to be final.

-

Terms and conditions apply. Please visit our website hsbc.com.hk/loan for all details, and terms and conditions regarding this promotion.

- Issued by The Hongkong and Shanghai Banking Corporation Limited

- To borrow or not to borrow? Borrow only if you can repay!

- Monthly flat rate as low as 0.22%, APR as low as 4.95%

- Repayment period up to 84 months

- Loan amount up to HK$2,000,000 or 21 times the monthly salary (whichever is lower)

- Handling fee wavier

- The Annualized Percentage Rate (“APR”) 4.95% is calculated based on 12 months repayment period and loan amount of HK$2,000,000 with monthly flat rate of 0.22%

To borrow or not to borrow? Borrow only if you can repay!

The above example is for reference only. The actual APR, total interest and repayment amount may vary for individual customer and subject to the loan amount, repayment period and credit condition of the customer, please contact the staff of the Bank for details.

- MoneyHero exclusive promotion code "MH2700"

- Only ID card is required, no proof of income is required, and the approval result will be known within 5 seconds

- 24/7 Instant Funds Disbursement: Once the loan contract is confirmed, the funds will be instantly transfer to your bank account by using the "FPS" system

- Zero Human Interference: The entire process from application, and contract signing to fund transfer can be completed without any manpower

- Lightning Approval in Seconds: By using Machine Learning, you will get the results within 5 seconds

- Flexible Loan Amount (as low as HK$1,000)

- No income proof is required (needs only your HKID for identity verification)

- The loan process is all done over the mobile phone

- Repayment term up to 48 months

- No handling fee

- No hidden charges

- No penalty for early repayment

(1) HKID Card

(2) Mobile phone

- Actual annual interest rate is from 1.15% to 48% as the maximum

- Final approval is subject to the actual situation and financial condition of the customer.

- Warning: You have to repay your loans. Don't pay any intermediaries.

- Money Lender’s Licence No.: 0666/2025

- Enquiry and Complaint Hotline: 2531 0333

- Warning: You have to repay your loans. Don't pay any intermediaries.

- "PrimeCredit Balance Transfer Analyst" provides a professional analysis of your current card and loan indebtedness, and tailor-make the most interest-saving and fastest repayment plan for your needs

- No handling fee, no early settlement fee

- Repayment terms up to 72 months

- Online application with instant approval result

- Only applicable to eligible customers. For more loan and offer details, please visit the PrimeCredit website

- All examples and information of interest rate are for reference only, and final approval is subject to actual circumstances of individual personal loan applicant

Warning: You have to repay your loans. Don't pay any intermediaries

Enquiry and Complaint Hotline: 2111 2999

Money Lender's Licence No.: 647/2025

- Repayment terms up to 72 months

- Monthly flat rate as low as 0.05%

- 14-day Flexi Payment

- No handling fee, no early settlement fee

- Only applicable to eligible customers. For more loan and offer details, please visit the PrimeCredit website

- All examples and information of interest rate are for reference only, and final approval is subject to actual circumstances of individual personal loan applicant

Professionals

- including, but not limited to, doctors, nurses, lawyers, and teachers

- PrimeCredit reserves the right of final interpretation of the definition of professionals

Warning: You have to repay your loans. Don't pay any intermediaries

Enquiry and Complaint Hotline: 2111 2999

Money Lender's Licence No.: 647/2025

- Monthly flat rate as low as 0.11%#

- Loan approval and drawdown as quick as 24 hours

- Loan amount up to HK$2,000,000 or 23 times your monthly income (whichever is lower)

- Interest savings up to 86%

- Cash out up to 8 times monthly income

- HKID Card

- Latest 1 month's income proof

- Latest 3 months' proof of current residence

- Proof of employment

- Promotion period is valid from now till 31 December 2025 (both dates inclusive)

- # The interest rate offer of as low as 0.11% monthly flat rate is only applicable to "Selected Customers". Assuming that the loan amount is HK$1,000,000, with a 72-month tenor and 0.11% monthly flat rate, APR including the loan handling fee of 1.1% p.a. is 4.83%. An APR is a reference rate which includes the basic interest rate and other fees and charges of a product expressed as an annualized rate.

- Subject to relevant terms and conditions. For details, please visit Dah Sing Bank website. In the event of discrepancies between the Chinese version and English version of this page, the Chinese version shall prevail.

- To borrow or not to borrow? Borrow only if you can repay! The service(s) / product(s) mentioned herein is / are not targeted at customers in the EU.

- APR as low as 3.25%

- Loan amount up to HK$2,000,000 or 20X of your monthly salary (whichever is lower)

- Repayment tenor up to 60 months

- Personal Identification Document: HKID card or passport

- Income Proof: Recent pay slip, your bank statement or bank book (with your name and account number) showing your recent income, your recent income tax bill, proof of your last MPF contribution, employment letter or contract, etc.

- Address Proof: Recent bank statement, credit card statement, water bill, telephone bill etc. If your address is shown on your income proof, you will be exempted from submitting the address proof.

- Other documents (if necessary)

- For more details, please click here

- APR is calculated according to the method set out in the relevant guidelines under the Code of Banking Practice issued by the Hong Kong Association of Banks as the basis.

- If the loan amount is $1,500,000, the monthly flat rate for 12 months is 0.060%, if the loan is approved finally by the Bank, the APR for 12 months is 3.25%, with a handling fee of 1% per annum included, the total loan repayment amount is HK$1,510,800.

- Example is for reference only, APR may differ with different loan amounts and tenors.

- For enquiries, please refer to OCBC Bank (Hong Kong) Limited - Balance Transfer Personal Loan website.

- To borrow or not to borrow? Borrow only if you can repay!

- MoneyHero exclusive promotion code "MHDC"

- 24/7 App application, same day approval

- Loan Amount up to 25X monthly salary or HK$1,000,000

- Flexible Repayment Period (From 6 to 72 months)

- All Credit Rating are accepted

- No handling fee

- No hidden charges

- No penalty for early repayment

- Actual annual interest rate is from 1.15% to 48% as the maximum

- Final approval is subject to the actual situation and financial condition of the customer.

- Money Lender’s Licence No.: 0666/2025

- Enquiry and Complaint Hotline: 2531 0333

- Warning: You have to repay your loans. Don't pay any intermediaries.

- Enjoy Cash Reward up to HK$33,800 upon successfully draw down

- Loan amount up to HK$1.5 million, with a repayment period of up to 84 months.

- 24 hours online application service, with instant approval and instant cash delivery.

- Deed waiver; legal fees waived too

- WeScore new credit indicator, assist you to restore long term financial health by using 400 million sets of data!

- No matter if your property is a private estate or apartment, or if it is self-occupied or leased, as long as you are the owner of the property, you are eligible to apply!

- Property deeds are not required. The loan application and contract will not be registered on Land Registry registration, avoiding complicated legal procedures.

- For customers who fulfil specific credit requirements.

Property deeds and Land Registry registration are not required, avoiding extra expenses

The above interest rates and repayment information are for reference only.

- The final terms will be determined based on the customer's application information and personal credit records.

- WELEND LIMITED reserves its absolute right on any loan approval decision and any disputes.

- Warning: You have to repay your loans. Don’t pay any intermediaries.

- Customer Service/ Complaint Hotline: 3590 6396

- Money Lender's License: 0900/2025

- APR as low as 1.38%. Flexible repayment term of 6 to 60 months

- Apply online anytime anywhere, no face-to-face contact is required

- Swift approval

- "MGM Program": Up to HK$60,000 for successful referral. Enjoy unlimited rewards with more referrals!

- ^Cash Reward Offer is subject to terms and conditions. For details, please click here.

New and existing customers refer to the customers who have not any loan transaction with the Company in the past 24 months from the date of application. For e-Cash Revloving Loan applicants who open account, before Personal Instalment Loan application, within the Promotion Period is granted for exemption to entitle the above reward.

New and existing customer is entitled for the Welcome Offer if the following requirements are satisfied within the Promotion Period:

The account opening cash reward only applicable to New Customers who successfully opened an e-Cash Revolving Loan Account

New and existing customers who successfully drawdown personal instalment loan are eligible to drawdown the cash reward, and such reward shall be calculated according to the amount of personal instalment loan

Loan approval and electronic transfer service is available from Monday to Friday (9:00am-6:30pm), Saturday (9:00am-12:30pm) and except to Sunday & public holidays. The actual date of transfer is subject to the transfer servicing hours of each individual bank. United Asia Finance Limited reserves the right to make final decision on loan approval

United Asia Finance Limited reserves the right to make final decision on loan approval

Warning: You have to repay your loans. Don't pay any intermediaries.

Enquiry and Complaint Hotline: 2681 8888

Money Lender’s Licence No.: 0805/2025

- A consolidated loan to clear all your debts to reduce interest expense for you

- Minimize your interest expenses

- Flexible repayment terms

- Tailor-made interest rate

- Loan amount of up to HK$2,000,000

- Flexible repayment term of up to 60 months; No handling fee

- "MGM Program": Up to HK$60,000 for successful referral. Enjoy unlimited rewards with more referrals!

1. Hong Kong Identity Card

2. Recent income proof, e.g., payroll slip, tax demand note, monthly bank account statement/passbook with your salary or MPF statement

3. Employment proof

4. Current residential proof, e.g. utility bills, bank statement

- ^Cash Reward Offer is subject to terms and conditions. For details, please click here.

New and existing customers refer to the customers who have not any loan transaction with the Company in the past 24 months from the date of application. For e-Cash Revloving Loan applicants who open account, before Personal Instalment Loan application, within the Promotion Period is granted for exemption to entitle the above reward.

New and existing customer is entitled for the Welcome Offer if the following requirements are satisfied within the Promotion Period:

The account opening cash reward only applicable to New Customers who successfully opened an e-Cash Revolving Loan Account

New and existing customers who successfully drawdown personal instalment loan are eligible to drawdown the cash reward, and such reward shall be calculated according to the amount of personal instalment loan

Loan approval and electronic transfer service is available from Monday to Friday (9:00am-6:30pm), Saturday (9:00am-12:30pm) and except to Sunday & public holidays. The actual date of transfer is subject to the transfer servicing hours of each individual bank.United Asia Finance Limited reserves the right to make final decision on loan approval

United Asia Finance Limited reserves the right to make final decision on loan approval

Warning: You have to repay your loans. Don't pay any intermediaries.

Enquiry and Complaint Hotline: 2681 8888

Money Lender’s Licence No.: 0805/2025

- Whole loan process is completed 24x7 online

- Apply online anytime anywhere, no face- to-face contact is required

- Property owners enjoy a large loan amount up to HK$1,500,000 with flexible cash out. No property deed is required

- Flexible repayment term of up to 60 months

- "MGM Program": Up to HK$60,000 for successful referral. Enjoy unlimited rewards with more

- ^Cash Reward Offer is subject to terms and conditions. For details, please click here.

New and existing customers refer to the customers who have not any loan transaction with the Company in the past 24 months from the date of application. For e-Cash Revloving Loan applicants who open account, before Personal Instalment Loan application, within the Promotion Period is granted for exemption to entitle the above reward.

New and existing customer is entitled for the Welcome Offer if the following requirements are satisfied within the Promotion Period:

The account opening cash reward only applicable to New Customers who successfully opened an e-Cash Revolving Loan Account

New and existing customers who successfully drawdown personal instalment loan are eligible to drawdown the cash reward, and such reward shall be calculated according to the amount of personal instalment loan

Loan approval and electronic transfer service is available from Monday to Friday (9:00am-6:30pm), Saturday (9:00am-12:30pm) and except to Sunday & public holidays. The actual date of transfer is subject to the transfer servicing hours of each individual bank.United Asia Finance Limited reserves the right to make final decision on loan approval

United Asia Finance Limited reserves the right to make final decision on loan approval

Warning: You have to repay your loans. Don't pay any intermediaries.

Enquiry and Complaint Hotline: 2681 8888

Money Lender’s Licence No.: 0805/2025

- Enjoy Cash Reward up to HK$33,800 upon successfully draw down

- Civil servants / professionals can enjoy interest rates as low as 1% APR.

- Loan amount of HK$500,000 or above can enjoy low interest rate as tax loans.

- A.I. processes loan quickly, cash is transferred automatically and instantly once the loan is confirmed.

- Utilizing A.I. big data to calculate personalized quotations, ensuring the loan amount based on your needs.

- WeScore new credit indicator, assist you to restore long term financial health by using 400 million sets of data!

- HKID Copy

- Disbursement account proof

- Residential address proof

- Commission Based Salary: Minimum recent 3 months of Income Proof

- Real Estate Industry: Minimum recent 6 months of Income Proof

- The loan will be transferred via Faster Payment System (FPS) after the loan is approved and the loan agreement is signed. Actual transfer time is subject to each individual bank's transfer service hours.

- Parts of the cash rebate will be distributed by WeLab Bank, all cash rebate is subject to the terms & conditions.

- The above interest rates and repayment information are for reference only. The final terms will be determined based on the customer's application information and personal credit records.

- WELEND LIMITED reserves its absolute right on any loan approval decision and any disputes.

- Warning: You have to repay your loans. Don’t pay any intermediaries.

- Customer Service/ Complaint Hotline: 3590 6396

- Money Lender's License: 0900/2025

- Enjoy up to HK$29,586 rewards upon successful application and drawdown of specified loan amount

- Loan amount up to HK$1,500,000 or up to 18x monthly salary (whichever is lower)

- Civil Servants and Professionals can enjoy interest rates as low as 0.78%* APR, including but not limited to civil servants, doctors, nurses, dentists, pharmacists, lawyers, accountants, engineers, actuaries, teachers, social workers, professionals with professional licenses or certifications, and any staff employed by public sector, Airport Authority and Hospital Authority. WeLab Bank Limited reserves the final right of interpretation on the above definition.

- **After get your loan in 1 day at the earliest with HKD 0 handling fee

- Smart Management in 1 App - Complete loan applications, approvals, and management in 1 app, truly simple and convenient!

- Intelligent Financial Health Analysis - Free and unlimited access to credit score assessments.^

Employed - Regular Income:

Latest 1 month income proof, and

A recent address proof issued within the last 3 months

Freelancer or Employed - Variable income:

Latest 6 months income proof, and

A recent address proof issued within the last 3 months

Business Owner:

Latest 3 months personal bank statement, and

Latest 6 months company bank statements or salary tax demand note, and

A recent address proof issued within the last 3 months

- **The estimated period is calculated from the day the loan agreement is signed. The actual approval period and the actual time the loan is disbursed may vary upon information provided by the applicants.

- The above APR is applicable for designated loan product with loan amount of HKD 600,000 and tenor of 39 months, including a cash rebate of HKD 9,000 and total repayment amount will be HKD 616,818.60. The APR will be 0.78% (including a cash rebate of HKD9,000) or 1.68% (without any cash rebate). The APR is calculated according to the guidelines issued in respect of the Code of Banking Practice and rounded to the nearest 2 decimal places and may vary for individual customers. The APR is a reference rate, which includes all applicable interest rates, fees and charges of the product, expressed as an annualized rate.

- We reserve the right to request customers to provide additional supporting documents for the loan application. The actual time for loan approval and the loan disbursement may vary depending on the information provided by the customer and are subject to the credit assessment result. Any loan application is subject assessment against normal lending criteria.

- ^Subject to terms and conditions. Customers must meet specified requirements, and actual circumstances may vary depending on individual situations. For details, please refer to the relevant terms and conditions on the WeLab Bank official website.

- To borrow or not to borrow? Borrow only if you can repay!

MoneyHero's Guide to Choosing a Personal Loan

As everyone’s financial situation and needs are unique, there are no one-size-fits-all loans. Rates and requirements for loan applications vary depending on circumstances, making certain loans a better fit for you. MoneyHero brings you what you need to know about personal loans, as well as elements to consider so that you can find the loan that best suits you.

Current average personal loan rates

Depending on your credit rating, your APR can be affected. This will influence your interest rate as well as limit how much you can borrow.

|

Rating |

Class |

Credit Score |

Estimated APR Range |

|

A |

Excellent |

3526 – 4000 |

1-10% |

|

B |

Good |

3417 – 3525 |

10-15% |

|

C |

3240 – 3416 |

||

|

D |

Fair |

3214 – 3239 |

15-20% |

|

E |

3143 – 3213 |

||

|

F |

3088 – 3142 |

||

|

G |

Poor |

2990 – 3087 |

20-25% |

|

H |

2868 – 2989 |

||

|

I |

Very Poor |

1820 -2867 |

25%+ (Or rejection) |

|

J |

1000-1819 |

Best personal loan rates for March 2025

MoneyHero brings you statistics on some of the best personal loan rates available this month offered by major financial institutions.

|

Lender |

APR as low as |

Minimum Annual Income (HKD) |

|

1.85% |

$96,000 |

|

|

1.56% |

$72,000 |

|

|

1.65% |

$84,000 |

|

|

1.98% |

$60,000 |

|

|

1.68% |

(None) |

|

|

1.18% |

$96,000 |

|

|

6.38% |

$100,000 |

How to compare personal loans

With so many offers available to you, consider the following factors to determine which deal is best for you.

APR

APR, or Annual Percentage Rate, is a crucial financial metric used to express the total cost of a loan over a year, including both the interest rate and any additional fees that may be associated with borrowing. APR provides you with a standardised way to compare different loan offers, allowing them to understand the true cost of borrowing more clearly.

When evaluating personal loan deals, considering the APR is essential because it takes into account not only the nominal interest rate but also any processing fees, closing costs, and other charges that may apply. This comprehensive view ensures that you are not misled by a lower interest rate that might be offset by hidden fees, which could make one loan significantly more expensive than another.

Monthly payment

The monthly payment represents the amount a borrower needs to repay each month over the loan's term. In the context of personal loans, this payment typically includes both the principal amount (the original loan amount) and the interest charged. Understanding your monthly payment is crucial for managing your budget, as it directly affects your cash flow and financial stability.

When comparing personal loan deals, the monthly payment plays a significant role because borrowers need to ensure they can comfortably afford it within their existing budget. A lower monthly payment might seem appealing, but it could extend the loan term and increase the total interest paid over time, potentially making the loan more expensive in the long run.

Fees

Fees are charges imposed by lenders in addition to the principal and interest costs of a loan. In the context of loans, these fees can significantly impact the total cost of borrowing and should be carefully considered when comparing personal loan deals. A loan with a low interest rate may still be expensive if it has high fees.

Common types of fees include late payment fees and prepayment penalties. Late payment fees occur when a borrower misses a payment deadline and can add an additional financial burden. Prepayment penalties may be applied if a borrower pays off the loan early, which can deter individuals from paying off debt sooner to save on interest.

Funding time

Funding time refers to the duration it takes for a lender to disburse the approved loan amount to the borrower after a loan application is submitted. This timeframe varies significantly among lenders and can range from a few hours to several days, depending on the lender’s policies, the type of loan, and the complexity of the application.

If you are in urgent need of funds—such as for medical emergencies, unexpected expenses, or significant purchases—a quicker funding time can be critical. A loan that offers rapid approval and same-day funding might be more appealing than one with a lower interest rate but a longer processing time.

Payment flexibility

Payment flexibility refers to the options and terms a lender offers regarding how you can manage your loan repayments. In the context of loans, payment flexibility can include aspects such as the ability to make extra payments without penalties, adjust payment schedules, and choose between fixed or variable repayment amounts.

Considering payment flexibility is crucial when comparing personal loan deals because it directly impacts a borrower’s ability to manage their finances effectively. For instance, a loan with flexible repayment options allows borrowers to make additional payments when they have extra funds, which helps them pay off the debt faster and reduce interest costs. This feature can be particularly beneficial for those who may experience fluctuations in income.

Other consumer-friendly features

Some loans may offer other consumer-friendly features that enhance the borrowing experience and provide more value to the borrower. These features can significantly affect the overall satisfaction and financial implications of a loan. One common example of this is rewards programs, which may offer cash back or points for on-time payments, allowing borrowers to earn benefits while managing their debt.

Pros and Cons of Personal Loans

|

Pros |

Cons |

|---|---|

|

|

Before Getting Your Personal Loan

Understand your creditworthiness as it influences the loan terms and interest rates you'll qualify for.

Clearly define why you need the loan and how much you require. This helps in choosing the right loan amount.

Be aware of any origination fees, interest rates, and other costs associated with the loan.

Ensure your monthly debt payments are manageable relative to your income. Lenders often consider this ratio when approving loans.

Compare different lenders to find the best personal loan rates and terms that suit your financial situation.

If your credit score is holding you back from better rates and higher limits, having a co-signer or co-borrower may improve your chances.

Gather necessary documentation like proof of income, employment details, and identification (e.g. Hong Kong ID card or passport), as these will be required during the application process.

Have a solid plan in place for how you will repay the loan, taking into account your monthly budget and any potential changes in your financial situation.

Managing Your Personal Loan

It may be daunting when you’re thinking about loan repayments before you borrow. Consider the following elements while assessing your options to ensure that you can make the most of your loan.

Assess Your Budget

Budget assessment involves a comprehensive evaluation of your income, expenses, and financial obligations to determine how much you can feasibly allocate toward loan repayments. The first step in budget assessment is to calculate your total monthly income, which includes salaries, bonuses, and any additional sources of revenue.

Next, list all your monthly expenses, categorising them into fixed expenses (like rent or mortgage, utilities, and insurance) and variable expenses (such as groceries, entertainment, and discretionary spending). This helps identify areas where you may cut back to make room for loan payments. It's essential to ensure that your total monthly expenses, including your new loan payment, do not exceed a sustainable percentage of your income.

Loan Amount and Terms

The loan amount refers to the total money you borrow, while loan terms encompass the length of time you have to repay the loan and the associated interest rates.

Consider your needs when deciding your loan amount. Borrowing only what you need helps prevent a cycle of debt, as larger loans often lead to higher monthly payments and increased interest costs. Lenders typically base the maximum loan amount on your creditworthiness and income, so it's important to find a balance between your needs and your ability to repay.

Loan terms can significantly affect your monthly payments and total interest paid over the life of the loan. Shorter terms may result in higher monthly payments but lower overall interest costs, while longer terms usually mean lower monthly payments but can lead to paying much more in interest over time.

Repayment Options

Repayment options refer to the various methods and schedules available to repay the loan, while repayment terms encompass the duration and conditions under which the loan must be repaid.

One important repayment option is the choice between fixed and variable interest rates. Fixed rates provide consistency, ensuring that your monthly payments remain the same throughout the loan's life, making budgeting easier. In contrast, variable rates can fluctuate based on market conditions, potentially leading to lower initial payments but uncertainty over time.

Need More Help with Choosing Personal Loans?

A personal instalment loan, also known as an unsecured loan, is a type of loan that allows you to borrow a specific amount of money and repay it through fixed instalments over a period of time. Unlike a secured loan that requires collateral like a house or car, a personal loan only requires a monthly payment that includes both the loan's principal and interest.

If you can pay off the loan principal and interest on time, you can use the money from your loan to finance your personal goals, such as renovating your home or planning your next dream vacation. Instead of paying off the loans in one lump sum, repaying them as instalments over 1 to 5 years could help ease your financial burden.

Personal loans can be applied in a majority of banks and lending companies here in Hong Kong. Popular lenders include the likes of Citibank, Hongkong and Shanghai Banking Corporation(HSBC), China Construction Bank, Standard Chartered Bank, Hang Seng Bank,vDBS Bank, WeLend, Promise, United Asia Finance, and many more. They provide loans at competitive rates and are often paired with equally tempting promotions and offers. You can also use MoneyHero's online comparison tool to easily find out the interest rates, loan amounts, total repayment values, and terms offered by various personal loan providers in Hong Kong, then instantly select the right personal instalment loan with the lowest monthly rates to suit your needs.

While low monthly interest rates may seem appealing for a personal instalment loan, they may not always offer the best overall deal. Additional factors such as handling and administrative fees, should be taken into consideration, as they can significantly impact the total cost. To make an informed decision, you can compare the Annual Percentage Rates (APR) of different loans, as they provide a more accurate representation of the borrowing costs. Additionally, be sure to watch out for any hidden charges that could potentially increase your expenses.

While certain financial companies advertise "instant loan approval," this typically refers to passing the initial screening of your application. In reality, you may still need to wait for a period ranging from 10 to 60 minutes to receive the actual approval. Certain banks may take longer, with approval times ranging from 2 to 5 working days.

You will repay the loan monthly with a fixed amount of principal and interest, and the interest for the loan amount will usually be calculated based on a flat monthly rate. If you know your total loan amount, monthly flat rate, and repayment period, you can calculate the monthly interest. You can consider using our free personal loan calculator to help.

Having trouble calculating the repayment amount? Hoping to learn more about loan formulas? We’ll handle the task of filtering precise loan offers tailored to your profile and needs. Our personal loan calculator makes it easy for you to compare different loan options and choose the one that works best for you. It only takes a few clicks to see a complete list of suitable loans that match your criteria.

Formula to calculate monthly loan payment:monthly payment = principal x (interest rate / 12)

Loans are financial products that offer a person or a business the necessary funds to fulfil their financial requirements or needs. Typically provided by financial institutions, loans come with specific repayment terms and conditions. Based on the terms that you agreed to, you will need to repay both the initial loan amount and the accumulated interest.

There are various types of loan products available in Hong Kong. If you are looking to borrow money or take out a personal loan (also known as P loan) for a particular financial goal, you should try to learn and understand the differences between each loan product before deciding the one that is best for your needs:

Personal Instalment Loans

A personal instalment loan allows you to borrow a fixed amount of money and repay it over a set period of time with

interest, usually in equal monthly instalments. These loans can be used for a wide range of purposes. If you don't have a specific need for a loan, such as paying taxes, clearing credit card debts, buying a car, or requiring quick cash, you may choose personal instalment loans due to its greater flexibility in terms of loan amounts and repayment periods.

Personal Tax Loans

Banks and lending companies typically offer personal tax loans to help individuals pay their taxes, particularly during tax season. These loans allow you to borrow a fixed amount and repay it in manageable instalments, easing the financial burden for those with higher income.

Debt Consolidation Plan

This type of unsecured personal loan helps you simplify and manage your debts. It allows you to combine multiple debts into a single loan with a lower interest rate and a fixed repayment plan. This way, you can reduce the overall amount of interest you pay and manage your debts more effectively. This type of loan is usually intended for consolidating existing debts.

Car Loans

A car loan is a type of personal loan provided by a bank to finance a car purchase. You can use the car loan to purchase a vehicle without needing to provide the car as collateral. Car loans have no restrictions on the age and model of the car, allowing you the freedom to choose any vehicle type, regardless of whether it is a new or used car. You are required to repay the initial loan amount and interest in fixed monthly instalments within the repayment period.

Refinance Loans

Revolving loans, also known as revolving credit or credit line, offer you a flexible pool of funds that you can withdraw within an approved limit. You can borrow and repay it whenever you want, and the credit becomes available again for future use. This helps you manage your cash flow effectively. Interest is only charged on the outstanding balance on a daily basis. A monthly handling fee may apply based on the lender's policy.

SME / Business Loans

Tailored for small and medium-sized enterprises (SMEs) and businesses, these loans are generally used to provide the necessary financial support for businesses for their operations, expansion, or investment. For example, the loans can help them purchase equipment, expand factories, or supplement working capital.

Student Loans

Geared towards assisting students in paying for their education, these unsecured loans enable students to borrow a fixed amount and repay it over a specific period of time with interest. The most common student loan available in Hong Kong is the Grant and Loan Scheme provided by the Student Finance Office. While a “Grant” is a subsidy for tuition fees, a “Loan” provides loans with low interest for university students.

The shortest repayment period for personal loan applications can be 60 days, while some lenders offer a flexible repayment period of up to 84 months.

The maximum loan amount you can borrow is typically 6 to 18 times your monthly income, with a limit of HK$4 million. The actual amount you qualify for depends on factors like your credit score and income status, regardless of the lender's maximum offering. Banks and financial institutions may also consider your Debt Servicing Ratio (DSR) to determine the loan amount. In general, maintaining your DSR below 40% increases your chance of receiving a favourable loan offer. We advise you to maintain your DSR within this percentage.

Bank loans and loans from lending companies are different in terms of interest rates, loan amounts, eligibility criteria, repayment terms, and the application process:

|

|

Bank Loans |

Lending Company Loans |

|

Interest Rates |

Generally lower |

Generally higher |

|

Loan Approval Process |

More strict |

More lenient |

|

Requirements |

More strict |

More flexible |

|

Collateral |

Required for some loans |

Often unsecured |

|

Repayment Terms |

Less flexible |

More flexible |

|

Customer Service |

Personalized |

Less personalized |

|

Loan Amount |

Higher depending on collateral |

Lower |

|

Loan Purpose |

More strict |

More flexible |

The process for a loan application largely depends on the lender and the type of loan you are applying for. Some common steps include comparing loan options, checking the eligibility criteria and required documents for the chosen loan, submitting the loan application form and required documents, and waiting for approval. Both traditional banks and virtual banks offer online loan applications that can be completed through a quick and easy process on their mobile banking apps.

However, not all of them will approve applications solely through the app or online channels. In certain cases, they may require additional steps or direct communication with you to proceed with the application. The approval process may involve connecting with you through phone calls to finalise the application.

The supporting documents needed vary depending on the lender and the type of loan you are applying for. In general, the documents listed below are typically required when applying for a loan:

1. Identity Proof: This could be in the form of a Hong Kong ID card or a passport.

2. Proof of Income: This may include a salary statement, bank statement, or tax returns.

3. Proof of Address: This might involve providing an utility bill or a bank statement.

4. Proof of Employment: This could entail an employment contract or a letter from your employer.

5. Collateral Documents: If the loan requires collateral, you will need to provide documents related to the collateral, such as a property deed or a vehicle registration.

Personal Loans Glossary

If you've read through our page and are struggling to gain a thorough understanding of which personal loan to select due to the unfamiliar terms and information about personal loans, don't worry; we've got you covered. We have a personal loans glossary where you can find a comprehensive list of terms with easy-to-understand definitions. Our glossary can be a valuable tool for anyone who wants to educate themselves on the world of personal finance. So, if you're confused about any of the terms we use on this page, be sure to check out our personal loans glossary for clarity.

Looking for another financial product?

MoneyHero has partnered with the most trusted banks and financial institutions in Hong Kong to help you find the right financial products. Through our comparison engine, you can compare credit cards, personal loans, mortgages, medical insurance, travel insurance, HK stock accounts, US stock accounts, payroll accounts, and other financial products. We provide accurate, up-to-date information and an unbiased overview of financial products in Hong Kong so that you can make the best choice, saving your time and money.