銀行/財務公司 | 每月還款額 | MoneyHero獎賞價值 | 總利息 | 最低實際年利率 | |||

|---|---|---|---|---|---|---|---|

| 信銀國際 $mart Plus 分期貸款 | HK$8,397 | HK$3,498 | HK$1,536 | 1.65 % | ||

| WeLend 低息私人貸款 | HK$8,495 | HK$9,800 | HK$3,888 | 1.00 % | ||

| Citi 特快現金私人貸款 | HK$8,473 | HK$4,000 | HK$3,360 | 1.40 % | ||

| 渣打銀行 私人貸款 | HK$8,499 | HK$3,750 | HK$3,984 | 1.85 % | ||

| UA i-Money 特快網上私人貸款 | HK$8,430 | HK$5,000 | HK$2,318 | 1.10 % | ||

| 安信 定額私人貸款 | HK$8,433 | HK$24,000 | HK$2,400 | 1.18 % | ||

| 邦民 特快低息貸款 | HK$8,433 | HK$2,100 | HK$2,400 | 1.12 % | ||

| 渣打銀行 結餘轉戶計劃 | HK$8,736 | HK$8,350 | HK$9,672 | 4.67 % | ||

| 華僑銀行 私人貸款 | HK$8,629 | HK$5,000 | HK$3,024 | 1.88 % | ||

| 東亞銀行分期貸款 | HK$8,633 | - | HK$7,200 | 3.36 % | ||

.png&w=256&q=75) | 滙豐 分期「萬應錢」 | HK$8,873 | HK$1,700 | HK$12,960 | 6.28 % | ||

| 星展銀行 「貸易清」私人貸款 | HK$8,553 | HK$5,100 | HK$5,280 | 6.38 % | ||

| 信銀國際 $mart Plus分期貸款 - 結餘轉戶 | HK$8,733 | HK$6,298 | HK$9,600 | 6.72 % | ||

| CreFIT 現金貸 | HK$8,511 | HK$22,400 | HK$4,272 | 1.98 % | ||

| Citi 卡數結餘轉戶 | HK$8,813 | HK$4,000 | HK$11,520 | 5.16 % | ||

| CreFIT 公務員及專業人士貸款 | HK$8,511 | HK$22,400 | HK$4,272 | 1.38 % | ||

| 富邦 「卡數清」私人貸款 | HK$8,801 | HK$9,880 | HK$11,232 | 5.28 % | ||

| WeLab Bank 私人分期貸款 | HK$8,493 | HK$4,000 | HK$3,840 | 1.68 % | ||

| Mox 「即時借」(新客戶) | HK$8,457 | HK$3,500 | HK$2,976 | 1.28 % | ||

| 建行(亞洲) 「好現金」私人分期貸款 | HK$8,873 | HK$3,500 | HK$12,960 | 6.28 % | ||

| Rabbit Cash 私人貸款 | HK$9,113 | HK$320 | HK$18,720 | 8.00 % | ||

| 富邦「合您意」私人貸款 | HK$8,679 | HK$2,799 | HK$8,304 | 3.88 % | ||

| 大新 分期「快應錢」 | HK$8,601 | HK$1,900 | HK$6,422 | 1.68 % | ||

| 星展銀行 定額私人貸款 | HK$8,513 | HK$1,800 | HK$4,320 | 5.91 % | ||

| X 大額私人貸款 | HK$8,437 | HK$3,000 | HK$2,496 | 1.15 % | ||

| CreFIT 卡卡貸 | HK$8,511 | - | HK$4,272 | 1.98 % | ||

| 結餘自由 Jump | HK$8,493 | HK$4,888 | HK$3,840 | 1.68 % | ||

| K Cash 私人樓業主私人貸款 | HK$9,133 | - | HK$19,200 | 8.88 % | ||

| Cashing Pro 特快私人貸款 | HK$8,733 | HK$1,500 | HK$9,600 | 4.40 % | ||

| Mox 「即時借」 (舊客戶) | HK$8,457 | HK$3,500 | HK$2,976 | 1.28 % | ||

| 建行(亞洲) 「低息清」結餘轉戶計畫 | HK$9,093 | HK$6,000 | HK$18,240 | 8.87 % | ||

| 邦民 特快低息私人貸款 | HK$8,433 | - | HK$2,400 | 1.12 % | ||

| 邦民 低息結餘轉戶貸款 | HK$8,433 | HK$2,100 | HK$2,400 | 1.12 % | ||

| 安信 結餘轉戶計劃 | HK$8,433 | HK$24,000 | HK$2,400 | 1.18 % | ||

| 安信 業主私人貸款 | HK$8,433 | HK$24,000 | HK$2,400 | 1.18 % | ||

| 安信 公務員及專業人士貸款 | HK$8,433 | HK$24,000 | HK$2,400 | 1.18 % | ||

| 大新 清卡數「快應錢」 | HK$8,553 | HK$1,900 | HK$5,280 | 4.83 % | ||

| 華僑銀行 結餘轉戶私人貸款 | HK$8,441 | HK$8,100 | HK$2,592 | 3.25 % | ||

| WeLend 電動車貸款 | HK$8,495 | HK$9,800 | HK$3,888 | 1.00 % | ||

| 中潤物業按揭 居屋業主尊享私人貸款 | HK$8,665 | HK$500 | HK$7,968 | 3.80 % | ||

| 中潤物業按揭 業主專享低息私人貸款 | HK$9,013 | HK$500 | HK$16,320 | 4.00 % | ||

| WeLend 業主私人貸款 | HK$8,497 | HK$9,800 | HK$3,936 | 1.00 % | ||

| X 結餘轉戶貸款 | HK$8,437 | HK$3,000 | HK$2,496 | 1.15 % | ||

| UA 公務員/專業人士特快低息貸款 | HK$8,453 | HK$5,000 | HK$2,880 | 1.38 % | ||

| UA 咭數一筆清 | HK$8,479 | HK$5,000 | HK$3,499 | 1.68 % | ||

| 中潤物業按揭 「房協」夾心階層、住宅發售計劃業主尊享私人貸款 | HK$9,013 | HK$500 | HK$16,320 | 7.76 % | ||

| 中潤物業按揭 租置公屋業主尊享私人貸款 | HK$8,665 | HK$500 | HK$7,968 | 3.80 % | ||

| UA i-Money 特快業主網上私人貸款 | HK$8,453 | HK$5,000 | HK$2,880 | 2.98 % | ||

| WeLend 結餘轉戶貸款 | HK$8,495 | HK$9,800 | HK$3,888 | 2.78 % | ||

| WeLend 特快批核貸款 | HK$8,497 | HK$9,800 | HK$3,936 | 1.00 % | ||

| 【MoneyHero獨家產品】WeLend「銀行用戶尊享貸款」 | HK$8,495 | HK$9,800 | HK$3,888 | 1.00 % | ||

| WeLab Bank 清卡數貸款 | HK$8,688 | HK$4,000 | HK$8,515 | 4.11 % | ||

| WeLab Bank 私人分期貸款 (公務員及專業人士) | HK$8,493 | HK$4,000 | HK$3,840 | 1.68 % | ||

| Cashing Pro 結餘轉戶貸款 | HK$8,733 | HK$1,500 | HK$9,600 | 4.40 % | ||

| K Cash 居屋業主私人貸款 | HK$9,133 | - | HK$19,200 | 8.88 % | ||

| K Cash 自置公屋業主私人貸款 | HK$9,133 | - | HK$19,200 | 8.88 % | ||

| 香港信貸 業主貸款 | HK$9,033 | HK$20,500 | HK$16,800 | 8.00 % | ||

| 香港信貸 公居屋業主貸款 | HK$9,033 | HK$20,500 | HK$16,800 | 8.00 % |

顯示所有貸款 (58)

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- Sony PlayStation®5 Pro 主機(價值HK$5,780); 或

- HK$5,000 Apple Store禮品卡; 或

- HK$5,000 惠康購物現金券; 或

- HK$4,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,000 至 HK$799,999 + 還款期 12 個月或以上

- Dyson Purifier Cool™ Gen1 二合一空氣清新機TP10(價值HK$3,480); 或

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$100,000 至 HK$299,999 + 還款期 12 個月或以上

- Philips 輕量強效無線吸塵機 XC2011/61 (價值HK$2,498); 或

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- 所有獨家優惠之款式、顏色等均以隨機形式發送

如欲了解優惠詳情,請參閱條款及細則

請注意,此優惠由Money Hero 提供,與銀行無關。

顯示條款與細則

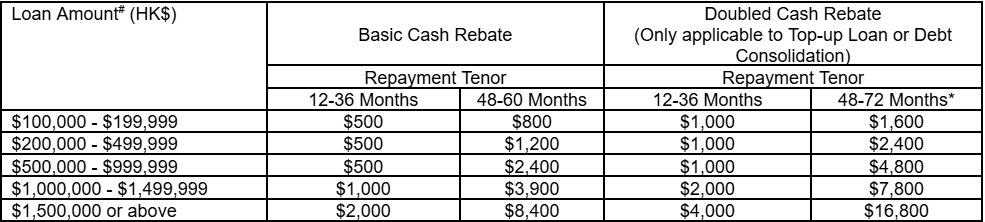

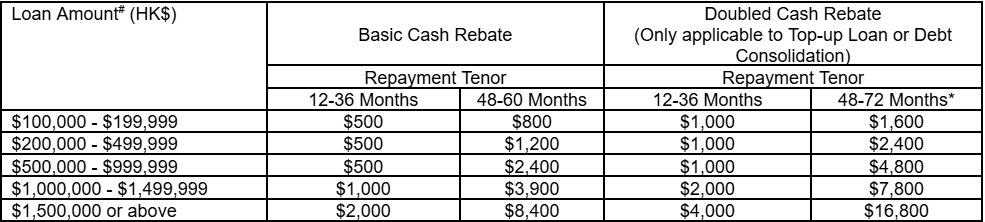

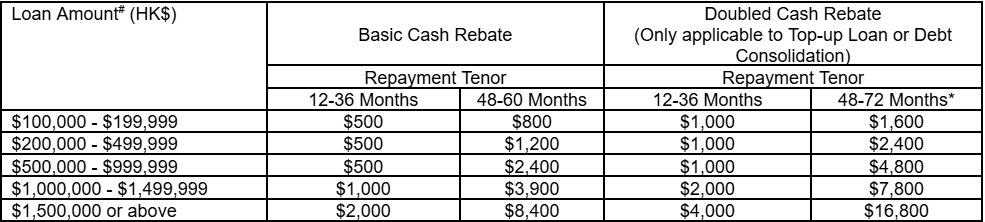

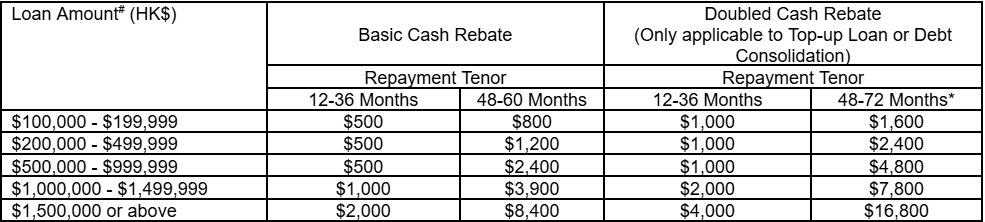

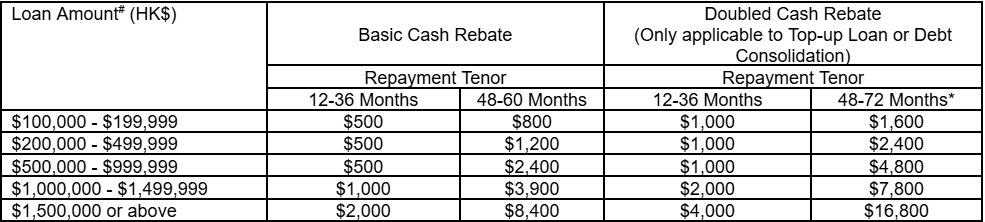

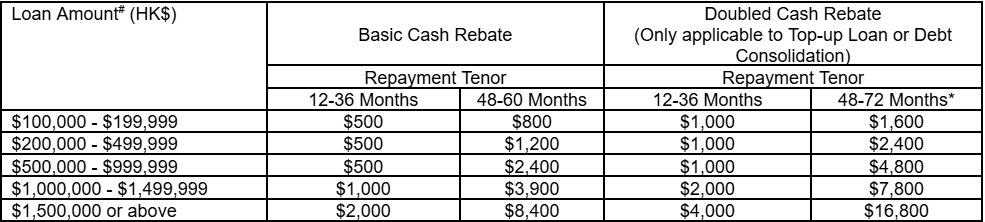

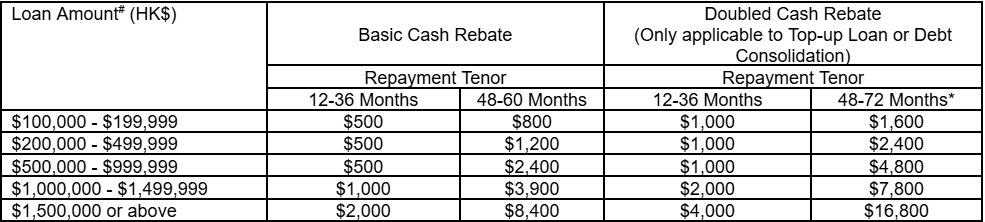

- Debt Consolidation and Top Up Loan with Cash Rebate:

- # If customers apply for Top Up Loan, the loan amount is calculated by actual cash out top up loan amount.

* Repayment tenor of 72 months is only applicable to Debt Consolidation. - For more details of promotion offer, please refer to Terms and Conditions

顯示條款與細則

- WeLend迎新現金回贈

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- HK$33,800 現金獎賞

- 貸款額 HK$800,000 至 HK$1,199,999+ 還款期至少 24 個月以上

- HK$21,800 現金獎賞

- 貸款額自 HK$600,000 至 HK$799,999 + 還款期至少 24 個月以上

- HK$17,800 現金獎賞

- 貸款額自 HK$500,001 至 HK$599,999 + 還款期至少 24 個月以上

- HK$15,800 現金獎賞

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期至少 24 個月以上

- HK$13,800 現金獎賞

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期至少 24 個月以上

- HK$9,800 現金獎賞

- 貸款額自 HK$150,001 至 HK$200,000 + 還款期至少 24 個月以上

- HK$2,800 現金獎賞

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- 受條款及細則約束

顯示條款與細則

MoneyHero獨家優惠:

貸款額 還款期 12個月-42個月 還款期48個月以上 貸款額 HK$2,000,000 或以上 HK$11,000 Apple Store 禮品卡;或 HK$11,000惠康現金券 ;或

HK$10,000 現金回贈(直接存入FPS戶口)HK$13,000 Apple Store 禮品卡;或 HK$13,000 惠康現金券;或

HK$10,000 現金回贈(直接存入FPS戶口)貸款額自 HK$800,000 至 HK$1,999,999 HK$8,500 Apple Store 禮品卡;或 HK$8,500惠康現金券;或

HK$7,200 現金回贈(直接存入FPS戶口)HK$9,000 Apple Store 禮品卡;或 HK$9,000惠康現金券 ;或

HK$7,200 現金回贈(直接存入FPS戶口)貸款額自 HK$500,000 至 HK$799,999 HK$7,500 Apple Store 禮品卡;或 HK$7,500 惠康現金券;或

HK$6,200 現金回贈(直接存入FPS戶口)HK$8,000 Apple Store 禮品卡;或 HK$8,000惠康現金券;或

HK$6,200 現金回贈(直接存入FPS戶口)貸款額自 HK$300,000 至 HK$499,999 HK$6,000 Apple Store 禮品卡;或 HK$6,000 惠康現金券 ;或

HK$6,000 現金回贈(直接存入FPS戶口)HK$7,500 Apple Store 禮品卡;或 HK$7,500 惠康現金券;或

HK$7,500 現金回贈(直接存入FPS戶口)貸款額自 HK$200,000 至 HK$299,999 HK$4,000 Apple Store 禮品卡;或 HK$4,000惠康現金券;或

HK$3,500 現金回贈(直接存入FPS戶口)HK$4,500 Apple Store 禮品卡;或 HK$4,500惠康現金券;或

HK$3,500 現金回贈(直接存入FPS戶口)貸款額自 HK$100,000 至 HK$199,999 HK$2,000 Apple Store 禮品卡;或 HK$2,000惠康現金券 ;或

HK$1,500 現金回贈(直接存入FPS戶口)HK$2,500 Apple Store 禮品卡;或 HK$2,500惠康現金券;或

HK$1,500 現金回贈(直接存入FPS戶口)- 所有獨家優惠均以顏色隨機形式發放

如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

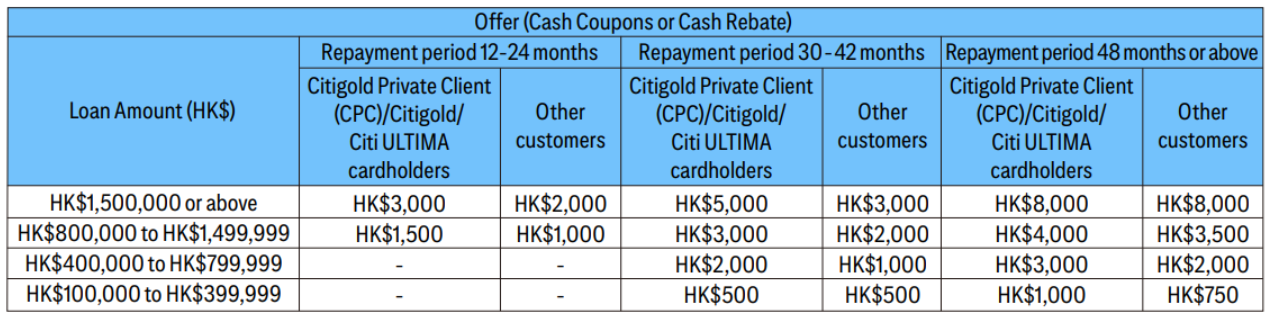

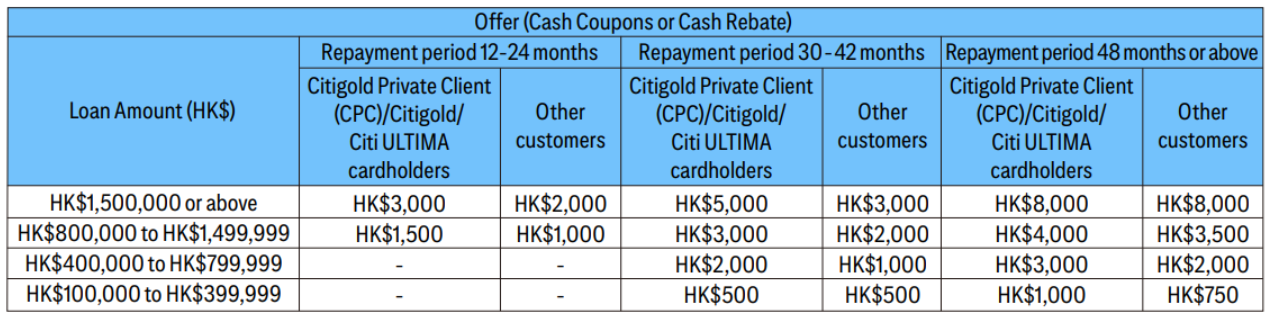

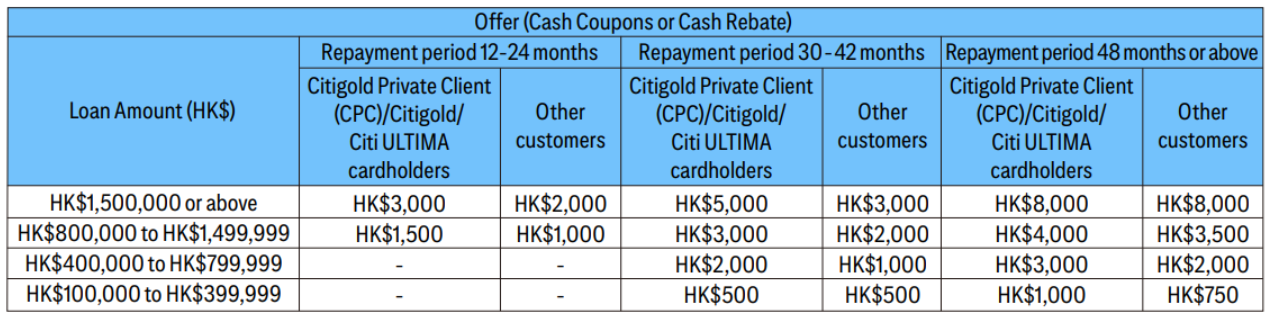

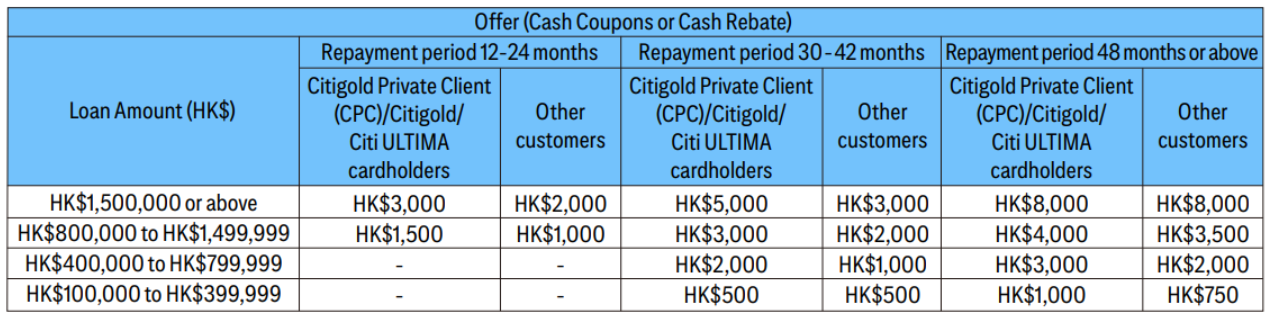

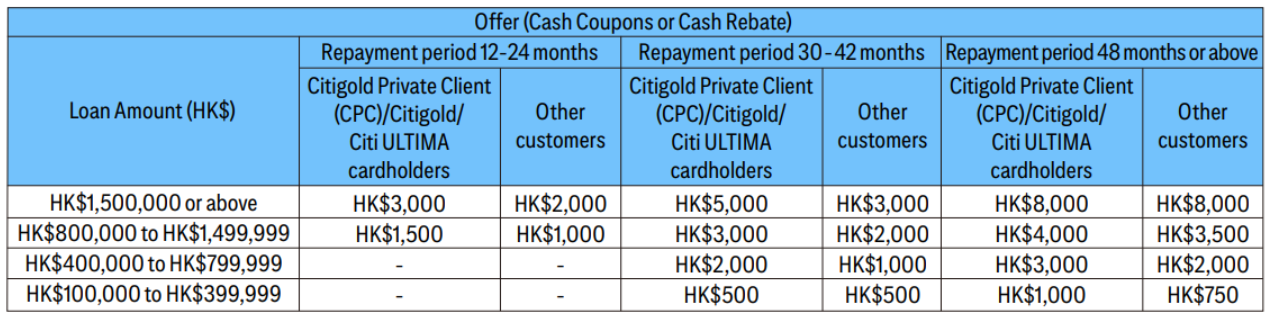

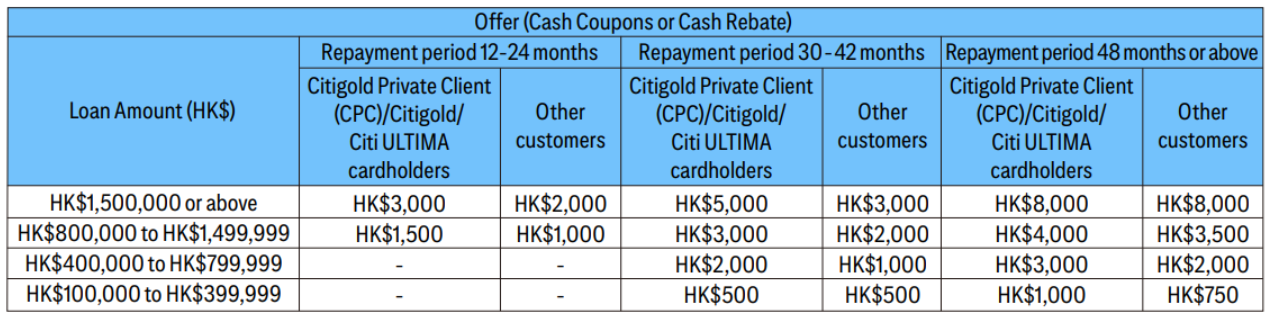

- The application of Citi Speedy Cash Personal Loan or Citi Debt Consolidation Loan must be successfully applied on or before 31 July 2025, and loan must be drawn down on or before 14 August 2025

The application date is subject to Citibank’s system records

- The Offer for Citigold Private Client/ Citigold Client / Citi ULTIMA cardholder is only applicable to the applicant who fulfill the following requirement from the date of application to the issue date of redemption letter (both dates inclusive):

Citigold Private Client should maintain the account balance at HK$8,000,000 or above, Citigold Client should maintain the account balance at HK$1,500,000 or above, and Citi ULTIMA cardholder needs to hold the Citi ULTIMA card.

A cash coupon redemption letter will be mailed to the eligible customers’ Hong Kong correspondence address according to Citibank’s record

For more details about the promotion, please see Terms and Conditions

顯示條款與細則

- MoneyHero 獨家優惠獎賞:

- 貸款額 HK$800,000 或以上:

- Roborock Saros 10R 掃拖機械人(價值: HK$9,999);或

- HK$8,000 惠康購物現金券;或

- HK$8,000 Apple Gift Card;或

- HK$6,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,000 至 HK$799,999:

- Dyson Purifier Hot+Cool™ Formaldehyde 三合一甲醛暖風空氣清新 HP09(價值: HK$7,180);或

- HK$6,000 惠康購物現金券;或

- HK$6,000 Apple Gift Card;或

- HK$4,800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$200,000 至 HK$299,999:

- Nintendo Switch 2 瑪利歐賽車世界 主機組合 (價值: HK$3,750);或

- HK$3,000 惠康購物現金券;或

- HK$3,000 Apple Gift Card;或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$100,000 至 HK$199,999:

- Dyson Zone™ 降噪耳機(價值HK$5,980);或

- HK$1,000 惠康購物現金券;或

- HK$1,000 Apple Gift Card;或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額 HK$800,000 或以上:

- 申請小貼士:

- 申請前記得預備好手機及香港身份證!申請過程會需要輸入手機驗證碼,要成功經MoneyHero申請並拎到獨家獎賞,必須成功完成此步驟!完成申請後,記得抄低申請參考編號,以方便隨時查詢申請進度及領取MoneyHero獨家優惠。

- 請記下完成申請後(「多謝申請」)頁面提供的申請參考編號 (例如 HKxxxxxxxxxxxxxx)。

- 請於成功申請批核後的7日內,請(1)申請之產品名稱、(2)申請日期及(3)提取貸款確認短訊之截圖,電郵至support@moneyhero.com.hk,並填寫經電郵發送之「獎賞換領表格」,以作核對及跟進

- 詳細流程:如何領取「MoneyHero獨家優惠」的現金券?

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- MoneyHero限時獨家優惠由MoneyHero提供,其換領、使用方法及爭議,均與渣打銀行無關。

如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

顯示條款與細則

- The promotion period of the Limited Time Cash Reward (including cash reward for opening of e-Cash Revolving Loan Account and cash reward for drawdown of personal instalment loan) offered by United Asia Finance Limited (the “Company”) is from 1 April 2025 to 30 September 2025, both dates inclusive (the “Promotion Period”).

- New and existing customers refer to the customers who have not any loan transaction with the Company in the past 24 months from the date of application. For e-Cash Revolving Loan applicants who open account, before Personal Instalment Loan application, within the Promotion Period is granted for exemption to entitle the above reward (the “Eligible Customers”).

- ^Cash Reward Offer is subject to terms and conditions. For details, please click here.

顯示條款與細則

"Up to HK$24,000 Cash Bonus” Terms and Conditions:

During the promotion period, customers who successfully apply for and drawdown designated personal loan with a net loan amount of HK$50,001 to HK$800,000 with a minimum 12 instalments through this webpage can enjoy Cash Bonus calculated based on 1% of the net loan amount; a net loan amount of HK$800,001 or above with a minimum 12 instalments to enjoy Cash Bonus calculated based on 2% of the net loan amount. The maximum amount that a property owner who applies for a designated personal loan can enjoy is Up to HK$24,000; while the maximum amount that a non-property owner can enjoy is HK$8,000. Each customer can enjoy the offer once during the promotion period.

The promotion period is from 21 July 2025 to 30 September 2025 (both days inclusive). Terms and conditions apply. The offers cannot be used in conjunction with other promotions. PrimeCredit reserves the right to terminate the offers or amend the details and terms & conditions without prior notice. For details of the loan and promotion, please contact PrimeCredit. PrimeCredit reserves its absolute rights on the final loan decision and any disputes.

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

顯示條款與細則

- 受條款及細則約束,詳情請瀏覽邦民的網頁▲。

顯示條款與細則

- MoneyHero 獨家優惠獎賞:

- 貸款額 HK$800,000 或以上:

- Roborock Saros 10R 掃拖機械人(價值: HK$9,999);或

- HK$8,000 惠康購物現金券;或

- HK$8,000 Apple Gift Card;或

- HK$6,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,000 至 HK$799,999:

- Dyson Purifier Hot+Cool™ Formaldehyde 三合一甲醛暖風空氣清新 HP09(價值: HK$7,180);或

- HK$6,000 惠康購物現金券;或

- HK$6,000 Apple Gift Card;或

- HK$4,800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$200,000 至 HK$299,999:

- Nintendo Switch 2 瑪利歐賽車世界 主機組合 (價值: HK$3,750);或

- HK$3,000 惠康購物現金券;或

- HK$3,000 Apple Gift Card;或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$100,000 至 HK$199,999:

- Dyson Zone™ 降噪耳機(價值HK$5,980);或

- HK$1,000 惠康購物現金券;或

- HK$1,000 Apple Gift Card;或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額 HK$800,000 或以上:

- 申請小貼士:

- 申請前記得預備好手機及香港身份證!申請過程會需要輸入手機驗證碼,要成功經MoneyHero申請並拎到獨家獎賞,必須成功完成此步驟!完成申請後,記得抄低申請參考編號,以方便隨時查詢申請進度及領取MoneyHero獨家優惠。

- 請記下完成申請後(「多謝申請」)頁面提供的申請參考編號 (例如 HKxxxxxxxxxxxxxx)。

- 請於成功申請批核後的7日內,請(1)申請之產品名稱、(2)申請日期及(3)提取貸款確認短訊之截圖,電郵至support@moneyhero.com.hk,並填寫經電郵發送之「獎賞換領表格」,以作核對及跟進

- 詳細流程:如何領取「MoneyHero獨家優惠」的現金券?

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- MoneyHero限時獨家優惠由MoneyHero提供,其換領、使用方法及爭議,均與渣打銀行無關。

如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

顯示條款與細則

Terms and Conditions apply.

顯示條款與細則

- MoneyHero獨家獎賞:

- 貸款額 HK$500,000 或以上

- iPhone 16 Pro (128GB;顏色隨機); 或

- HK$8,600 Apple Store禮品卡; 或

- HK$8,600 惠康購物現金券; 或

- HK$7,500 現金回贈(直接存入FPS戶口)

- 貸款額由 HK$300,000 至 HK$499,999

- HK$6,000 Apple Store禮品卡; 或

- HK$6,000 惠康購物現金券; 或

- HK$5,000 現金回贈(直接存入FPS戶口)

- 貸款額由 HK$100,000 至 HK$299,999

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- Nintendo Switch 2 瑪利歐賽車世界 主機組合 (價值:HK$3750); 或

- HK$2,000 現金回贈(直接存入FPS戶口)

- 貸款額 HK$500,000 或以上

- 詳情可參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

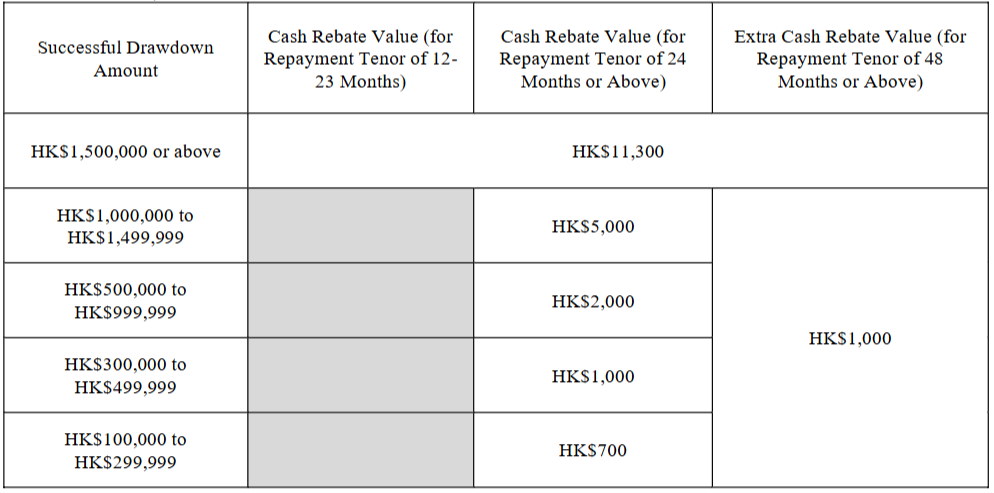

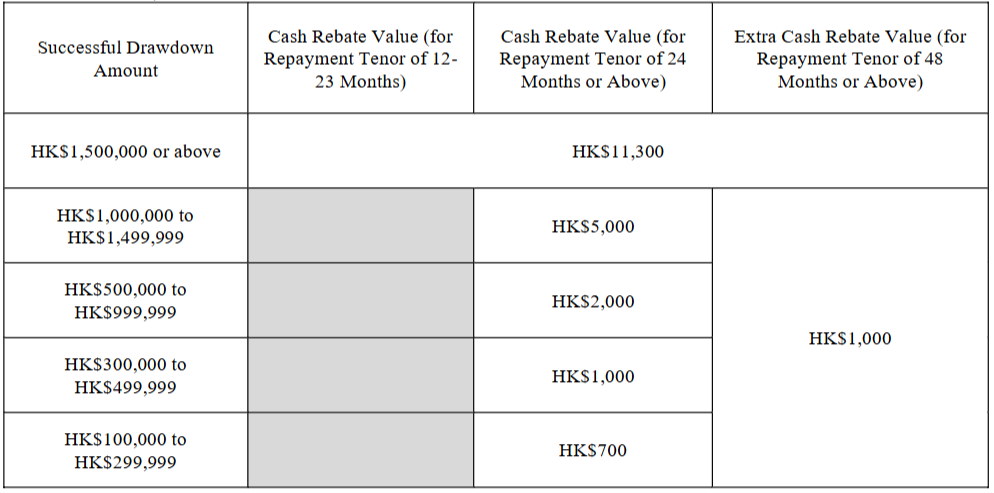

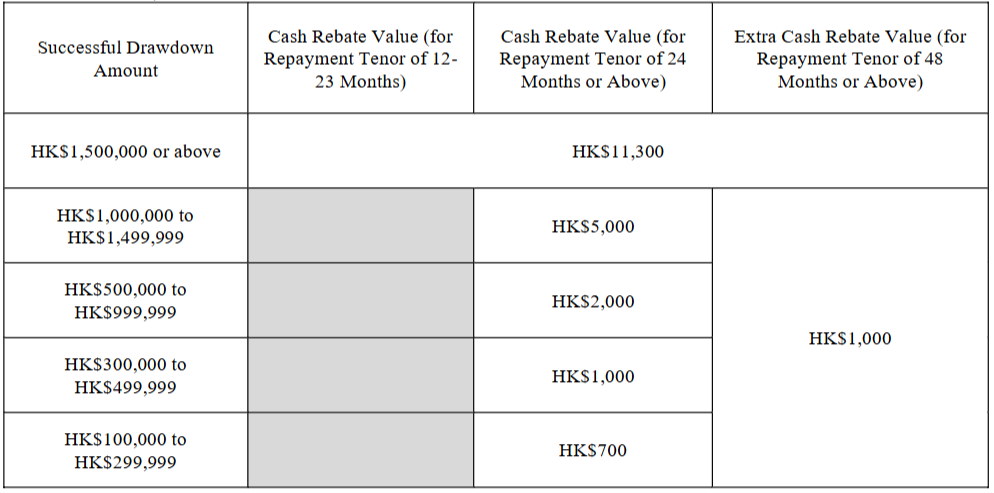

- Cash rebate:

For more details about the promotion, please see Terms and Conditions

顯示條款與細則

- Please refer to terms and conditions for more details

顯示條款與細則

- Please refer to terms and conditions for more details

顯示條款與細則

- MoneyHero 獨家優惠 :

- 貸款額 HK$300,000 至 HK$799,999及還款期24個月或以上

- HK$1,000 Apple Store禮品卡 ; 或

- HK$1,000 惠康購物現金券 ; 或

- HK$800 現金回贈 (直接存入FPS戶口)

- 貸款額 HK$800,000 至 HK$1,499,999及還款期24個月或以上

- HK$2,000 Apple Store禮品卡 ; 或

- HK$2,000 惠康購物現金券 ; 或

- HK$1,600 現金回贈 (直接存入FPS戶口)

- 貸款額 HK$1,500,000 或以上及還款期24個月或以上

- HK$3,000 Apple Store禮品卡 ; 或

- HK$3,000 惠康購物現金券 ; 或

- HK$2,400 現金回贈 (直接存入FPS戶口)

- 貸款額 HK$300,000 至 HK$799,999及還款期24個月或以上

- 現金回贈將於 2025 年 10 月 31 日或之前存入客戶之還款戶口內而不作另行通知。於東亞銀行存入現金回贈時,客戶之貸款戶口必須仍然有效及無任何逾期還款 / 不良信貸記錄。

- 如欲了解優惠詳情,請參閱條款與細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- 您可獲享高達港幣 6,000 元的額外現金回贈,若您:

- (a) 於推廣期內經我們網頁上的指定登記表格內以指定推廣碼(MHHSBC)成功進行優惠登記*; 及

- (b) 於推廣期內經滙豐網上理財或 HSBC HK App 成功申請並獲批核還款期為 24 個月或以上的貸 款

- MoneyHero 獨家優惠獎賞:

- 貸款額 HK$1,000,000 或以上:

HK$6,000 額外現金回贈

- 貸款額自 HK$300,000 至 HK$999,999:

HK$2,000 額外現金回贈

- 貸款額自 HK$200,000 至 HK$299,999:

HK$1,000 額外現金回贈

- 貸款額自 HK$100,000 至 HK$199,999:

HK$500 額外現金回贈

- 貸款額 HK$1,000,000 或以上:

- *優惠登記必須於遞交貸款申請之前完成(以香港時間及我們的伺服器接收時間為準)。

- 額外現金回贈金額將全數於2025年11月30日或之前(「優惠過賬日」)存入您的貸款還款戶口,而不會作出通知。您須確保貸款還款戶口於優惠過賬日當天仍然生效,以享優惠。

如欲了解優惠詳情,請參閱條款及細則。

顯示條款與細則

- Payroll Service Customer

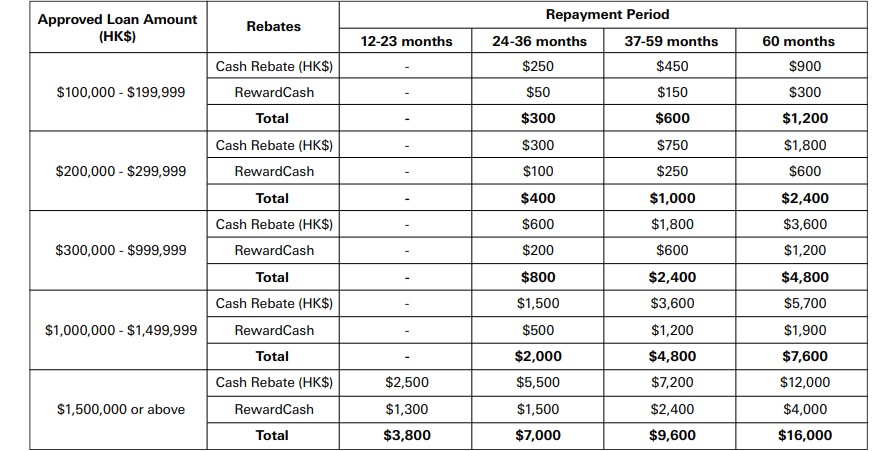

If you are HSBC Payroll Service Customer* and submit a Loan application during the promotional period, and the loan is approved with the designated Loan amount and repayment period, you will be eligible for rebates of up to $16,000. The cash rebates amounts and RewardCash amounts for different Loan amounts and repayment period are as follows: - For rebates of up to $8,000 under the Successful Application Offer for other customers, please view promotional Terms and Conditions.

- Promotional Period for the offer is from 10 July 2025 to 5 August 2025.

- The cash rebate will be credited to the Eligible Customer's Loan repayment account on or before 30 November 2025.

- For more details about the promotion, please refer to Terms and Conditions.

顯示條款與細則

- Promotional Period for the offer is from 10 July 2025 to 5 August 2025.

- The cash rebate will be credited to the Eligible Customer's Loan repayment account on or before 30 November 2025.

Terms and conditions apply; please refer to the Terms and Conditions.

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額 HK$1,000,000 或以上

- HK$13,000 Apple Store 禮品卡 (全新客戶); 或

- HK$13,000 惠康購物現金券 (全新客戶); 或

- HK$11,000 Apple Store 禮品卡 (現有客戶); 或

- HK$11,000 惠康購物現金券 (現有客戶); 或

HK$11,000現金回饋 (直接存入FPS戶口) (全新客戶與現有客戶)

- 貸款額 HK$700,000 至 HK$999,999

- HK$12,300 Apple Store禮品卡 (全新客戶); 或

- HK$12,300 惠康購物現金券(全新客戶); 或

- HK$10,300 Apple Store 禮品卡(現有客戶); 或

- HK$10,300 惠康購物現金券(現有客戶); 或

HK$10,300現金回饋 (直接存入FPS戶口) (全新客戶與現有客戶)

- 貸款額 HK$300,000 至 HK$699,999

- HK$8,200 Apple Store 禮品卡(全新客戶); 或

- HK$8,200 惠康購物現金券(全新客戶); 或

- HK$7,200 Apple Store 禮品卡(現有客戶); 或

- HK$7,200 惠康購物現金券(現有客戶); 或

HK$7,200現金回饋 (直接存入FPS戶口) (全新客戶與現有客戶)

- 貸款額 HK$100,000 至 HK$299,999

- HK$2,300 Apple Store 禮品卡(全新客戶); 或

- HK$2,300 惠康購物現金券(全新客戶); 或

- HK$2,000 Apple Store 禮品卡 (現有客戶); 或

- HK$2,000 惠康購物現金券(現有客戶); 或

HK$2,000現金回饋 (直接存入FPS戶口) (全新客戶與現有客戶)

- 貸款額 HK$1,000,000 或以上

- 受條款及細則約束

顯示條款與細則

- Successfully apply via MoneyHero

- From 1 July 2025 to 30 September 2025 (Promotion Period): Successfully apply DBS Debt Consolidation Loan

- Successfully drawdown the loan within one calendar month from the application date;

- A redemption letter will be sent to the eligible customer by mail within 7 months after the end of the Promotional Period for the customer to redeem the Coupons at designated redemption center. Use of the Coupons is subject to the terms and conditions stipulated by the supplier.

顯示條款與細則

- DBS Debt Consolidation Loan Promotion (the “Promotion”) commences from 1 July 2025 and ends on 30 September 2025, both dates inclusive (the “Promotional Period”).

- Customers who successfully apply for Debt Consolidation Loan (the “Loan”) offered by DBS Bank (Hong Kong) Limited (the “Bank”) during the Promotional Period, do not hold the Loan when applying for the Loan and draw down the approved Loan within one calendar month from the application date of the Loan, if the approved Loan amount reaches the amount and tenor set out in the below table, customers will be awarded with the corresponding amount of supermarket cash coupon (“Coupons”).

- For customers who fulfilled the requirements described in Clause 2, if his/her Loan is successfully applied for via the Bank’s website, DBS Card+ or promotion hotline 2290 8118 of the Bank; and draw down the Loan will be entitled to an extra HK$300 Coupons.

- A redemption letter will be sent to the eligible customer by mail within 7 months after the end of the Promotional Period for the customer to redeem the Coupons at designated redemption center. Use of the Coupons is subject to the terms and conditions stipulated by the supplier.

- The Coupons are only applicable to customers whose Loan accounts are in good standing and not in default (as determined by the Bank at its sole discretion). If the customer’s credit standing is unsatisfactory or the customer early repays the full amount of the Loan, the Bank reserves the rights to stop issuing the Coupons or deduct the face value of the Coupons awarded to the customers from the relevant Loan account without prior notice. The Bank has the sole discretion to determine whether eligible customer is eligible for the Reward.

- The Bank may modify or terminate the promotion and/or change these terms and conditions. The Bank’s decision is final.

- The English version shall prevail if there is any inconsistency between the English and Chinese versions.

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- Sony PlayStation®5 Pro 主機(價值HK$5,780); 或

- HK$5,000 Apple Store禮品卡; 或

- HK$5,000 惠康購物現金券; 或

- HK$4,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,000 至 HK$799,999 + 還款期 12 個月或以上

- Dyson Purifier Cool™ Gen1 二合一空氣清新機TP10(價值HK$3,480); 或

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$100,000 至 HK$299,999 + 還款期 12 個月或以上

- Philips 輕量強效無線吸塵機 XC2011/61 (價值HK$2,498); 或

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- 所有獨家優惠之款式、顏色等均以隨機形式發送

如欲了解優惠詳情,請參閱條款及細則

請注意,此優惠由Money Hero 提供,與銀行無關。

顯示條款與細則

- Debt Consolidation and Top Up Loan with Cash Rebate:

- # If customers apply for Top Up Loan, the loan amount is calculated by actual cash out top up loan amount.

* Repayment tenor of 72 months is only applicable to Debt Consolidation. - For more details of promotion offer, please refer to Terms and Conditions

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

顯示條款與細則

- *VCREDIT reserves the final rights and is subject to the terms and conditions on a case-by-case basis

顯示條款與細則

- Civil servants/professionals include, but are not limited to, civil servants, doctors, nurses, dentists, pharmacists, lawyers, accountants, engineers, actuaries, teachers, social workers, and other licensed or registered professionals. This also includes any employees working in public institutions/semi-government organizations, the Airport Authority, and the Hospital Authority. (VCREDIT reserves the final right of interpretation regarding the definition of professionals.)

- VCREDIT reserves the final rights and is subject to the terms and conditions on a case-by-case basis

Loan Amount for the first CreFIT Cash Loan drawdown Cashback HK$30,000-$49,999 HK$500 HK$50,000-$99,999 HK$1000 HK$100,000-$149,999 HK$3,000 HK$150,000-$249,999 HK$8,000 HK$250,000-$349,999 HK$10,000 HK$350,000 or above HK$20,000

顯示條款與細則

MoneyHero獨家優惠:

貸款額 還款期 12個月-42個月 還款期48個月以上 貸款額 HK$2,000,000 或以上 HK$11,000 Apple Store 禮品卡;或 HK$11,000惠康現金券 ;或

HK$10,000 現金回贈(直接存入FPS戶口)HK$13,000 Apple Store 禮品卡;或 HK$13,000 惠康現金券;或

HK$10,000 現金回贈(直接存入FPS戶口)貸款額自 HK$800,000 至 HK$1,999,999 HK$8,500 Apple Store 禮品卡;或 HK$8,500惠康現金券;或

HK$7,200 現金回贈(直接存入FPS戶口)HK$9,000 Apple Store 禮品卡;或 HK$9,000惠康現金券 ;或

HK$7,200 現金回贈(直接存入FPS戶口)貸款額自 HK$500,000 至 HK$799,999 HK$7,500 Apple Store 禮品卡;或 HK$7,500 惠康現金券;或

HK$6,200 現金回贈(直接存入FPS戶口)HK$8,000 Apple Store 禮品卡;或 HK$8,000惠康現金券;或

HK$6,200 現金回贈(直接存入FPS戶口)貸款額自 HK$300,000 至 HK$499,999 HK$6,000 Apple Store 禮品卡;或 HK$6,000 惠康現金券 ;或

HK$6,000 現金回贈(直接存入FPS戶口)HK$7,500 Apple Store 禮品卡;或 HK$7,500 惠康現金券;或

HK$7,500 現金回贈(直接存入FPS戶口)貸款額自 HK$200,000 至 HK$299,999 HK$4,000 Apple Store 禮品卡;或 HK$4,000惠康現金券;或

HK$3,500 現金回贈(直接存入FPS戶口)HK$4,500 Apple Store 禮品卡;或 HK$4,500惠康現金券;或

HK$3,500 現金回贈(直接存入FPS戶口)貸款額自 HK$100,000 至 HK$199,999 HK$2,000 Apple Store 禮品卡;或 HK$2,000惠康現金券 ;或

HK$1,500 現金回贈(直接存入FPS戶口)HK$2,500 Apple Store 禮品卡;或 HK$2,500惠康現金券;或

HK$1,500 現金回贈(直接存入FPS戶口)- 所有獨家優惠均以顏色隨機形式發放

如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- The application of Citi Speedy Cash Personal Loan or Citi Debt Consolidation Loan must be successfully applied on or before 31 July 2025, and loan must be drawn down on or before 14 August 2025

The application date is subject to Citibank’s system records

- The Offer for Citigold Private Client/ Citigold Client / Citi ULTIMA cardholder is only applicable to the applicant who fulfill the following requirement from the date of application to the issue date of redemption letter (both dates inclusive):

Citigold Private Client should maintain the account balance at HK$8,000,000 or above, Citigold Client should maintain the account balance at HK$1,500,000 or above, and Citi ULTIMA cardholder needs to hold the Citi ULTIMA card.

A cash coupon redemption letter will be mailed to the eligible customers’ Hong Kong correspondence address according to Citibank’s record

For more details about the promotion, please see Terms and Conditions

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

顯示條款與細則

- *VCREDIT reserves the final rights and is subject to the terms and conditions on a case-by-case basis

顯示條款與細則

- Civil servants/professionals include, but are not limited to, civil servants, doctors, nurses, dentists, pharmacists, lawyers, accountants, engineers, actuaries, teachers, social workers, and other licensed or registered professionals. This also includes any employees working in public institutions/semi-government organizations, the Airport Authority, and the Hospital Authority. (VCREDIT reserves the final right of interpretation regarding the definition of professionals.)

- VCREDIT reserves the final rights and is subject to the terms and conditions on a case-by-case basis

Loan Amount for the first CreFIT Cash Loan drawdown Cashback HK$30,000-$49,999 HK$500 HK$50,000-$99,999 HK$1000 HK$100,000-$149,999 HK$3,000 HK$150,000-$249,999 HK$8,000 HK$250,000-$349,999 HK$10,000 HK$350,000 or above HK$20,000

顯示條款與細則

- 貸款額 HK$600,000 或以上

- iPhone 16 Pro 128GB (價值HK$8,599;顏色隨機) ; 或

- HK$8,500 Apple Store 禮品卡; 或

- HK$8,500 惠康購物現金券; 或

- HK$8,500 Trip.com 電子禮券

- 貸款額 HK$400,000 至 HK$599,999

- SONY 索尼 PlayStation 5 PS5 Pro 遊戲主機 (價值HK$5,780); 或

- HK$5,800 Apple Store禮品卡; 或

- HK$5,800 惠康購物現金券; 或

- HK$5,800 Trip.com 電子禮券

- 貸款額 HK$200,000 至 HK$399,999

- Dyson Zone™ 降噪耳機 (價值HK$5,980); 或

- Marshall Acton III 家用藍牙喇叭(價值HK$2,499;顏色隨機); 或

- HK$2,500 Apple Store禮品卡; 或

- HK$2,500 惠康購物現金券; 或

- HK$2,500 Trip.com 電子禮券

- 客戶經MoneyHero官網申請貸款時必須輸入電郵地址,MoneyHero會即時經電郵發送奬賞換領表格供客戶填寫

- 合資格客戶請於7日內填妥MoneyHero奬賞換領表格 (所需資料如下) 及遞交,以供MoneyHero與富邦銀行核對獎賞資格:

- 申請編號 (經網上向富邦銀行申請貸款後於頁面提供的參考編號);及

- 聯絡資料

- 若合資格客戶未有收到獎賞換領表格,可以連同(1)申請之產品名稱 (eg. 富邦「卡數清」私人貸款 ) 及 (2)申請日期,電郵至support@moneyhero.com.hk 以索取「獎賞換領表格」。

- 申請小貼士﹕

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- 優惠受條款及細則約束

- 換領流程由銀行確認奬賞資格起計需時至少16星期,所需時間或會因批核及其他實際情況變動,獎賞換領信會透過電郵發出。

顯示條款與細則

- Cash Coupon Rewards:

- Loan amount HK$2,000,000 or above

- HK$23,500 Supermarket Voucher

- Loan amount From HK$1,000,000 to HK$1,999,999

- HK$10,000 Supermarket Voucher

- Loan amount From HK$700,000 to HK$999,999

- HK$5,000 Supermarket Voucher

- Loan amount From HK$400,000 to HK$699,999

- HK$2,000 Supermarket Voucher

- Loan amount From HK$200,000 to HK$399,999

- HK$800 Supermarket Voucher

- Loan amount HK$2,000,000 or above

- For more details of promotion offer, please refer to : More Info - Terms and Conditions

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- MoneyHero獨家獎賞:

- 貸款額自 HK$1,200,000 或以上 + 還款期 24 個月或以上

- iPhone 16 Pro Max 256GB (價值HK$10,199;顏色隨機); 或

- HK7,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$500,001 至 HK$1,199,999 + 還款期 24 個月或以上

- iPhone 16 Pro 128GB (價值HK$8,599;顏色隨機); 或

- HK$5,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期 24 個月或以上

- HK$2,000 Apple Store 禮品卡; 或

- HK$2,000 惠康購物現金券; 或

- HK$1,600 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期 24 個月或以上

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 受條款及細則約束

顯示條款與細則

- Terms and Conditions apply

顯示條款與細則

- MoneyHero 獨家獎賞:

- 貸款額自 HK$70,000 至 HK$149,999

- HK$2,500 Apple Store 禮品卡; 或

- HK$2,500 HKTVmall 電子購物禮券; 或

- HK$2,500 Trip.com電子禮券

- 貸款額自 HK$150,000 至 HK$299,999

- HK$3,500 Apple Store 禮品卡; 或

- HK$3,500 HKTVmall 電子購物禮券; 或

- HK$3,500 Trip.com電子禮券

- 貸款額 HK$300,000 或以上

- HK$4,500 Apple Store 禮品卡; 或

- HK$4,500 HKTVmall 電子購物禮券; 或

- HK$4,500 Trip.com電子禮券

- 貸款額自 HK$70,000 至 HK$149,999

- 新客戶請於收到電郵後14日內,填妥及遞交早前經電郵發出之「獨家獎賞換領表格」

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- 新客戶請於申請前記得預備好手機及香港身份證!成功開戶及成功申請Mox 「即時借」後30個工作天內會收到Mox Bank發出兌換碼的電郵,兌換碼由“7位字母和數字組成”(電郵會發送到你所登記Mox的電郵地址,如你尚未收到電郵,請檢查你的垃圾郵件匣)

- 現有Mox客戶於成功申請貸款後將不會收到Mox Bank發出的兌換碼,因此只需於「獎賞換領表格」 的相關欄目填寫「MoneyHero」,及其他聯絡資料 。 你必須於申請貸款後七日內填交表格

- MoneyHero限時獨家優惠由MoneyHero提供,其換領、使用方法及爭議,均與Mox Bank無關

- 優惠受條款及細則約束及MHCASH10邀請碼推廣條款及細則約束

顯示條款與細則

- Instant Loan Cash Reward Promotion Terms and Conditions apply

- Instant Loan Cash Reward Promotion Terms and Conditions apply. For an Instant Loan on a Mox Credit transaction of HKD750,000 spilt into 60 monthly instalments, the Annualised Percentage Rate (APR) is as low as 3.09% (which includes the cash reward of HKD10,888 which will be credited to your Mox Account on or before 31 July 2025), while the APR excluding cash rewards of Instant Loan Cash Reward Promotion is as low as 3.47%. If you apply to top up your active Instant Loan(s), the Eligible Instant Loan Amount applicable for this promotion will be additionally borrowed principal amount on top of the outstanding principal amount of your active Instant Loan(s).

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額 HK$250,001 或以上

- HK$5,000 Apple Store禮品卡; 或

- HK$5,000 惠康購物現金券; 或

- HK$5,000 Trip.com電子禮券

- 貸款額由 HK$100,000 至 HK$250,000

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- HK$3,000 Trip.com電子禮券

- 貸款額 HK$250,001 或以上

- 客戶需於2025年8月31日或之前成功前提取貸款

- 詳情請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

- 任何有關以上Apple Store 禮品卡/惠康購物現金劵/Trip.com電子禮劵之爭議均由Money Hero擁有最終決定權並與銀行無關

顯示條款與細則

- Promotion Period: From 1 July 2025 till 31 July 2025, customers who successfully apply for CCB (Asia) Personal Instalment Loan / CCB (Asia) “Low Interest” Balance Transfer Program and drawdown with a loan amount of HK$200,000 or above can enjoy HK$500 Cash Rebate via online application.

- Customers have to drawdown the loan successfully on or before 31 August 2025

顯示條款與細則

- Promotion period: From 1 July 2025 to 31 July 2025

- Successfully apply for the CCB (Asia) Personal Instalment Loan

- Successfully drawdown the loan on or before 31 August 2025

顯示條款與細則

如欲了解優惠詳情,請參閱條款及細則

- 客戶必須為Rabbit Credit Limited 的新客戶(以前從未與本公司進行過私人貸款交易)。

- 客戶必須準時償還第一至第四期分期貸款金額,不能有任何逾期付款。還款必須按照還款時間表進行,不能擅自更改還款期或/及還款金額。

- 客戶必須設定自動轉帳。

- 本促銷優惠不可轉讓,且不能與其他促銷優惠同時使用。

- 是次推廣優惠只適用於香港永久性居民,並不適用於破產中人士。因此非香港永久性居民及破產中人士申請 Rabbit Cash 私人貸款不能享有推廣優惠。

顯示條款與細則

- MoneyHero獨家優惠 :

- 貸款額 HK$50,000 或以上

- HK$1,500 Apple Store 禮品卡; 或

- HK$1,500 惠康購物現金券

- 貸款額自HK$1 至 HK$49,999

- HK$1,000 Apple Store 禮品卡; 或

- HK$1,000 惠康購物現金券

- 貸款額 HK$50,000 或以上

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- 獎賞選項適用於特定留存金額及期限。請參閱條款及細則了解獎賞詳情

顯示條款與細則

MoneyHero獨家優惠:

- 貸款額 HK$400,000 或以上

- Nintendo Switch 2 瑪利歐賽車世界 主機組合 (價值 HK$3,750); 或

- HK$3,800 Apple Store 禮品卡; 或

- HK$3,800 惠康購物現金券; 或

- HK$3,800 Trip.com電子禮券

- 貸款額自 HK$100,000 至 HK$399,999

- Marshall Emberton III 藍牙喇叭(價值HK$1,499); 或

- HK$1,000 Apple Store 禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$1,000 Trip.com電子禮券

如要領取MoneyHero獨家優惠:

- 客戶經MoneyHero官網申請貸款時必須輸入電郵地址,MoneyHero會即時經電郵發送奬賞換領表格供客戶填寫

- 合資格客戶請於7日內填妥MoneyHero奬賞換領表格 (所需資料如下) 及遞交,以供MoneyHero與富邦銀行核對獎賞資格:

- 申請編號 (經網上向富邦銀行申請貸款後於頁面提供的參考編號);及

- 聯絡資料

- 換領流程由銀行確認奬賞資格起計需時至少16星期,所需時間或會因批核及其他實際情況變動,獎賞換領信會透過電郵發出。

- 若合資格客戶未有收到獎賞換領表格,可以連同(1)申請之產品名稱 (eg. 富邦「卡數清」私人貸款 ) 及 (2)申請日期,電郵至support@moneyhero.com.hk 以索取「獎賞換領表格」。

- 申請小貼士﹕

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

- 優惠受條款及細則約束

顯示條款與細則

- Cash Rewards:

- Loan amount HK$2,000,000 or above

- HK$10,000 Supermarket Voucher

- Loan amount from HK$1,000,000 to HK$1,999,999

- HK$7,000 Supermarket Voucher

- Loan amount from HK$600,000 to HK$999,999

- HK$3,000 Supermarket Voucher

- Loan amount from HK$300,000 to HK$599,999

- HK$1,200 Supermarket Voucher

- Loan amount from HK$150,000 to HK$299,999

- HK$500 Supermarket Voucher

- Loan amount HK$2,000,000 or above

- For more details of promotion offer, please refer to : More Info - Terms and Conditions

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- Cash Reward:

- Loan amount HK$1,990,000 or above

- HK$13,888 Cash Rebate

- Loan amount from HK$1,000,000 to HK$1,989,999

- HK$5,000 Cash Rebate

- Loan amount from HK$500,000 to HK$999,999

- HK$1,000 Cash Rebate

- Loan amount from HK$200,000 to HK$499,999

- HK$500 Cash Rebate

- Loan amount from HK$50,000 to HK$199,999

- HK$100 Cash Rebate

- Loan amount from HK$5,000 to HK$49,999

- HK$50 Cash Rebate

- Loan amount HK$1,990,000 or above

- To enjoy the Cash Rebate Reward, the Eligible Customers' loan account, its repayment account, Dah Sing ONE+ Credit Card account and relevant HKD Dah Sing Current Account or Savings Account must remain normal, valid and with good repayment records from the loan disbursement date to the date when Dah Sing Bank credits the cash rebate. For details, please refer to Express Money (iv) and (v) of the relevant terms and conditions.

- *FlexiMoney Overdraft Facility accounts, joint name accounts, non-HKD accounts, Time Deposit and Margin Trading Settlement accounts are not eligible.

顯示條款與細則

New to Bank Customers^ who fulfil the criteria listed below during the Promotion Period are entitled to an extra reward of HK$200 supermarket cash coupons:

- successfully apply for the Loan during the Promotion Period with a loan tenor of 12 months or above and a loan amount of HK$5,000 or above; and

- successfully submit all documents requested by Dah Sing Bank regarding the application.

New to Bank Customers^ are customers who are not holding any of Dah Sing Bank's products or services within 1 month prior to the date of the relevant Loan application submission (both dates inclusive). The New Customer Reward is subject to a quota of 3,000 on a first come, first served basis, while stocks last. For details, please refer to Express Money (vii) - (xii) of the relevant terms and conditions.

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額 HK$1,500,000 或以上

- HK$10,800 Apple Store 禮品卡 (全新客戶); 或

- HK$10,800 惠康購物現金券 (全新客戶); 或

- HK$8,000 Apple Store禮品卡 (現有客戶); 或

- HK$8,000 惠康購物現金券 (現有客戶)

- 貸款額自 HK$1,000,000 至 HK$1,499,999

- HK$7,000 Apple Store禮品卡 (全新客戶); 或

- HK$7,000 惠康購物現金券 (全新客戶); 或

- HK$5,500 Apple Store禮品卡 (現有客戶); 或

- HK$5,500 惠康購物現金券 (現有客戶)

- 貸款額自 HK$500,000 至 HK$999,999

- HK$5,500 Apple Store禮品卡 (全新客戶); 或

- HK$5,500 惠康購物現金券 (全新客戶); 或

- HK$4,500 Apple Store 禮品卡 (現有客戶); 或

- HK$4,500 惠康購物現金券 (現有客戶)

- 貸款額自 HK$300,000 至 HK$499,999

- HK$3,500 Apple Store 禮品卡 (全新客戶); 或

- HK$3,500 惠康購物現金券 (全新客戶); 或

- HK$3,000 Apple Store 禮品卡 (現有客戶); 或

- HK$3,000 惠康購物現金券 (現有客戶)

- 貸款額自 HK$100,000 至 HK$299,999

- HK$1,500 Apple Store 禮品卡 (全新客戶); 或

- HK$1,500 惠康購物現金券 (全新客戶); 或

- HK$1,000 Apple Store 禮品卡 (現有客戶); 或

- HK$1,000 惠康購物現金券 (現有客戶)

- 貸款額 HK$1,500,000 或以上

- 優惠受條款及細則約束

顯示條款與細則

- A redemption letter will be sent to the eligible customer by mail within 8 months after the end of the Promotion Period for the customer to redeem the Coupons at designated redemption center. Use of the Coupons is subject to the terms and conditions stipulated by the supplier.

- The Extra Award will be awarded to the eligible customers via the red “InstaRedeem” button of DBS Card+ upon eligible customers spend with the Applicable Credit Card (as defined in Clause 10a) issued by the Bank during 1 June 2026 to 30 November 2026 (“Extra Award Period”) and when the spending is displayed on the spending page of DBS Card+. Customers can use the Extra Award received to set off the amount payable for that transaction via the “InstaRedeem” function of DBS Card+.

- To receive the Extra Award, customers must:

hold a valid principal credit card issued by the Bank (including Co-branded Cards, except Private Label Cards and Business Cards) ("Applicable Credit Card"), choose the DBS$ Redemption Scheme under the DBS$ Reward Scheme for that Applicable Credit Card, download DBS Card+, register and activate DBS Card+ account successfully, enable the “InstaRedeem” push notification of DBS Card+ on 30 April 2026. For customer who holds more than one valid principal credit card issued by the Bank on 30 April 2026, his/her Applicable Credit Card is by default based on the following priority

顯示條款與細則

- A redemption letter will be sent to the eligible customer by mail within 8 months after the end of the Promotion Period for the customer to redeem the Coupons at designated redemption center. Use of the Coupons is subject to the terms and conditions stipulated by the supplier

- The Extra Award will be awarded to the eligible customers via the red “InstaRedeem” button of DBS Card+ upon eligible customers spend with the Applicable Credit Card (as defined in Clause 10a) issued by the Bank during 1 June 2026 to 30 November 2026 (“Extra Award Period”) and when the spending is displayed on the spending page of DBS Card+. Customers can use the Extra Award received to set off the amount payable for that transaction via the “InstaRedeem” function of DBS Card+.

- To receive the Extra Award, customers must:

hold a valid principal credit card issued by the Bank (including Co-branded Cards, except Private Label Cards and Business Cards) ("Applicable Credit Card"), choose the DBS$ Redemption Scheme under the DBS$ Reward Scheme for that Applicable Credit Card, download DBS Card+, register and activate DBS Card+ account successfully, enable the “InstaRedeem” push notification of DBS Card+ on 30 April 2026. For customer who holds more than one valid principal credit card issued by the Bank on 30 April 2026, his/her Applicable Credit Card is by default based on the following priority

顯示條款與細則

- To enjoy this offer, customers must first download and install the X Wallet application. Only applications submitted through the X Wallet app are eligible for this offer.

- Eligible Customers will be entitled to the Offer only if their accounts are in normal active status (late payment, frozen account, bad debt, etc. are regarded as abnormal accounts) on or before the Offer Settlement Date.

顯示條款與細則

- MoneyHero 獨家獎賞

- 貸款額自 HK$800,000 或以上

- HK$8,000 Apple Store禮品卡; 或

- HK$8,000 惠康購物現金券; 或

- HK$6,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$400,000 至 HK$799,999

- HK$5,000 Apple Store禮品卡; 或

- HK$5,000 惠康購物現金券; 或

- HK$4,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$200,000 至 HK$399,999

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$150,000 至 HK$199,999

- HK$2,000 Apple Store 禮品卡; 或

- HK$2,000 惠康購物現金券; 或

- HK$1,600 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$100,000 至 HK$149,999

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$50,000 至 HK$99,999

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$800,000 或以上

- 受條款及細則約束

顯示條款與細則

- Terms and Conditions apply

- To borrow or not to borrow? Borrow only if you can repay!

顯示條款與細則

- MoneyHero獨家優惠 :

- 貸款額 HK$50,000 或以上

- HK$1,500 Apple Store 禮品卡; 或

- HK$1,500 惠康購物現金券

- 貸款額自HK$1 至 HK$49,999

- HK$1,000 Apple Store 禮品卡; 或

- HK$1,000 惠康購物現金券

- 貸款額 HK$50,000 或以上

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- MoneyHero 獨家獎賞:

- 貸款額自 HK$70,000 至 HK$149,999

- HK$2,500 Apple Store 禮品卡; 或

- HK$2,500 HKTVmall 電子購物禮券; 或

- HK$2,500 Trip.com電子禮券

- 貸款額自 HK$150,000 至 HK$299,999

- HK$3,500 Apple Store 禮品卡; 或

- HK$3,500 HKTVmall 電子購物禮券; 或

- HK$3,500 Trip.com電子禮券

- 貸款額 HK$300,000 或以上

- HK$4,500 Apple Store 禮品卡; 或

- HK$4,500 HKTVmall 電子購物禮券; 或

- HK$4,500 Trip.com電子禮券

- 貸款額自 HK$70,000 至 HK$149,999

- 新客戶請於收到電郵後14日內,填妥及遞交早前經電郵發出之「獨家獎賞換領表格」

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- 新客戶請於申請前記得預備好手機及香港身份證!成功開戶及成功申請Mox 「即時借」後30個工作天內會收到Mox Bank發出兌換碼的電郵,兌換碼由“7位字母和數字組成”(電郵會發送到你所登記Mox的電郵地址,如你尚未收到電郵,請檢查你的垃圾郵件匣)

- 現有Mox客戶於成功申請貸款後將不會收到Mox Bank發出的兌換碼,因此只需於「獎賞換領表格」 的相關欄目填寫「MoneyHero」,及其他聯絡資料 。 你必須於申請貸款後七日內填交表格

- MoneyHero限時獨家優惠由MoneyHero提供,其換領、使用方法及爭議,均與Mox Bank無關

- 優惠受條款及細則約束及MHCASH10邀請碼推廣條款及細則約束

顯示條款與細則

- Instant Loan Cash Reward Promotion Terms and Conditions apply

- Instant Loan Cash Reward Promotion Terms and Conditions apply. For an Instant Loan on a Mox Credit transaction of HKD750,000 spilt into 60 monthly instalments, the Annualised Percentage Rate (APR) is as low as 3.09% (which includes the cash reward of HKD10,888 which will be credited to your Mox Account on or before 31 July 2025), while the APR excluding cash rewards of Instant Loan Cash Reward Promotion is as low as 3.47%. If you apply to top up your active Instant Loan(s), the Eligible Instant Loan Amount applicable for this promotion will be additionally borrowed principal amount on top of the outstanding principal amount of your active Instant Loan(s).

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額 HK$250,001 或以上

- HK$5,000 Apple Store禮品卡; 或

- HK$5,000 惠康購物現金券; 或

- HK$5,000 Trip.com電子禮券

- 貸款額由 HK$100,000 至 HK$250,000

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- HK$3,000 Trip.com電子禮券

- 貸款額 HK$250,001 或以上

- 客戶需於2025年8月31日或之前成功前提取貸款

- 詳情請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

- 任何有關以上Apple Store 禮品卡/惠康購物現金劵/Trip.com電子禮劵之爭議均由Money Hero擁有最終決定權並與銀行無關

顯示條款與細則

- Promotion Period: From 1 July 2025 till 31 July 2025, customers who successfully apply for CCB (Asia) Personal Instalment Loan / CCB (Asia) “Low Interest” Balance Transfer Program and drawdown with a loan amount of HK$200,000 or above can enjoy HK$500 Cash Rebate via online application.

- Customers have to drawdown the loan successfully on or before 31 August 2025

顯示條款與細則

- Promotion period: From 1 July 2025 to 31 July 2025

- Successfully apply for the CCB (Asia) 'Low Interest' Balance Transfer and submit all the required documents

- Successfully drawdown the loan on or before 31 August 2025

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

顯示條款與細則

- 受條款及細則約束,詳情請瀏覽邦民的網頁▲。

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

- 客戶必須是在學學生。申請人須為香港任何一所大專院校的學生,並需提交本年度的學費單和學生證作為證明。

- 客戶必須為Rabbit Credit Limited 的新客戶(以前從未與本公司進行過私人貸款交易)。

- 客戶必須準時償還第一至第四期分期貸款金額,不能有任何逾期付款。還款必須按照還款時間表進行,不能擅自更改還款期或/及還款金額。

- 客戶必須設定自動轉帳。

- 本促銷優惠不可轉讓,且不能與其他促銷優惠同時使用。

- 是次推廣優惠只適用於香港永久性居民,並不適用於破產中人士。因此非香港永久性居民及破產中人士申請 Rabbit Cash 私人貸款不能享有推廣優惠。

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

顯示條款與細則

Terms and conditions apply.

顯示條款與細則

"Up to HK$24,000 Cash Bonus” Terms and Conditions:

During the promotion period, customers who successfully apply for and drawdown designated personal loan with a net loan amount of HK$50,001 to HK$800,000 with a minimum 12 instalments through this webpage can enjoy Cash Bonus calculated based on 1% of the net loan amount; a net loan amount of HK$800,001 or above with a minimum 12 instalments to enjoy Cash Bonus calculated based on 2% of the net loan amount. The maximum amount that a property owner who applies for a designated personal loan can enjoy is Up to HK$24,000; while the maximum amount that a non-property owner can enjoy is HK$8,000. Each customer can enjoy the offer once during the promotion period.

The promotion period is from 21 July 2025 to 30 September 2025 (both days inclusive). Terms and conditions apply. The offers cannot be used in conjunction with other promotions. PrimeCredit reserves the right to terminate the offers or amend the details and terms & conditions without prior notice. For details of the loan and promotion, please contact PrimeCredit. PrimeCredit reserves its absolute rights on the final loan decision and any disputes.

顯示條款與細則

"Up to HK$24,000 Cash Bonus” Terms and Conditions:

During the promotion period, customers who successfully apply for and drawdown designated personal loan with a net loan amount of HK$50,001 to HK$800,000 with a minimum 12 instalments through this webpage can enjoy Cash Bonus calculated based on 1% of the net loan amount; a net loan amount of HK$800,001 or above with a minimum 12 instalments to enjoy Cash Bonus calculated based on 2% of the net loan amount. The maximum amount that a property owner who applies for a designated personal loan can enjoy is Up to HK$24,000; while the maximum amount that a non-property owner can enjoy is HK$8,000. Each customer can enjoy the offer once during the promotion period.

The promotion period is from 21 July 2025 to 30 September 2025 (both days inclusive). Terms and conditions apply. The offers cannot be used in conjunction with other promotions. PrimeCredit reserves the right to terminate the offers or amend the details and terms & conditions without prior notice. For details of the loan and promotion, please contact PrimeCredit. PrimeCredit reserves its absolute rights on the final loan decision and any disputes.

顯示條款與細則

"Up to HK$24,000 Cash Bonus” Terms and Conditions:

During the promotion period, customers who successfully apply for and drawdown designated personal loan with a net loan amount of HK$50,001 to HK$800,000 with a minimum 12 instalments through this webpage can enjoy Cash Bonus calculated based on 1% of the net loan amount; a net loan amount of HK$800,001 or above with a minimum 12 instalments to enjoy Cash Bonus calculated based on 2% of the net loan amount. The maximum amount that a property owner who applies for a designated personal loan can enjoy is Up to HK$24,000; while the maximum amount that a non-property owner can enjoy is HK$8,000. Each customer can enjoy the offer once during the promotion period.

The promotion period is from 21 July 2025 to 30 September 2025 (both days inclusive). Terms and conditions apply. The offers cannot be used in conjunction with other promotions. PrimeCredit reserves the right to terminate the offers or amend the details and terms & conditions without prior notice. For details of the loan and promotion, please contact PrimeCredit. PrimeCredit reserves its absolute rights on the final loan decision and any disputes.

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- Cash Reward:

- Loan amount HK$1,990,000 or above

- HK$18,000 Cash Rebate

- Loan amount from HK$1,000,000 to HK$1,989,999

- HK$5,000 Cash Rebate

- Loan amount from HK$500,000 to HK$999,999

- HK$1,000 Cash Rebate

- Loan amount from HK$200,000 to HK$499,999

- HK$500 Cash Rebate

- Loan amount from HK$50,000 to HK$199,999

- HK$100 Cash Rebate

- Loan amount from HK$30,000 to HK$49,999

- HK$50 Cash Rebate

- Loan amount HK$1,990,000 or above

To enjoy the Drawdown Reward, Eligible Customers' Loan account, its repayment accounts and relevant HKD Dah Sing Current Account or Savings Account must remain normal, valid and with good repayment records from the Loan disbursement date to the date when Dah Sing Bank credits the cash rebate. For details, please refer to Credit Mastermind Instalment Loan (iv) and (v) of the relevant terms and conditions.

*FlexiMoney Overdraft Facility accounts, joint name accounts, non-HKD accounts, Time Deposit and Margin Trading Settlement accounts are not eligible.

顯示條款與細則

- New to Bank Customers^ who fulfil the criteria listed below during the Promotion Period are entitled to an extra reward of HK$200 supermarket cash coupons:

- successfully apply for the Loan during the Promotion Period with a loan tenor of 12 months or above and a loan amount of HK$30,000 or above; and

- successfully submit all documents requested by Dah Sing Bank regarding the application.

New to Bank Customers^ are customers who are not holding any of Dah Sing Bank's products or services within 1 month prior to the date of the relevant Loan application submission (both dates inclusive). The New Customer Reward is subject to a quota of 2,500 on a first come, first served basis, while stocks last. For details, please refer to Credit Mastermind Instalment Loan (vii) - (xii) of the relevant terms and conditions.

顯示條款與細則

- MoneyHero獨家獎賞:

- 貸款額 HK$500,000 或以上

- iPhone 16 Pro (128GB;顏色隨機); 或

- HK$8,600 Apple Store禮品卡; 或

- HK$8,600 惠康購物現金券; 或

- HK$7,500 現金回贈(直接存入FPS戶口)

- 貸款額由 HK$300,000 至 HK$499,999

- HK$6,000 Apple Store禮品卡; 或

- HK$6,000 惠康購物現金券; 或

- HK$5,000 現金回贈(直接存入FPS戶口)

- 貸款額由 HK$100,000 至 HK$299,999

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- Nintendo Switch 2 瑪利歐賽車世界 主機組合 (價值:HK$3750); 或

- HK$2,000 現金回贈(直接存入FPS戶口)

- 貸款額 HK$500,000 或以上

- 詳情可參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- Please refer to terms and conditions for more details

顯示條款與細則

- Please refer to terms and conditions for more details

顯示條款與細則

- Please refer to OCBC Bank (Hong Kong) Limited - Personal Loan for more details

顯示條款與細則

- WeLend迎新現金回贈

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- HK$33,800 現金獎賞

- 貸款額 HK$800,000 至 HK$1,199,999+ 還款期至少 24 個月以上

- HK$21,800 現金獎賞

- 貸款額自 HK$600,000 至 HK$799,999 + 還款期至少 24 個月以上

- HK$17,800 現金獎賞

- 貸款額自 HK$500,001 至 HK$599,999 + 還款期至少 24 個月以上

- HK$15,800 現金獎賞

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期至少 24 個月以上

- HK$13,800 現金獎賞

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期至少 24 個月以上

- HK$9,800 現金獎賞

- 貸款額自 HK$150,001 至 HK$200,000 + 還款期至少 24 個月以上

- HK$2,800 現金獎賞

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- 受條款及細則約束

顯示條款與細則

如何領取MoneyHero獨家優惠方法:

- 申請時請記下申請參考編號。建議一次過交齊所需文件,以加快批核程序

- 申請參考編號請參考銀行 / 金融機構發送的確認信件,如果還不確定哪裡可以找到這組號碼,請瀏覽這文章

- 收到表格後7日內,請填妥及遞交較早前經電郵發送之「獎賞換領表格」,供MoneyHero與中潤物業按揭核對獎賞資格

- 申請小貼士﹕

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

詳情可參閱條款及細則

顯示條款與細則

如何領取MoneyHero獨家優惠方法:

- 申請時請記下申請參考編號。建議一次過交齊所需文件,以加快批核程序

- 申請參考編號請參考銀行 / 金融機構發送的確認信件,如果還不確定哪裡可以找到這組號碼,請瀏覽這文章

- 收到表格後7日內,請填妥及遞交較早前經電郵發送之「獎賞換領表格」,供MoneyHero與中潤物業按揭核對獎賞資格

- 申請小貼士﹕

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

詳情可參閱條款及細則

顯示條款與細則

* 客戶經MoneyHero官網申請貸款時必須輸入電郵地址,MoneyHero會即時經電郵發送奬賞換領表格供客戶填寫

* 合資格客戶請於7日內填妥MoneyHero奬賞換領表格 (所需資料如下) 及遞交,以供MoneyHero與富邦銀行核對獎賞資格:

- 申請編號 (經網上向富邦銀行申請貸款後於頁面提供的參考編號);及

- 聯絡資料

* 換領流程由銀行確認奬賞資格起計需時至少16星期,所需時間或會因批核及其他實際情況變動,獎賞換領信會透過電郵發出。

* 若合資格客戶未有收到獎賞換領表格,可以連同(1)申請之產品名稱 (eg. 富邦「卡數清」私人貸款 ) 及 (2)申請日期,電郵至support@moneyhero.com.hk 以索取「獎賞換領表格」。

* 申請小貼士﹕

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

* 優惠受條款及細則約束

顯示條款與細則

- Cash Coupon Rewards:

- Loan amount HK$180,000 or above

- HK$1,000 Supermarket Voucher

- Loan amount from HK$80,000 to HK$179,999

- HK$1,000 Supermarket Voucher

- Loan amount HK$180,000 or above

- For more details of promotion offer, please refer to : More Info - Terms and Conditions

顯示條款與細則

- WeLend迎新現金回贈

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- HK$33,800 現金獎賞

- 貸款額 HK$800,000 至 HK$1,199,999+ 還款期至少 24 個月以上

- HK$21,800 現金獎賞

- 貸款額自 HK$600,000 至 HK$799,999 + 還款期至少 24 個月以上

- HK$17,800 現金獎賞

- 貸款額自 HK$500,001 至 HK$599,999 + 還款期至少 24 個月以上

- HK$15,800 現金獎賞

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期至少 24 個月以上

- HK$13,800 現金獎賞

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期至少 24 個月以上

- HK$9,800 現金獎賞

- 貸款額自 HK$150,001 至 HK$200,000 + 還款期至少 24 個月以上

- HK$2,800 現金獎賞

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- 受條款及細則約束

顯示條款與細則

- To enjoy this offer, customers must first download and install the X Wallet application. Only applications submitted through the X Wallet app are eligible for this offer.

- Eligible Customers will be entitled to the Offer only if their accounts are in normal active status (late payment, frozen account, bad debt, etc. are regarded as abnormal accounts) on or before the Offer Settlement Date.

顯示條款與細則

- The promotion period of the Limited Time Cash Reward (including cash reward for opening of e-Cash Revolving Loan Account and cash reward for drawdown of personal instalment loan) offered by United Asia Finance Limited (the “Company”) is from 1 April 2025 to 30 September 2025, both dates inclusive (the “Promotion Period”).

- New and existing customers refer to the customers who have not any loan transaction with the Company in the past 24 months from the date of application. For e-Cash Revolving Loan applicants who open account, before Personal Instalment Loan application, within the Promotion Period is granted for exemption to entitle the above reward (the “Eligible Customers”).

- ^Cash Reward Offer is subject to terms and conditions. For details, please click here.

顯示條款與細則

- The promotion period of the Limited Time Cash Reward (including cash reward for opening of e-Cash Revolving Loan Account and cash reward for drawdown of personal instalment loan) offered by United Asia Finance Limited (the “Company”) is from 1 April 2025 to 30 September 2025, both dates inclusive (the “Promotion Period”).

- New and existing customers refer to the customers who have not any loan transaction with the Company in the past 24 months from the date of application. For e-Cash Revolving Loan applicants who open account, before Personal Instalment Loan application, within the Promotion Period is granted for exemption to entitle the above reward (the “Eligible Customers”).

- ^Cash Reward Offer is subject to terms and conditions. For details, please click here.

顯示條款與細則

如何領取MoneyHero獨家優惠方法:

- 申請時請記下申請參考編號。建議一次過交齊所需文件,以加快批核程序

- 申請參考編號請參考銀行 / 金融機構發送的確認信件,如果還不確定哪裡可以找到這組號碼,請瀏覽這文章

- 收到表格後7日內,請填妥及遞交較早前經電郵發送之「獎賞換領表格」,供MoneyHero與中潤物業按揭核對獎賞資格

- 申請小貼士﹕

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

詳情可參閱條款及細則

顯示條款與細則

如何領取MoneyHero獨家優惠方法:

- 申請時請記下申請參考編號。建議一次過交齊所需文件,以加快批核程序

- 申請參考編號請參考銀行 / 金融機構發送的確認信件,如果還不確定哪裡可以找到這組號碼,請瀏覽這文章

- 收到表格後7日內,請填妥及遞交較早前經電郵發送之「獎賞換領表格」,供MoneyHero與中潤物業按揭核對獎賞資格

- 申請小貼士﹕

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

詳情可參閱條款及細則

顯示條款與細則

- The promotion period of the Limited Time Cash Reward (including cash reward for opening of e-Cash Revolving Loan Account and cash reward for drawdown of personal instalment loan) offered by United Asia Finance Limited (the “Company”) is from 1 April 2025 to 30 September 2025, both dates inclusive (the “Promotion Period”).

- New and existing customers refer to the customers who have not any loan transaction with the Company in the past 24 months from the date of application. For e-Cash Revolving Loan applicants who open account, before Personal Instalment Loan application, within the Promotion Period is granted for exemption to entitle the above reward (the “Eligible Customers”).

- ^Cash Reward Offer is subject to terms and conditions. For details, please click here.

顯示條款與細則

- WeLend迎新現金回贈

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- HK$33,800 現金獎賞

- 貸款額 HK$800,000 至 HK$1,199,999+ 還款期至少 24 個月以上

- HK$21,800 現金獎賞

- 貸款額自 HK$600,000 至 HK$799,999 + 還款期至少 24 個月以上

- HK$17,800 現金獎賞

- 貸款額自 HK$500,001 至 HK$599,999 + 還款期至少 24 個月以上

- HK$15,800 現金獎賞

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期至少 24 個月以上

- HK$13,800 現金獎賞

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期至少 24 個月以上

- HK$9,800 現金獎賞

- 貸款額自 HK$150,001 至 HK$200,000 + 還款期至少 24 個月以上

- HK$2,800 現金獎賞

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- 受條款及細則約束

顯示條款與細則

- WeLend迎新現金回贈

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- HK$33,800 現金獎賞

- 貸款額 HK$800,000 至 HK$1,199,999+ 還款期至少 24 個月以上

- HK$21,800 現金獎賞

- 貸款額自 HK$600,000 至 HK$799,999 + 還款期至少 24 個月以上

- HK$17,800 現金獎賞

- 貸款額自 HK$500,001 至 HK$599,999 + 還款期至少 24 個月以上

- HK$15,800 現金獎賞

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期至少 24 個月以上

- HK$13,800 現金獎賞

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期至少 24 個月以上

- HK$9,800 現金獎賞

- 貸款額自 HK$150,001 至 HK$200,000 + 還款期至少 24 個月以上

- HK$2,800 現金獎賞

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- 受條款及細則約束

顯示條款與細則

- WeLend迎新現金回贈

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- HK$33,800 現金獎賞

- 貸款額 HK$800,000 至 HK$1,199,999+ 還款期至少 24 個月以上

- HK$21,800 現金獎賞

- 貸款額自 HK$600,000 至 HK$799,999 + 還款期至少 24 個月以上

- HK$17,800 現金獎賞

- 貸款額自 HK$500,001 至 HK$599,999 + 還款期至少 24 個月以上

- HK$15,800 現金獎賞

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期至少 24 個月以上

- HK$13,800 現金獎賞

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期至少 24 個月以上

- HK$9,800 現金獎賞

- 貸款額自 HK$150,001 至 HK$200,000 + 還款期至少 24 個月以上

- HK$2,800 現金獎賞

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- 受條款及細則約束

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- MoneyHero獨家獎賞:

- 貸款額自 HK$1,200,000 + 還款期 24 個月或以上

- HK$7,000 Apple Store禮品卡; 或

- HK$7,000 惠康購物現金券; 或

- HK$5,600 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$800,000 至 HK$1,199,999 + 還款期 24 個月或以上

- HK$5,000 Apple Store禮品卡; 或

- HK$5,000 惠康購物現金券; 或

- HK$4,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$600,000 至 HK$799,999 + 還款期 24 個月或以上

- HK$4,000 Apple Store 禮品卡; 或

- HK$4,000 惠康購物現金券; 或

- HK$3,200 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$500,001 至 HK$599,999 + 還款期 24 個月或以上

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期 24 個月或以上

- HK$2,000 Apple Store 禮品卡; 或

- HK$2,000 惠康購物現金券; 或

- HK$1,600 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期 24 個月或以上

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 受條款及細則約束

顯示條款與細則

- Terms and Conditions apply

顯示條款與細則

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- MoneyHero獨家獎賞:

- 貸款額自 HK$1,200,000 或以上 + 還款期 24 個月或以上

- iPhone 16 Pro Max 256GB (價值HK$10,199;顏色隨機); 或

- HK7,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$500,001 至 HK$1,199,999 + 還款期 24 個月或以上

- iPhone 16 Pro 128GB (價值HK$8,599;顏色隨機); 或

- HK$5,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期 24 個月或以上

- HK$2,000 Apple Store 禮品卡; 或

- HK$2,000 惠康購物現金券; 或

- HK$1,600 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期 24 個月或以上

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 受條款及細則約束

顯示條款與細則

- Terms and Conditions apply

顯示條款與細則

- MoneyHero獨家優惠 :

- 貸款額 HK$50,000 或以上

- HK$1,500 Apple Store 禮品卡; 或

- HK$1,500 惠康購物現金券

- 貸款額自HK$1 至 HK$49,999

- HK$1,000 Apple Store 禮品卡; 或

- HK$1,000 惠康購物現金券

- 貸款額 HK$50,000 或以上

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- MoneyHero獨家優惠 :

- 貸款額 HK$50,000 或以上

- HK$1,500 Apple Store 禮品卡; 或

- HK$1,500 惠康購物現金券

- 貸款額自HK$1 至 HK$49,999

- HK$1,000 Apple Store 禮品卡; 或

- HK$1,000 惠康購物現金券

- 貸款額 HK$50,000 或以上

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- MoneyHero獨家優惠 :

- 貸款額 HK$50,000 或以上

- HK$1,500 Apple Store 禮品卡; 或

- HK$1,500 惠康購物現金券

- 貸款額自HK$1 至 HK$49,999

- HK$1,000 Apple Store 禮品卡; 或

- HK$1,000 惠康購物現金券

- 貸款額 HK$50,000 或以上

- 如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- 詳情可參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- 此推廣只適用於香港信貸(私人貸款)有限公司或香港信貸財務有限公司(合稱為「香港信貸」)之全新客戶(即從未曾於香港信貸持有任何貸款戶口之客戶)並於推廣期內申請港幣10萬或以上之貸款,成功申請(於下列定義)後該貸款戶口於成功取款後起計六個月內不可以任何原因終結。該戶口持有人後稱為「合資格客戶」。

- 每位合資格客戶或聯名貸款戶口之所有相關合資格客戶,於推廣期內只可領取優惠一次。合資格客戶不可同時享受其他香港信貸之推廣、回贈及/或優惠。如該名合資格客戶或聯名貸款戶口之相關客戶,於推廣期內申請多個貸款戶口,則仍以推廣期內首次成功申請之貸款合約條款計算回贈。

- 優惠先到先得,送完即止。

- 「成功申請」指合資格客戶於推廣期內遞交申請,並在香港信貸批核貸款後,及於推廣期內成功取款。

- 「8%特惠年利率」指凡經Money Hero申請而成功批核之特選客戶,香港信貸可按年利率8%及為期十二個月計算該特選客戶持有之貸款戶口中不多於港幣50萬的貸款金額之利息及設定相應還款細則,其餘貸款金額及/或其餘貸款期內之利息計算、還款表及其他合約條款按實際貸款合約為準。

- 如合資格客戶於成功取款後起計六個月內以任何原因終結其相關貸款戶口或提早清還該相關戶口中的部份貸款(Partial Payment),原有合約之所有回贈將被取消,香港信貸可酌情按與該合資格客戶簽訂之新貸款合約內所載之內容、條件、條款及細則重新計算及向該客戶發放更新後的回贈(如有)。如舊合約之回贈經已送出,相關回贈之差額須於新合約最後一期或之前的還款中一拼補回。

- 申請人必須18歲或以上。

- 本推廣不適用於(1)經其他銷售代理及/或平台、轉介及/或申請(「其他渠道」)的客戶;及(2)同時經其他渠道及Money Hero申請的客戶。

- 本公司保留對貸款審批、優惠及任何爭議之最終決定權,並可更改此優惠之條款及細則而不作另行通知。

- 利率等上述數字僅供參考,批核結果或因個別申請而異。

- 香港信貸保留對相關貸款合約內所有條款包括但不限於貸款額、還款期、利率及放款要求等及因應此推廣而適用於該貸款合約之所有由香港信貸發放的回贈之最終批核權利。

顯示條款與細則

- 此推廣只適用於香港信貸(私人貸款)有限公司或香港信貸財務有限公司(合稱為「香港信貸」)之全新客戶(即從未曾於香港信貸持有任何貸款戶口之客戶)並於推廣期內申請港幣10萬或以上之貸款,成功申請(於下列定義)後該貸款戶口於成功取款後起計六個月內不可以任何原因終結。該戶口持有人後稱為「合資格客戶」。

- 每位合資格客戶或聯名貸款戶口之所有相關合資格客戶,於推廣期內只可領取優惠一次。合資格客戶不可同時享受其他香港信貸之推廣、回贈及/或優惠。如該名合資格客戶或聯名貸款戶口之相關客戶,於推廣期內申請多個貸款戶口,則仍以推廣期內首次成功申請之貸款合約條款計算回贈。

- 優惠先到先得,送完即止。

- 「成功申請」指合資格客戶於推廣期內遞交申請,並在香港信貸批核貸款後,及於推廣期內成功取款。

- 合資格客戶根據其貸款實際年利率,可獲得如下相應比例之現金回贈額*:

轉按後實際年利率 (%)

貸款額

回贈金額

等於或超過 26.4%

30萬及以上

總貸款額之1%

低於26.4%

10萬至30萬

總貸款額之0.5%

- 如回贈金額超過港幣$20,000,亦只會按港幣$20,000之回贈上限作計算。並以超市現金禮券方式贈予合資格客戶。合資格客戶需於完成第一期供款後的30日內,向香港信貸申請及安排領取現金回贈之事宜。

- 如合資格客戶於成功取款後起計六個月內以任何原因終結其相關貸款戶口或提早清還該相關戶口中的部份貸款(Partial Payment),原有合約之所有回贈將被取消,香港信貸可酌情按與該合資格客戶簽訂之新貸款合約內所載之內容、條件、條款及細則重新計算及向該客戶發放更新後的回贈(如有)。如舊合約之回贈經已送出,相關回贈之差額須於新合約最後一期或之前的還款中一拼補回。

- 申請人必須18歲或以上。

- 本推廣不適用於(1)經其他銷售代理及/或平台、轉介及/或申請(「其他渠道」)的客戶;及(2)同時經其他渠道及Money Hero申請的客戶。

- 本公司保留對貸款審批、優惠及任何爭議之最終決定權,並可更改此優惠之條款及細則而不作另行通知。

- 利率等上述數字僅供參考,批核結果或因個別申請而異。

- 香港信貸保留對相關貸款合約內所有條款包括但不限於貸款額、還款期、利率及放款要求等及因應此推廣而適用於該貸款合約之所有由香港信貸發放的回贈之最終批核權利。

顯示條款與細則

- 詳情可參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- 此推廣只適用於香港信貸(私人貸款)有限公司或香港信貸財務有限公司(合稱為「香港信貸」)之全新客戶(即從未曾於香港信貸持有任何貸款戶口之客戶)並於推廣期內申請港幣10萬或以上之貸款,成功申請(於下列定義)後該貸款戶口於成功取款後起計六個月內不可以任何原因終結。該戶口持有人後稱為「合資格客戶」。

- 每位合資格客戶或聯名貸款戶口之所有相關合資格客戶,於推廣期內只可領取優惠一次。合資格客戶不可同時享受其他香港信貸之推廣、回贈及/或優惠。如該名合資格客戶或聯名貸款戶口之相關客戶,於推廣期內申請多個貸款戶口,則仍以推廣期內首次成功申請之貸款合約條款計算回贈。

- 優惠先到先得,送完即止。

- 「成功申請」指合資格客戶於推廣期內遞交申請,並在香港信貸批核貸款後,及於推廣期內成功取款。

- 「8%特惠年利率」指凡經Money Hero申請而成功批核之特選客戶,香港信貸可按年利率8%及為期十二個月計算該特選客戶持有之貸款戶口中不多於港幣50萬的貸款金額之利息及設定相應還款細則,其餘貸款金額及/或其餘貸款期內之利息計算、還款表及其他合約條款按實際貸款合約為準。

- 如合資格客戶於成功取款後起計六個月內以任何原因終結其相關貸款戶口或提早清還該相關戶口中的部份貸款(Partial Payment),原有合約之所有回贈將被取消,香港信貸可酌情按與該合資格客戶簽訂之新貸款合約內所載之內容、條件、條款及細則重新計算及向該客戶發放更新後的回贈(如有)。如舊合約之回贈經已送出,相關回贈之差額須於新合約最後一期或之前的還款中一拼補回。

- 申請人必須18歲或以上。

- 本推廣不適用於(1)經其他銷售代理及/或平台、轉介及/或申請(「其他渠道」)的客戶;及(2)同時經其他渠道及Money Hero申請的客戶。

- 本公司保留對貸款審批、優惠及任何爭議之最終決定權,並可更改此優惠之條款及細則而不作另行通知。

- 利率等上述數字僅供參考,批核結果或因個別申請而異。

- 香港信貸保留對相關貸款合約內所有條款包括但不限於貸款額、還款期、利率及放款要求等及因應此推廣而適用於該貸款合約之所有由香港信貸發放的回贈之最終批核權利。

顯示條款與細則

- 此推廣只適用於香港信貸(私人貸款)有限公司或香港信貸財務有限公司(合稱為「香港信貸」)之全新客戶(即從未曾於香港信貸持有任何貸款戶口之客戶)並於推廣期內申請港幣10萬或以上之貸款,成功申請(於下列定義)後該貸款戶口於成功取款後起計六個月內不可以任何原因終結。該戶口持有人後稱為「合資格客戶」。

- 每位合資格客戶或聯名貸款戶口之所有相關合資格客戶,於推廣期內只可領取優惠一次。合資格客戶不可同時享受其他香港信貸之推廣、回贈及/或優惠。如該名合資格客戶或聯名貸款戶口之相關客戶,於推廣期內申請多個貸款戶口,則仍以推廣期內首次成功申請之貸款合約條款計算回贈。

- 優惠先到先得,送完即止。

- 「成功申請」指合資格客戶於推廣期內遞交申請,並在香港信貸批核貸款後,及於推廣期內成功取款。

- 合資格客戶根據其貸款實際年利率,可獲得如下相應比例之現金回贈額*:

轉按後實際年利率 (%)

貸款額

回贈金額

等於或超過 26.4%

30萬及以上

總貸款額之1%

低於26.4%

10萬至30萬

總貸款額之0.5%

- 如回贈金額超過港幣$20,000,亦只會按港幣$20,000之回贈上限作計算。並以超市現金禮券方式贈予合資格客戶。合資格客戶需於完成第一期供款後的30日內,向香港信貸申請及安排領取現金回贈之事宜。

- 如合資格客戶於成功取款後起計六個月內以任何原因終結其相關貸款戶口或提早清還該相關戶口中的部份貸款(Partial Payment),原有合約之所有回贈將被取消,香港信貸可酌情按與該合資格客戶簽訂之新貸款合約內所載之內容、條件、條款及細則重新計算及向該客戶發放更新後的回贈(如有)。如舊合約之回贈經已送出,相關回贈之差額須於新合約最後一期或之前的還款中一拼補回。

- 申請人必須18歲或以上。

- 本推廣不適用於(1)經其他銷售代理及/或平台、轉介及/或申請(「其他渠道」)的客戶;及(2)同時經其他渠道及Money Hero申請的客戶。

- 本公司保留對貸款審批、優惠及任何爭議之最終決定權,並可更改此優惠之條款及細則而不作另行通知。

- 利率等上述數字僅供參考,批核結果或因個別申請而異。

- 香港信貸保留對相關貸款合約內所有條款包括但不限於貸款額、還款期、利率及放款要求等及因應此推廣而適用於該貸款合約之所有由香港信貸發放的回贈之最終批核權利。

🎁 申請完貸款?立即填表領取獎賞!

如果你已透過 MoneyHero 申請私人貸款,記得填寫獎賞換領表格並選擇你想要嘅禮品,幾步即可完成登記。專屬獎賞,切勿錯過!

唔好錯過呢個超筍優惠!

清卡數限時加碼送HK$2,800獎賞

遇上卡數債務終極Boss點算好?用結餘轉戶貸款KO難纏卡數,申請即送HK$800現金/現金券,提取貸款再賞你HK$2,000!額外現金get!

Jul 31, 2025前申請可享以下優惠:

價值 HK$800

價值 HK$800

價值 HK$800

價值 HK$2,800

價值 HK$2,800

價值 HK$2,800

價值 HK$800

價值 HK$800

價值 HK$800

價值 HK$2,800

價值 HK$2,800

價值 HK$2,800

指定金融產品:

渣打銀行 結餘轉戶計劃

:

清卡數之選

顯示條款與細則

- MoneyHero 獨家優惠獎賞:

- 貸款額 HK$800,000 或以上:

- Roborock Saros 10R 掃拖機械人(價值: HK$9,999);或

- HK$8,000 惠康購物現金券;或

- HK$8,000 Apple Gift Card;或

- HK$6,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,000 至 HK$799,999:

- Dyson Purifier Hot+Cool™ Formaldehyde 三合一甲醛暖風空氣清新 HP09(價值: HK$7,180);或

- HK$6,000 惠康購物現金券;或

- HK$6,000 Apple Gift Card;或

- HK$4,800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$200,000 至 HK$299,999:

- Nintendo Switch 2 瑪利歐賽車世界 主機組合 (價值: HK$3,750);或

- HK$3,000 惠康購物現金券;或

- HK$3,000 Apple Gift Card;或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$100,000 至 HK$199,999:

- Dyson Zone™ 降噪耳機(價值HK$5,980);或

- HK$1,000 惠康購物現金券;或

- HK$1,000 Apple Gift Card;或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額 HK$800,000 或以上:

- 申請小貼士:

- 申請前記得預備好手機及香港身份證!申請過程會需要輸入手機驗證碼,要成功經MoneyHero申請並拎到獨家獎賞,必須成功完成此步驟!完成申請後,記得抄低申請參考編號,以方便隨時查詢申請進度及領取MoneyHero獨家優惠。

- 請記下完成申請後(「多謝申請」)頁面提供的申請參考編號 (例如 HKxxxxxxxxxxxxxx)。

- 請於成功申請批核後的7日內,請(1)申請之產品名稱、(2)申請日期及(3)提取貸款確認短訊之截圖,電郵至support@moneyhero.com.hk,並填寫經電郵發送之「獎賞換領表格」,以作核對及跟進

- 詳細流程:如何領取「MoneyHero獨家優惠」的現金券?

- 申請產品前請關掉AdBlocker及「私人模式」:3項設定讓你順利取得MoneyHero獨家優惠

- MoneyHero限時獨家優惠由MoneyHero提供,其換領、使用方法及爭議,均與渣打銀行無關。

如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

顯示條款與細則

Terms and Conditions apply.

華僑銀行 結餘轉戶私人貸款

:

清卡數之選

顯示條款與細則

- MoneyHero獨家獎賞:

- 貸款額 HK$500,000 或以上

- iPhone 16 Pro (128GB;顏色隨機); 或

- HK$8,600 Apple Store禮品卡; 或

- HK$8,600 惠康購物現金券; 或

- HK$7,500 現金回贈(直接存入FPS戶口)

- 貸款額由 HK$300,000 至 HK$499,999

- HK$6,000 Apple Store禮品卡; 或

- HK$6,000 惠康購物現金券; 或

- HK$5,000 現金回贈(直接存入FPS戶口)

- 貸款額由 HK$100,000 至 HK$299,999

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- Nintendo Switch 2 瑪利歐賽車世界 主機組合 (價值:HK$3750); 或

- HK$2,000 現金回贈(直接存入FPS戶口)

- 貸款額 HK$500,000 或以上

- 詳情可參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- Please refer to terms and conditions for more details

顯示條款與細則

- Please refer to terms and conditions for more details

顯示條款與細則

- Please refer to OCBC Bank (Hong Kong) Limited - Personal Loan for more details

信銀國際 $mart Plus分期貸款 - 結餘轉戶

:

清卡數之選

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- Sony PlayStation®5 Pro 主機(價值HK$5,780); 或

- HK$5,000 Apple Store禮品卡; 或

- HK$5,000 惠康購物現金券; 或

- HK$4,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,000 至 HK$799,999 + 還款期 12 個月或以上

- Dyson Purifier Cool™ Gen1 二合一空氣清新機TP10(價值HK$3,480); 或

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$100,000 至 HK$299,999 + 還款期 12 個月或以上

- Philips 輕量強效無線吸塵機 XC2011/61 (價值HK$2,498); 或

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- 所有獨家優惠之款式、顏色等均以隨機形式發送

如欲了解優惠詳情,請參閱條款及細則

請注意,此優惠由Money Hero 提供,與銀行無關。

顯示條款與細則

- Debt Consolidation and Top Up Loan with Cash Rebate:

- # If customers apply for Top Up Loan, the loan amount is calculated by actual cash out top up loan amount.

* Repayment tenor of 72 months is only applicable to Debt Consolidation. - For more details of promotion offer, please refer to Terms and Conditions

星展銀行 「貸易清」私人貸款

:

清卡數之選

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額 HK$1,000,000 或以上

- HK$13,000 Apple Store 禮品卡 (全新客戶); 或

- HK$13,000 惠康購物現金券 (全新客戶); 或

- HK$11,000 Apple Store 禮品卡 (現有客戶); 或

- HK$11,000 惠康購物現金券 (現有客戶); 或

HK$11,000現金回饋 (直接存入FPS戶口) (全新客戶與現有客戶)

- 貸款額 HK$700,000 至 HK$999,999

- HK$12,300 Apple Store禮品卡 (全新客戶); 或

- HK$12,300 惠康購物現金券(全新客戶); 或

- HK$10,300 Apple Store 禮品卡(現有客戶); 或

- HK$10,300 惠康購物現金券(現有客戶); 或

HK$10,300現金回饋 (直接存入FPS戶口) (全新客戶與現有客戶)

- 貸款額 HK$300,000 至 HK$699,999

- HK$8,200 Apple Store 禮品卡(全新客戶); 或

- HK$8,200 惠康購物現金券(全新客戶); 或

- HK$7,200 Apple Store 禮品卡(現有客戶); 或

- HK$7,200 惠康購物現金券(現有客戶); 或

HK$7,200現金回饋 (直接存入FPS戶口) (全新客戶與現有客戶)

- 貸款額 HK$100,000 至 HK$299,999

- HK$2,300 Apple Store 禮品卡(全新客戶); 或

- HK$2,300 惠康購物現金券(全新客戶); 或

- HK$2,000 Apple Store 禮品卡 (現有客戶); 或

- HK$2,000 惠康購物現金券(現有客戶); 或

HK$2,000現金回饋 (直接存入FPS戶口) (全新客戶與現有客戶)

- 貸款額 HK$1,000,000 或以上

- 受條款及細則約束

顯示條款與細則

- Successfully apply via MoneyHero

- From 1 July 2025 to 30 September 2025 (Promotion Period): Successfully apply DBS Debt Consolidation Loan

- Successfully drawdown the loan within one calendar month from the application date;

- A redemption letter will be sent to the eligible customer by mail within 7 months after the end of the Promotional Period for the customer to redeem the Coupons at designated redemption center. Use of the Coupons is subject to the terms and conditions stipulated by the supplier.

顯示條款與細則

- DBS Debt Consolidation Loan Promotion (the “Promotion”) commences from 1 July 2025 and ends on 30 September 2025, both dates inclusive (the “Promotional Period”).

- Customers who successfully apply for Debt Consolidation Loan (the “Loan”) offered by DBS Bank (Hong Kong) Limited (the “Bank”) during the Promotional Period, do not hold the Loan when applying for the Loan and draw down the approved Loan within one calendar month from the application date of the Loan, if the approved Loan amount reaches the amount and tenor set out in the below table, customers will be awarded with the corresponding amount of supermarket cash coupon (“Coupons”).

- For customers who fulfilled the requirements described in Clause 2, if his/her Loan is successfully applied for via the Bank’s website, DBS Card+ or promotion hotline 2290 8118 of the Bank; and draw down the Loan will be entitled to an extra HK$300 Coupons.

- A redemption letter will be sent to the eligible customer by mail within 7 months after the end of the Promotional Period for the customer to redeem the Coupons at designated redemption center. Use of the Coupons is subject to the terms and conditions stipulated by the supplier.

- The Coupons are only applicable to customers whose Loan accounts are in good standing and not in default (as determined by the Bank at its sole discretion). If the customer’s credit standing is unsatisfactory or the customer early repays the full amount of the Loan, the Bank reserves the rights to stop issuing the Coupons or deduct the face value of the Coupons awarded to the customers from the relevant Loan account without prior notice. The Bank has the sole discretion to determine whether eligible customer is eligible for the Reward.

- The Bank may modify or terminate the promotion and/or change these terms and conditions. The Bank’s decision is final.

- The English version shall prevail if there is any inconsistency between the English and Chinese versions.

如何參加

3重現金獎賞

第一重:成功申請並向有關銀行交齊文件,可享HK$800現金券/現金回贈

第二重:提取貸款額達HK$100,000,還款期達12個月,可享額外HK$2,000現金券/現金回贈

第三重:按照不同貸款額,可享原有獨家獎賞,可享額外現金券/現金回贈

Jul 31, 2025前申請可享以下優惠:

價值 HK$800

價值 HK$800

價值 HK$800

價值 HK$2,800

價值 HK$2,800

價值 HK$2,800

價值 HK$800

價值 HK$800

價值 HK$800

價值 HK$2,800

價值 HK$2,800

價值 HK$2,800

熱門銀行貸款

featured_seasonal_and_giftsMoneyHero獎賞價值 高達 HK$48,180

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- Sony PlayStation®5 Pro 主機(價值HK$5,780); 或

- HK$5,000 Apple Store禮品卡; 或

- HK$5,000 惠康購物現金券; 或

- HK$4,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,000 至 HK$799,999 + 還款期 12 個月或以上

- Dyson Purifier Cool™ Gen1 二合一空氣清新機TP10(價值HK$3,480); 或

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$100,000 至 HK$299,999 + 還款期 12 個月或以上

- Philips 輕量強效無線吸塵機 XC2011/61 (價值HK$2,498); 或

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- 所有獨家優惠之款式、顏色等均以隨機形式發送

如欲了解優惠詳情,請參閱條款及細則

請注意,此優惠由Money Hero 提供,與銀行無關。

顯示條款與細則

- Debt Consolidation and Top Up Loan with Cash Rebate:

- # If customers apply for Top Up Loan, the loan amount is calculated by actual cash out top up loan amount.

* Repayment tenor of 72 months is only applicable to Debt Consolidation. - For more details of promotion offer, please refer to Terms and Conditions

account_balance產品禮遇

顯示條款與細則

- MoneyHero獨家優惠:

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- Sony PlayStation®5 Pro 主機(價值HK$5,780); 或

- HK$5,000 Apple Store禮品卡; 或

- HK$5,000 惠康購物現金券; 或

- HK$4,000 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$300,000 至 HK$799,999 + 還款期 12 個月或以上

- Dyson Purifier Cool™ Gen1 二合一空氣清新機TP10(價值HK$3,480); 或

- HK$3,000 Apple Store禮品卡; 或

- HK$3,000 惠康購物現金券; 或

- HK$2,400 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$100,000 至 HK$299,999 + 還款期 12 個月或以上

- Philips 輕量強效無線吸塵機 XC2011/61 (價值HK$2,498); 或

- HK$1,000 Apple Store禮品卡; 或

- HK$1,000 惠康購物現金券; 或

- HK$800 現金回贈(直接存入FPS戶口)

- 貸款額自 HK$800,000 或以上 + 還款期 12 個月或以上

- 所有獨家優惠之款式、顏色等均以隨機形式發送

如欲了解優惠詳情,請參閱條款及細則

請注意,此優惠由Money Hero 提供,與銀行無關。

顯示條款與細則

- Debt Consolidation and Top Up Loan with Cash Rebate:

- # If customers apply for Top Up Loan, the loan amount is calculated by actual cash out top up loan amount.

* Repayment tenor of 72 months is only applicable to Debt Consolidation. - For more details of promotion offer, please refer to Terms and Conditions

MoneyHero 產品分析

- 實際年利率低至1.65%

- 貸款金額高達月薪18倍或HK$2,000,000(以較低者為準)

- 靈活還款期由最短6個月至最長60個月

- 最快即日放款至您的信銀國際戶口

產品資訊

1. 有效香港身份證/ 護照/ 或其他身份證明文件

2. 最近 1 個月顯示入息證明之銀行月結單或存摺影印本( 存摺影印本需附上印有閣下姓名及賬戶號碼之首頁)或任何形式的入息證明。

若月薪收入為佣金制人士,請提供最近 2 個月之入息證明

3. 如為自僱人士,請附上公司之商業登記及最近期之利得稅稅單及最近 3 個月之公司戶口月結單

4. 附有閣下姓名之最近 3 個月內發出的現居址證明(例如:電費單或銀行月結單)

5. 專業資格證明(只適用於專業資人士)

6. 如閣下為非香港永久性居民身份證持有人,請附護照/往來港澳通行證/原居地身份證副本(如適用)及香港特別行政區發出的工作證

7. 放款戶口之存摺首頁/月結單副本

8. 自動轉賬授權書

9. 欲轉至信銀國際 $mart Plus 分期貸款之信用卡或貸款之貸款確認信或最近 1 個月之信用卡結單(須印有閣下姓名及貸款號碼)

- 實際年利率是按照香港銀行公會發出的有關指引所載的做法及方式計算,實際年利率是一個參考利率,以年化利率展示出已包括基本的利率、其他適用的手續費及收費。所示之實際年利率已約至小數點後兩個位。

- 實際年利率 1.65% 以貸款金額 HK$2,000,000 還款期 12 個月及每月平息 0.032% 計算,並已包括每年 0.5% 手續費。手續費為 0.5% 僅適用於 12 個月還款期限和貸款金額為 HK$2,000,000, 手續費為 1% 適用於其他情況。例子只供參考。最終批核之實際年利率將根據客戶的信貸評級及其他相關審批貸款因素決定,信銀國際保留貸款批核,適用利率及手續費的最終酌情權。

- 按貸款金額每年收取1%手續費並於提取貸款時從貸款金額中扣除。

- 即日放款服務只適用於銀行服務時間內(星期一至五上午9時至晚上8時,星期六、日及公眾假期除外)放款至信銀國際戶口。有關處理時間由銀行確定已批核之貸款開始計算。

- 受有關條款及細則約束。借定唔借?還得到先好借!請參閱網頁

特快私人貸款

featured_seasonal_and_giftsMoneyHero獎賞價值 高達 HK$33,800

顯示條款與細則

- WeLend迎新現金回贈

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- HK$33,800 現金獎賞

- 貸款額 HK$800,000 至 HK$1,199,999+ 還款期至少 24 個月以上

- HK$21,800 現金獎賞

- 貸款額自 HK$600,000 至 HK$799,999 + 還款期至少 24 個月以上

- HK$17,800 現金獎賞

- 貸款額自 HK$500,001 至 HK$599,999 + 還款期至少 24 個月以上

- HK$15,800 現金獎賞

- 貸款額自 HK$300,001 至 HK$500,000 + 還款期至少 24 個月以上

- HK$13,800 現金獎賞

- 貸款額自 HK$200,001 至 HK$300,000 + 還款期至少 24 個月以上

- HK$9,800 現金獎賞

- 貸款額自 HK$150,001 至 HK$200,000 + 還款期至少 24 個月以上

- HK$2,800 現金獎賞

- 貸款額 HK$1,200,000+ 還款期至少 24 個月以上

- 受條款及細則約束

MoneyHero 產品分析

- 成功申請並提取指定貸款額享高達HK$33,800 現金回贈

- 公務員或專業人士,貸款額HK$1,000,001或以上,還款期12 個月,可享低至1%實際年利率

- A.I. 全自動貸款,由申請、批核到過戶,全程網上處理,現金即到手

- A.I. 1秒報價,貸款額準確批足

- WeScore信貸新指標 WeLend 4億組數據助你信貸健康!

產品資訊

1. 香港身份證影本

2. 放款戶口的證明

3. 住址證明

4. 收入證明

(固定收入人士:最近1個月的收入證明

佣金制收入人士:最近3個月的收入證明

地產銷售行業人士: 最近6個月的收入證明)

- 所有現金獎受條款及細則約束

- 以上利率及還款資料僅供參考,最終須按客戶之申請資料及個人信貸紀錄而定。WELEND LIMITED擁有對貸款審批及任何爭議之最終決定權

- 忠告:借錢梗要還,咪俾錢中介

- 查詢及投訴熱線:3590 6396

- 放債人牌照號碼:0829/2024

熱門銀行貸款

featured_seasonal_and_giftsMoneyHero獎賞價值 高達 HK$59,250

顯示條款與細則

MoneyHero獨家優惠:

貸款額 還款期 12個月-42個月 還款期48個月以上 貸款額 HK$2,000,000 或以上 HK$11,000 Apple Store 禮品卡;或 HK$11,000惠康現金券 ;或

HK$10,000 現金回贈(直接存入FPS戶口)HK$13,000 Apple Store 禮品卡;或 HK$13,000 惠康現金券;或

HK$10,000 現金回贈(直接存入FPS戶口)貸款額自 HK$800,000 至 HK$1,999,999 HK$8,500 Apple Store 禮品卡;或 HK$8,500惠康現金券;或

HK$7,200 現金回贈(直接存入FPS戶口)HK$9,000 Apple Store 禮品卡;或 HK$9,000惠康現金券 ;或

HK$7,200 現金回贈(直接存入FPS戶口)貸款額自 HK$500,000 至 HK$799,999 HK$7,500 Apple Store 禮品卡;或 HK$7,500 惠康現金券;或

HK$6,200 現金回贈(直接存入FPS戶口)HK$8,000 Apple Store 禮品卡;或 HK$8,000惠康現金券;或

HK$6,200 現金回贈(直接存入FPS戶口)貸款額自 HK$300,000 至 HK$499,999 HK$6,000 Apple Store 禮品卡;或 HK$6,000 惠康現金券 ;或

HK$6,000 現金回贈(直接存入FPS戶口)HK$7,500 Apple Store 禮品卡;或 HK$7,500 惠康現金券;或

HK$7,500 現金回贈(直接存入FPS戶口)貸款額自 HK$200,000 至 HK$299,999 HK$4,000 Apple Store 禮品卡;或 HK$4,000惠康現金券;或

HK$3,500 現金回贈(直接存入FPS戶口)HK$4,500 Apple Store 禮品卡;或 HK$4,500惠康現金券;或

HK$3,500 現金回贈(直接存入FPS戶口)貸款額自 HK$100,000 至 HK$199,999 HK$2,000 Apple Store 禮品卡;或 HK$2,000惠康現金券 ;或

HK$1,500 現金回贈(直接存入FPS戶口)HK$2,500 Apple Store 禮品卡;或 HK$2,500惠康現金券;或

HK$1,500 現金回贈(直接存入FPS戶口)- 所有獨家優惠均以顏色隨機形式發放

如欲了解優惠詳情,請參閱條款及細則

- 換領流程由推廣期結束後起計需時至少16星期,所需時間或會因批核、簽賬及其他實際情況變動

顯示條款與細則

- The application of Citi Speedy Cash Personal Loan or Citi Debt Consolidation Loan must be successfully applied on or before 31 July 2025, and loan must be drawn down on or before 14 August 2025

The application date is subject to Citibank’s system records