If you live and work in Hong Kong, you'll need to pay taxes. Whether or not you're self-employed or work for a company, you'll need to file a tax claim individually and pay the estimated amount on time (or face severe penalties).

You can now visit CreditGo.com.hk, our sister site and Hong Kong's first and only free credit score and report platform, to obtain your personalized credit report. It only takes a few mins to check your score and find out if you are eligible for the lowest interest rate loan offer! Take a look now!

You might be used to the system in other territories where employers typically pay income taxes on your behalf and deduct these tax payments from your monthly salary. So it's important to remember to save for your annual tax payments in Hong Kong as you might be surprised by the lump sum that you'll be expected to pay at the end of the year.

Quick Facts on the Hong Kong Tax System:

- Period of assessment: 1 April to 31 March

- Max. rate of income tax: 17%

- Government body responsible: Inland Revenue Department (IRD)

1. How Are Hong Kong Tax Rates Determined by the IRD?

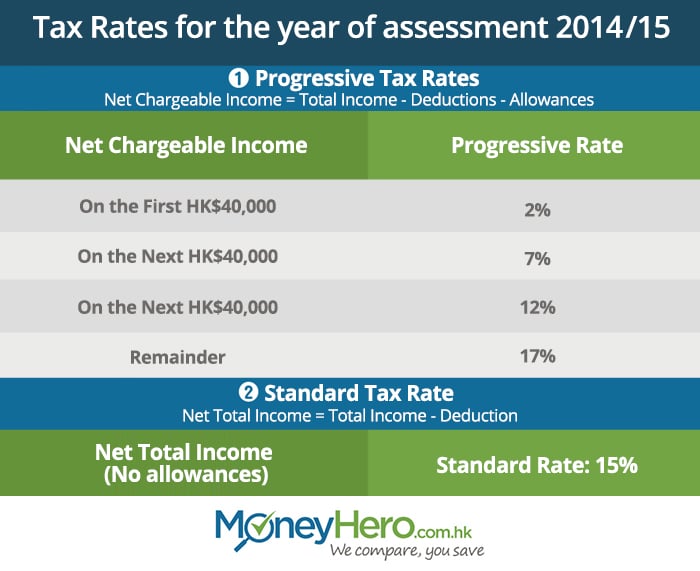

Hong Kong salaries tax is chargeable at (1) progressive rates on your net chargeable income or (2) at standard rates based on your net total income, whichever is lower. Your chargeable income includes salaries, wages, director's fees and allowances.

Read more about chargeable and non-chargeable income in Hong Kong on the official website of the Hong Kong Inland Revenue Department (IRD).

Get a glimpse at how much the rest of the world pays in taxes with our handy infographic.

Read More: Income Tax Rates Around the World

2. What Are Your Tax Obligations?

I. Is your employment sourced inside or outside of Hong Kong?

If you are employed by a Hong Kong company to work in Hong Kong, all of your earnings (including income that is attributable to services outside Hong Kong) are taxable.

If you are assigned to work in Hong Kong by your overseas employer, then only income derived from services you rendered in Hong Kong would be assessed and generally on a days-in-days-out basis (the number of days you were in Hong Kong).

If you have been in Hong Kong for not exceeding 60 days during the year of assessment, you will be exempt from salaries tax.

Find out how to determine the source of your employment here.

II. What are your tax obligations if you’re a company director?

If you are a director of a Hong Kong company, that means you are holding a Hong Kong office and your earnings will be taxable, regardless of the number of days you stayed in Hong Kong during the year of assessment, with no exemptions or relief available.

If you are a director of an overseas company but reside in Hong Kong, earnings from a non-Hong Kong directorship are exempt from salaries tax.

III. Can you apply for full or partial exemptions under the salaries tax?

You may seek full or partial exemptions from taxes on a year-by-year basis if you:

(a) performed all income earning services outside Hong Kong during that year of assessment;

(b) were employed by a company outside Hong Kong and the aggregated periods of your visits to Hong Kong did not exceed 60 days;

(c) have paid tax (similar to salaries tax) to an overseas tax authority relating to services rendered by you outside Hong Kong; OR

(d) wish to claim double taxation relief in respect of PRC tax paid by you in the Mainland

Read more about the application for Full or Partial Exemption of Income under the Salaries Tax.

If your income is taxed outside Hong Kong, you should read more about Double Taxation Relief here to see if you are liable for double taxation.

3. How Do You File a Hong Kong Tax Return?

Individuals Tax Returns (BIR60) are normally issued on the first working day of May each year. You are required to complete and send the tax return back to the IRD within 1 month from the date of issue.

You can also file the return electronically by opening a personal account under the IRD's eTAX services. The deadline for submission will be extended by 1 month automatically.

If you run your own business as a corporation or partnership, you should complete the Profit Tax Return (BIR51, BIR52 or BIR54). Read more about completion of profit tax returns here.

If you think that your income for the year is taxable but haven’t received a tax return the IRD , then you have up to 4 months to get in touch with the IRD to request a return form.

Even if you’re not eligible for taxes in Hong Kong, you should still send a completed tax return form to the IRD by the stipulated due date.

Read More: Everything You Need to Know About Filing Income Tax 2015

4. How Do You Calculate Taxes in Hong Kong?

In Hong Kong, you are entitled to a non-taxable allowance of HK$120,000 and eligible to claim other allowances such as married person’s allowance and child allowance.

Apart from that, you may also claim other deductions such as outgoings and expenses, approved charitable donations and expenses for self-education.

You can calculate your tax liabilities under Hong Kong salaries tax or personal assessment by using the IRD Tax Calculator for the relevant year of assessment.

5. How Do You Pay Taxes in Hong Kong?

Starting from October each year, taxpayers in Hong Kong will receive a notice of assessment.

You can settle your tax in person at post offices and convenience stores, by post or electronically via the Internet, by phone or ATM.

You may also join the Electronic Tax Reserve Certificate Scheme (TRCs) which helps taxpayers to build up funds for tax payment and provides users with an auto tax payment service.

6. How Do You Pay Your Tax Bill If You Don't Have Enough Money Saved?

- Pay in installments by applying to the IRD.

- Take out a tax loan from banks or non-bank lenders in Hong Kong - interest rates for tax loans are lower than regular personal loans and easier to apply for.

Remember to compare the tax loans offered by different providers using the Annualised Percentage Rate (APR), which can reflect the true cost of a loan.

For more detailed questions on taxation in Hong Kong, visit the official website of the IRD.

If you're shopping around for a tax loan, read more about our tips to help you get the best deals in Hong Kong.

Read More: 6 Must-Know Tips to Get the Best Tax Loan in Hong Kong

Read More: Don’t Forget to Pay Your 2014/2015 Tax Bill On Time!

Check out our Tax Loan Comparison Platform to find the best Tax Loan for you.

Additional resources that may be useful:

Hong Kong Government - Salaries Tax & Personal Assessment

A guide to Salaries Tax for people coming to work in Hong Kong

Visit MoneyHero.com.hk Blog for more useful money-saving tips and personal financial advice. Don’t forget to follow our Facebook Page!