香港地一屋難求,擁有一層未補地價的公屋、居屋或者綠置居 ,都稱得上是「人生勝利組」。有瓦遮頭固然好,但未補地價的公屋同居屋等資助出售房屋,在加按套現周轉方面始終有限制。如果擅自將未補地價單位加按更屬犯法!究竟未補價單位的業主需要現金周轉時可以如何合法套現呢?今次就等MoneyHero為大家拆解!。

根據房屋條例,即使你嘅公屋、居屋喺5年轉讓限制期內,或5年過後未補地價,都可以再做按揭。不過必須符合以下條件,再獲房委會批准,而可獲批准嘅加按原因包括:

當你獲得房委會批準,取得「重新按揭准許證明」,就可以向銀行或財務公司申請加按。不過要注意,即使業主獲得當局批准,加按套現的金額亦受到嚴格限制,只能套取有關特別/ 緊急情況所需的金額。另外,加按嘅按揭利率會根據業主嘅信貸評分同入息等財務背景而定,一般較新造按揭為高,實際年利率可以達到5%以上。

延伸閱讀:【樓宇買賣須知】甚麼是補地價?公屋/居屋/資助出售房屋補地價計算指南

MoneyHero遵從《個人資料(隱私)條例 2013 》致力保障你的個人資料。透過MoneyHero申請貸款時,你的個人資料將傳送至銀行或貸款機構,並由他們處理有關申請。銀行或貸款機構可能會直接聯絡你。除非你同意,否則MoneyHero不會儲存你的個人資料。

安信業主私人貸款特色是大額借到足,貸款額按物業估值及個人信貸狀況計算,而且不限物業種類,私樓、唐樓、單幢樓及未補地價居屋的業主均可申請,就算聯名物業,一人申請都可以。

💡貸款特點

即日起至2024年12月31日,成功申請及提取指定安信私人貸款,送高達HK$12,000現金獎(以淨貸款額1%計算,申請指定私人貸款的業主可獲最高金額HK$12,000,非業主可獲最高HK$8,000)

💰MoneyHero獨家優惠

即日起至至2024年9月2日,成功經MoneyHero申請,並於2024年9月2日或之前向安信交齊所有文件,不論貸款額及是否獲批核,可享4張Now E 英超及西甲賽事1個月通行證 (價值HK$1,072) / HK$500 Apple Store禮品卡 或 惠康現金券(若該申請的最後狀況為取消,客戶將不可享有此推廣活動之任何獎賞)。

網上申請,最快30分鐘有批核結果。無論私人屋苑、單棟洋樓、政府公屋或居屋(包括未補地價),不論自住或出租,只要是業主,即使聯名物業亦可以一人申請。免律師費,亦毋須提供樓契,貸款申請及合約不會紀錄於土地註冊處。

💡貸款特點

此外,即日起至2024年8月7日,經本網成功申請及提取WeLend私人貸款達指定貸款額,還款期24個月或以上,可獲高達HK$18,800現金獎賞

中潤物業按揭針對居屋、租者置其屋及夾屋業主,推出多種業主私人貸款,讓他們在未補地價的情況下,無須抵押物業也可借取私人貸款。貸款額可達HK$200萬,樓價越高,貸款額越高,而還款期亦具彈性,長達180個月,提早還款亦無罰息,借一日利息還一日。

💡貸款特點

即日起至2024年9月2日,經MoneyHero申請並成功提取貸款,即可享獨家HK$500惠康購物現金券。

相關文章:【居屋】「 白表 」、「 綠表 」資格有咩分別?

相關文章:【加按套現?】有樓人士資金周轉大法 比較加按/業主私人貸款

如果大家想知多啲理財貼士,就要留意 MoneyHero Blog,同埋緊貼我哋嘅 Facebook Page!

未補地價可合法加按?

唔少業主需要現金時都會考慮將物業加按,但一般情況下,未補價的公營房屋,不論係居屋、公屋定綠置居單位,都唔可以加按套現。就特別或緊急情況,業主可向房委會申請將有關物業加按,但房委會只會就非常極端的情況作考慮。根據房屋條例,即使你嘅公屋、居屋喺5年轉讓限制期內,或5年過後未補地價,都可以再做按揭。不過必須符合以下條件,再獲房委會批准,而可獲批准嘅加按原因包括:

- 籌措醫藥費;

- 家庭成員教育費;

- 殮葬費;

- 業主因離婚/分居而致需向配偶付還樓價或支付贍養費;

- 業主因生意出現財政困難,以致難以應付開支。

當你獲得房委會批準,取得「重新按揭准許證明」,就可以向銀行或財務公司申請加按。不過要注意,即使業主獲得當局批准,加按套現的金額亦受到嚴格限制,只能套取有關特別/ 緊急情況所需的金額。另外,加按嘅按揭利率會根據業主嘅信貸評分同入息等財務背景而定,一般較新造按揭為高,實際年利率可以達到5%以上。

延伸閱讀:【樓宇買賣須知】甚麼是補地價?公屋/居屋/資助出售房屋補地價計算指南

輕鬆周轉 毋須按樓

如果持有未補價嘅資助房屋單位,有事急須套現,但唔符合房委會要求,或者唔夠時間等待申請,可以考慮利用市面上嘅業主貸款周轉,係唔涉及按揭性質下提取現金。不過,申請任何貸款都要量力而為,特別要睇清楚貸款利息水平同評估個人嘅財政能力,目前唔少財務公司,例如安信信貸同中潤物業按揭都有提供業主貸款,業主可根據需要比較及選擇。MoneyHero遵從《個人資料(隱私)條例 2013 》致力保障你的個人資料。透過MoneyHero申請貸款時,你的個人資料將傳送至銀行或貸款機構,並由他們處理有關申請。銀行或貸款機構可能會直接聯絡你。除非你同意,否則MoneyHero不會儲存你的個人資料。

精選業主私人貸款

精選業主貸款

安信業主私人貸款︰高達HK$1,072獎賞

安信業主私人貸款特色是大額借到足,貸款額按物業估值及個人信貸狀況計算,而且不限物業種類,私樓、唐樓、單幢樓及未補地價居屋的業主均可申請,就算聯名物業,一人申請都可以。

💡貸款特點

- 最低實際年利率︰1.18%

- 最高貸款額︰HK$120萬(視乎物業估值及申請人信貸狀況而定)

- 還款期︰長達84個月

- 申請門檻︰持有物業

- 手續費︰免費

即日起至2024年12月31日,成功申請及提取指定安信私人貸款,送高達HK$12,000現金獎(以淨貸款額1%計算,申請指定私人貸款的業主可獲最高金額HK$12,000,非業主可獲最高HK$8,000)

💰MoneyHero獨家優惠

即日起至至2024年9月2日,成功經MoneyHero申請,並於2024年9月2日或之前向安信交齊所有文件,不論貸款額及是否獲批核,可享4張Now E 英超及西甲賽事1個月通行證 (價值HK$1,072) / HK$500 Apple Store禮品卡 或 惠康現金券(若該申請的最後狀況為取消,客戶將不可享有此推廣活動之任何獎賞)。

WeLend業主私人貸款︰毋須提供樓契+高達HK$18,800獎賞

網上申請,最快30分鐘有批核結果。無論私人屋苑、單棟洋樓、政府公屋或居屋(包括未補地價),不論自住或出租,只要是業主,即使聯名物業亦可以一人申請。免律師費,亦毋須提供樓契,貸款申請及合約不會紀錄於土地註冊處。

💡貸款特點

- 最低實際年利率︰1.88%

- 申請門檻︰持有物業;年薪HK$96,000

- 最高貸款額︰HK$150萬(視乎物業估值及申請人信貸狀況而定)

- 還款期︰長達84個月

此外,即日起至2024年8月7日,經本網成功申請及提取WeLend私人貸款達指定貸款額,還款期24個月或以上,可獲高達HK$18,800現金獎賞

| 提取貸款金額 | MoneyHero獨家現金回贈 + WeLend迎新優惠 |

|---|---|

| HK$800,001以上 | HK$16,000 |

| HK$600,001 至 HK$80萬 | HK$18,800 |

| HK$500,001 至 HK$60萬 | HK$13,800 |

| HK$400,001 至 HK$50萬 | HK$10,800 |

| HK$300,001 至 HK$40萬 | HK$8,600 |

| HK$200,001 至 HK$30萬 | HK$7,600 |

| HK$100,001 至 HK$20萬 | HK$2,800 |

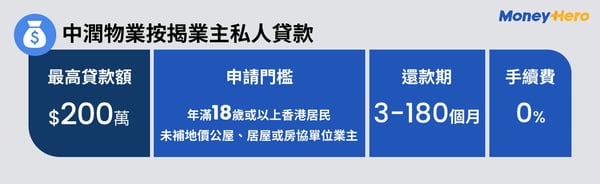

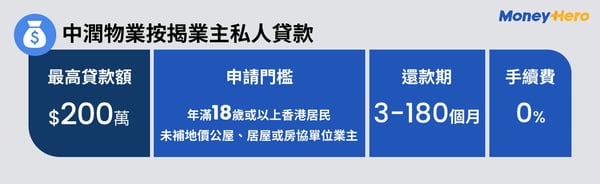

中潤物業按揭業主私人貸款︰獨家獎賞價值HK$500

中潤物業按揭針對居屋、租者置其屋及夾屋業主,推出多種業主私人貸款,讓他們在未補地價的情況下,無須抵押物業也可借取私人貸款。貸款額可達HK$200萬,樓價越高,貸款額越高,而還款期亦具彈性,長達180個月,提早還款亦無罰息,借一日利息還一日。

💡貸款特點

- 最低實際年利率︰7%

- 申請門檻︰居屋、租置公屋或夾屋業主

- 最高貸款額︰高達HK$200萬

- 還款期︰長達180個月

- 準時還款可享現金回贈

- 手續費︰免費

即日起至2024年9月2日,經MoneyHero申請並成功提取貸款,即可享獨家HK$500惠康購物現金券。

精選銀行首次置業/轉按按揭優惠

相關文章:【居屋】「 白表 」、「 綠表 」資格有咩分別?

相關文章:【加按套現?】有樓人士資金周轉大法 比較加按/業主私人貸款

如果大家想知多啲理財貼士,就要留意 MoneyHero Blog,同埋緊貼我哋嘅 Facebook Page!