Free to check your credit score Anytime, Anywhere

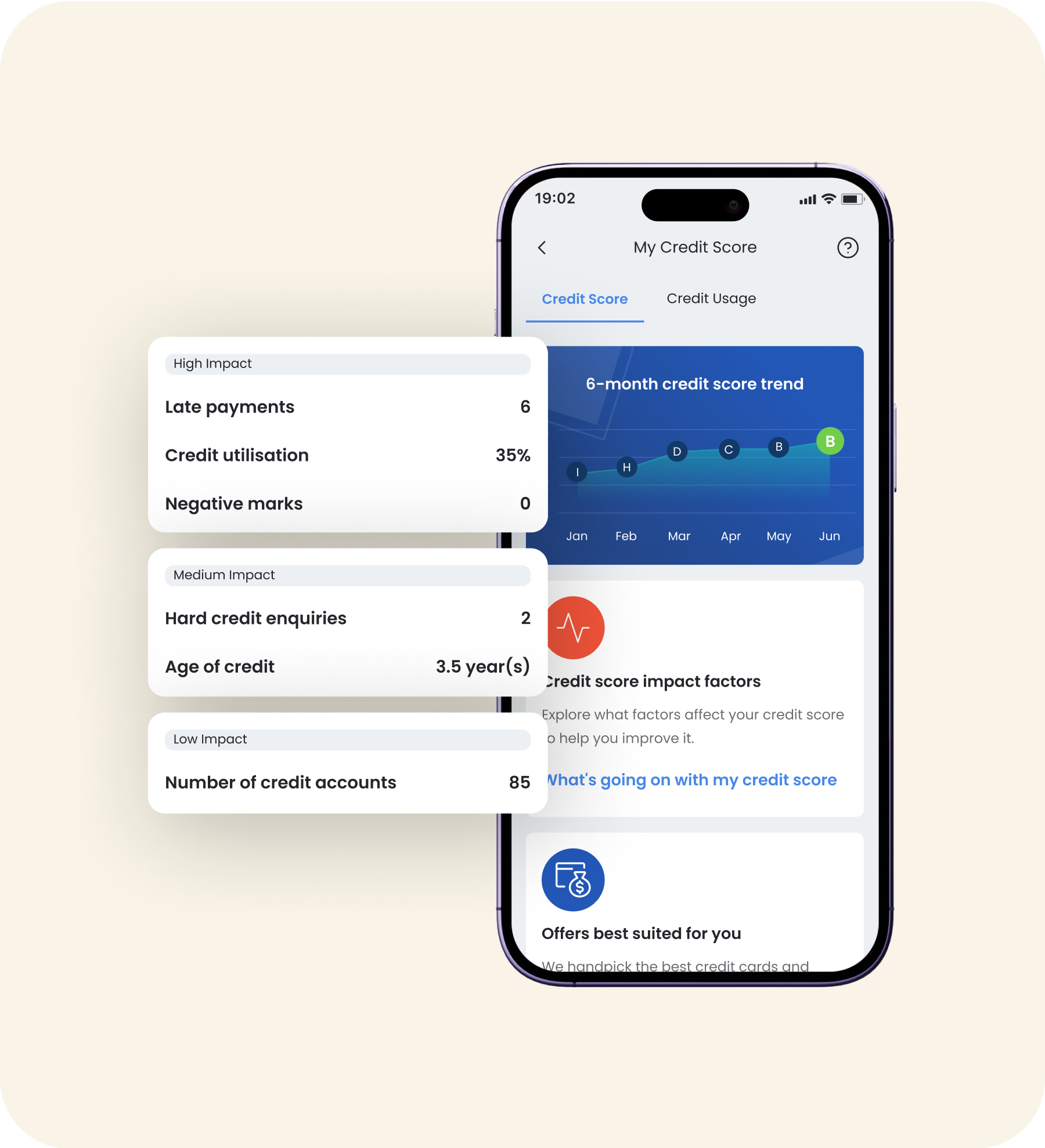

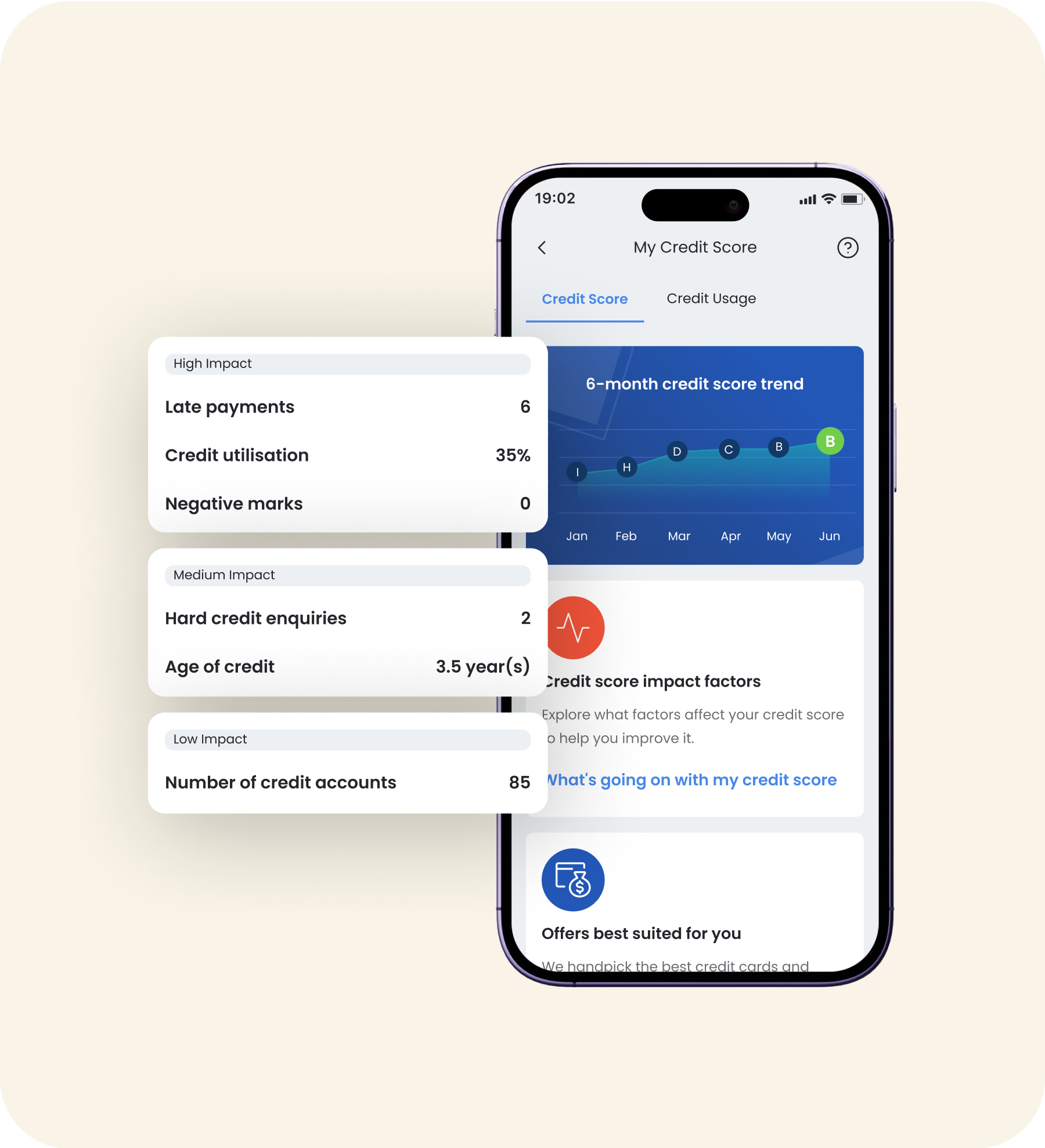

6-month credit score trend & credit score impact factors

Credit usage and summary

Credit report and credit activity alerts

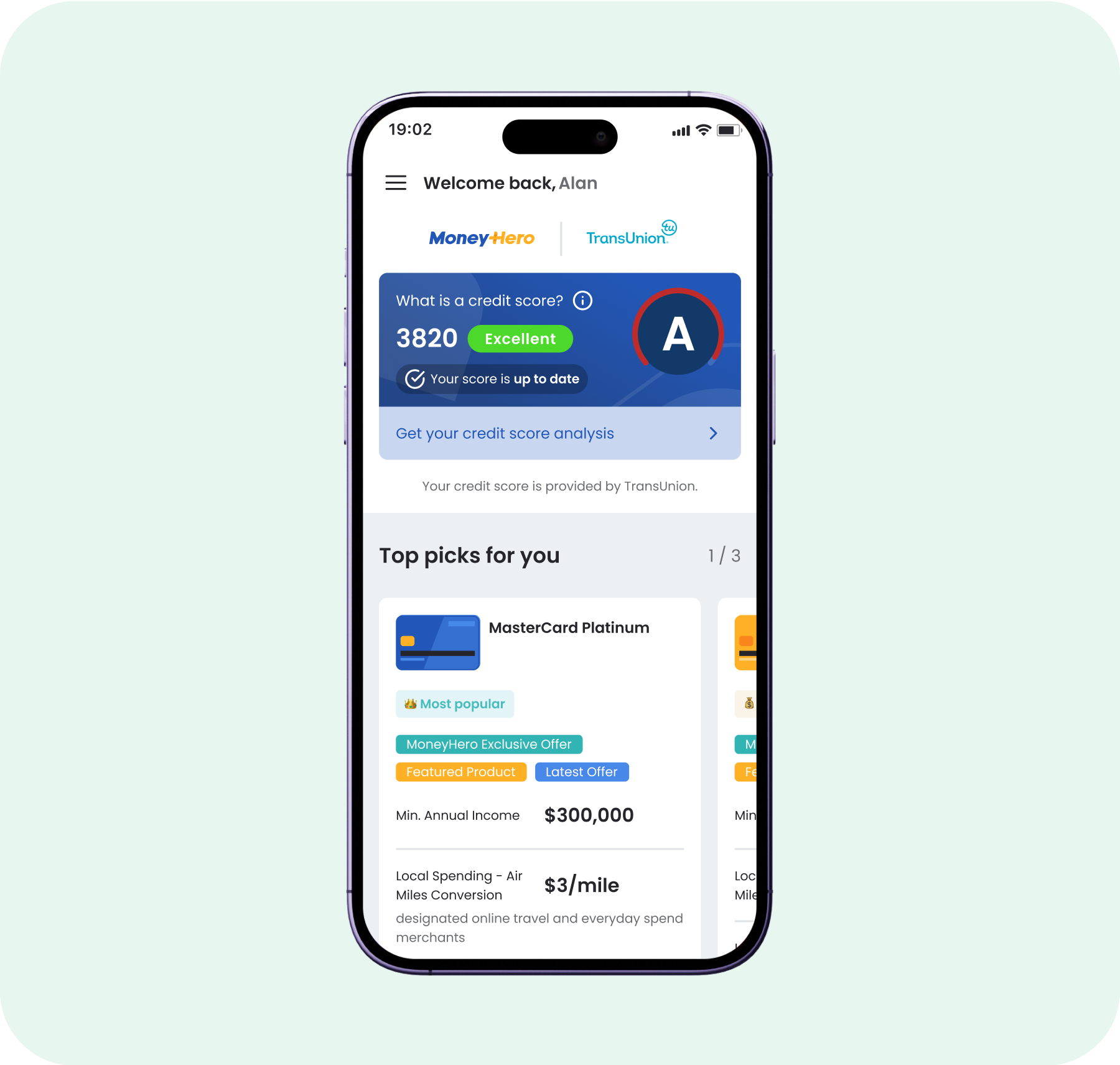

Explore the best product based on your credit score

Top picks and financial tips for you

MoneyHero App Account Opening 101

Create an account and unlock your credit score for free in as fast as 5 minutes!

We adopt a bank-level standard encryption system with ISO 27001 certification to protect your data and information, and no third-party can access your data without your consent.

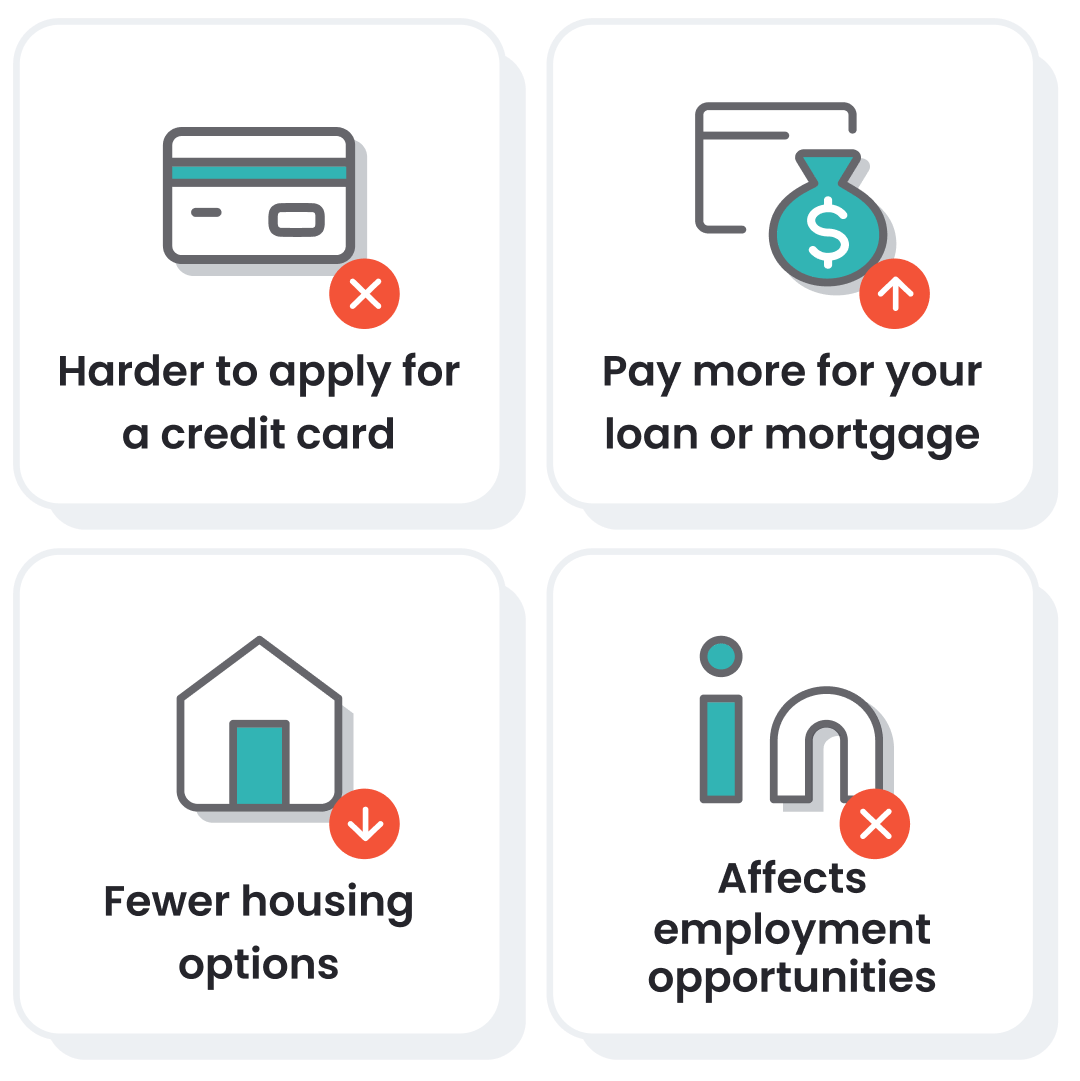

How Your Credit Score

Affects Your Everyday Life

Your Credit.

Your Financial Identity.

Improve your credit score for free with real-time credit score monitoring powered by MoneyHero and TransUnion with professional tips!

It’s Free!

Check Your Credit Score Anytime, Anywhere

Get your credit score from TransUnion for free to keep track of your credit health and make improvements. Check your score as often as you like - it won't hurt!

Improve Your Credit Score

6-month credit score trend & credit score impact factors

The 6-month credit score trend feature enables you to easily monitor changes in your credit score over time. Additionally, MoneyHero App analyses a range of factors that impact your credit score with tips to help you improve your score!

#Full 6-month trend can only be shown if user logins and checks TU score each month consecutively.

Improve Your Credit Score

6-month credit score trend & credit score impact factors

The 6-month credit score trend feature enables you to easily monitor changes in your credit score over time. Additionally, MoneyHero App analyses a range of factors that impact your credit score with tips to help you improve your score!

#Full 6-month trend can only be shown if user logins and checks TU score each month consecutively.

Simple, Clear, and Comprehensive!

Credit usage summary

This summary provides an overview of your credit usage, including both credit cards and personal loans. Here, you can easily gain insights into your credit portfolio, including the limit for each credit card and outstanding balance.

Stay on top of your credit usage and take control of your financial well-being easily!

Stay Informed and Secure

Credit report and credit activity alerts

A detailed overview of your bill payment history, outstanding loans, current debt, and credit card details. The credit alert helps notify users the possibility of identity theft by notifying you of any attempts to open new credit cards or loans in your name.

Stay Informed and Secure

Credit report and credit activity alerts

A detailed overview of your bill payment history, outstanding loans, current debt, and credit card details. The credit alert helps notify users the possibility of identity theft by notifying you of any attempts to open new credit cards or loans in your name.

Personalised recommendations

Explore the best financial product based on your credit score

Our app recommends the most suitable financial products based on your credit score, ensuring that you make the best decisions about your finances.

Eye-Opening Insights

Top picks and financial tips for you

You can find top picks from MoneyHero and a wide range of blog articles and content to help you increase your financial literacy and knowledge all within the palm of your hand.

Eye-Opening Insights

Top picks and financial tips for you

You can find top picks from MoneyHero and a wide range of blog articles and content to help you increase your financial literacy and knowledge all within the palm of your hand.

Need Some Help?

- How to download the MoneyHero App?

-

Register your email address at the MoneyHero App's homepage to join our beta test. We will send you a link to download the MoneyHero App when it is ready.

- How does MoneyHero protect my data?

-

MoneyHero adopts a bank-level standard encryption system to protect your data and information. No one can access your data without your consent; All identifiable personal credit information will not be stored for more than 24 hours.

- What is a credit score?

-

A credit report is established once you have applied for a credit card or a personal loan. The information within would be filtered and calculated to generate a credit score, commonly known as a credit score. When you apply for credit cards, personal instalment loans, car loans, mortgage loans and other loan products, banks and financial institutions will ask TransUnion for your credit score and report as one of their criteria for approving the application.

- What is a credit report?

-

Your credit report contains detailed information about your credit history, including your repayment history, total credit line, available balance, past bankruptcy records, and other relevant details. Hong Kong's personal credit report is provided by TransUnion.

- Which key factors impact my credit scores?

-

Your credit score reflects your credit usage and history, and the significant factors impacting your score are:

- Payment records

- Total credit/loan balance

- The length of the credit history

- The type(s) of credit account(s)

- The number of newly opened credit account(s)

.png)