Best Citibank Personal Loan Rates and Offers Comparison

Citi Speedy Cash Personal Loan

2 Offer Available

+ 35 other gift options

Valid until

31 July 2025

+ 17 other gift options

Valid until

31 July 2025

- Same-day approval and same-day loan disbursement

- The loan amount is up to 12 times of the monthly salary or HK$3,500,000, whichever is lower

- Repayment term up to 60 months, HK$0 handling fee

- No hidden terms and conditions

【MoneyHero Exclusive Offer】From 30 June 2025 6 p.m. to 31 July 2025 6 p.m., successfully apply for Citi Speedy Cash Personal Loan or Citi Card Debt Consolidation Loan on MoneyHero, choose a repayment period of 12 months or above, and drawdown the loan within 1 month to enjoy the MoneyHero exclusive offer.

✍🏻Remember to complete the "MoneyHero Reward Redemption Form" after loan application within 7 days

Gift Options

Loan amount HK$2,000,000 or above + repayment period from 12 months to 42 months

Loan amount HK$2,000,000 or above + repayment period from 48 months or above

Loan amount from HK$800,000 to HK$1,999,999 + repayment period from 12 months to 42 months

Loan amount from HK$800,000 to HK$1,999,999 + repayment period from 48 months or above

Repayment period from 12 months to 42 months + loan amount from HK$500,000 to HK$799,999

Repayment period from 48 months or above + loan amount from HK$500,000 to HK$799,999

Repayment period from 12 months to 42 months + loan amount from HK$300,000 to HK$499,999

Repayment period from 48 months or above + loan amount from HK$300,000 to HK$499,999

Repayment period from 12 months to 42 months + loan amount from HK$200,000 to HK$299,999

Repayment period from 48 months or above + loan amount from HK$200,000 to HK$299,999

Repayment period from 12 months to 42 months + loan amount from HK$100,000 to HK$199,999

Repayment period from 48 months or above + loan amount from HK$100,000 to HK$199,999

MoneyHero Exclusive Offer :

Loan amount Repayment period from 12months-42months Repayment period from 48months or above Loan amount HK$2,000,000 or above HK$11,000 Apple Store Gift Card;OR

HK$11,000 Wellcome Shopping Voucher ;OR

HK$10,000 Cash Rebate(Deposited via FPS Account)HK$13,000 Apple Store Gift Card;OR HK$13,000 Wellcome Shopping Voucher;OR

HK$10,000 Cash Rebate(Deposited via FPS Account)Loan amount from HK$800,000 to HK$1,999,999 HK$8,500 Apple Store Gift Card;OR HK$8,500 Wellcome Shopping Voucher;OR

HK$7,200 Cash Rebate(Deposited via FPS Account)HK$9,000 Apple Store Gift Card;OR HK$9,000 Wellcome Shopping Voucher ;OR

HK$7,200 Cash Rebate(Deposited via FPS Account)Loan amount from HK$500,000 to HK$799,999 HK$7,500 Apple Store Gift Card;OR HK$7,500 Wellcome Shopping Voucher;OR

HK$6,200 Cash Rebate(Deposited via FPS Account)HK$8,000 Apple Store Gift Card;OR HK$8,000 Wellcome Shopping Voucher;OR

HK$6,200 Cash Rebate(Deposited via FPS Account)Loan amount from HK$300,000 to HK$499,999 HK$6,000 Apple Store Gift Card;OR HK$6,000 Wellcome Shopping Voucher ;OR

HK$5,500 Cash Rebate(Deposited via FPS Account)HK$7,500 Apple Store Gift Card;OR HK$7,500 Wellcome Shopping Voucher;OR

HK$5,500 Cash Rebate(Deposited via FPS Account)Loan amount from HK$200,000 to HK$299,999 HK$4,000 Apple Store Gift Card;OR HK$4,000 Wellcome Shopping Voucher;OR

HK$3,500 Cash Rebate(Deposited via FPS Account)HK$4,500 Apple Store Gift Card;OR HK$4,500 Wellcome Shopping Voucher;OR

HK$3,500 Cash Rebate(Deposited via FPS Account)Loan amount from HK$100,000 to HK$199,999 HK$2,000 Apple Store Gift Card;OR HK$2,000 Wellcome Shopping Voucher ;OR

HK$1,500 Cash Rebate(Deposited via FPS Account)HK$2,500 Apple Store Gift Card;OR HK$2,500 Wellcome Shopping Voucher;OR

HK$1,500 Cash Rebate(Deposited via FPS Account)- All of the Rewards will be issued randomly in colour

- For more details about the promotion, please see Terms and Conditions

- The redemption process may take at least 16 weeks upon campaign period ends, depending on the actual situation regarding user approval and transaction status or other factors that may affect eligibility for the Promotion Reward

Gift Options

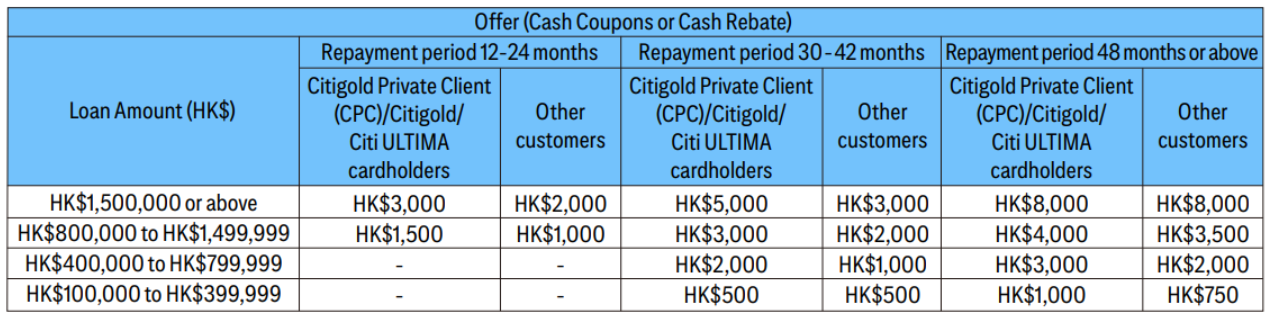

Repayment period from 48 months above + loan amount HK$1,500,000 or above

Repayment period from 48 months above + loan amount from HK$800,000 to HK$1,499,999

Repayment period from 48 months above + loan amount from HK$400,000 to HK$799,999

Repayment period from 48 months above + loan amount from HK$100,000 to HK$399,999

Repayment period from 30 months to 42 months + loan amount HK$1,500,000 or above

Repayment period from 30 months to 42 months + loan amount from HK$800,000 to HK$1,499,999

Repayment period from 30 months to 42 months + loan amount from HK$400,000 to HK$799,999

Repayment period from 30 months to 42 months + loan amount from HK$100,000 to HK$399,999

Repayment period from 12 months to 24 months + loan amount from HK$1,500,000 or above

Repayment period from 12 months to 24 months + loan amount from HK$800,000 to HK$1,499,999

- The application of Citi Speedy Cash Personal Loan or Citi Debt Consolidation Loan must be successfully applied on or before 31 July 2025, and loan must be drawn down on or before 14 August 2025

The application date is subject to Citibank’s system records

- The Offer for Citigold Private Client/ Citigold Client / Citi ULTIMA cardholder is only applicable to the applicant who fulfill the following requirement from the date of application to the issue date of redemption letter (both dates inclusive):

Citigold Private Client should maintain the account balance at HK$8,000,000 or above, Citigold Client should maintain the account balance at HK$1,500,000 or above, and Citi ULTIMA cardholder needs to hold the Citi ULTIMA card.

A cash coupon redemption letter will be mailed to the eligible customers’ Hong Kong correspondence address according to Citibank’s record

For more details about the promotion, please see Terms and Conditions

- The Offer for Citigold Private Client/ Citigold Client / Citi ULTIMA cardholder is only applicable to the applicant who fulfill the following requirement from the date of application to the issue date of redemption letter (both dates inclusive):

- Citigold Private Client should maintain the account balance at HK$8,000,000 or above, Citigold Client should maintain the account balance at HK$1,500,000 or above, and Citi ULTIMA cardholder needs to hold the Citi ULTIMA card.

- Offers are only applicable to customers who do not hold any Personal Loan account offered by Citibank (Hong Kong) Limited at the time of application

- A cash coupon redemption letter will be mailed to the eligible customers' Hong Kong correspondence address according to Citibank's record

- Each eligible customer can enjoy the Reward once during the promotion period

- "Same day approval and same day loan disbursement" is only applicable to selected customers who successfully submit the required documents together with a filled in application form before 10am of that working day (Monday to Friday). Actual approval and loan disbursement time may differ based on the information provided

- The Annualised Percentage Rate ("APR") is as low as 1.40% (including a HK$3,000 cash rebate) or 1.56% (excluding any cash rebate), based on a monthly flat rate of 0.07%, a loan amount of HK$3,500,000, and a repayment period of 12 months.

- To borrow or not to borrow? Borrow only if you can repay!

Citi Tax Season Loan

Offer Available

+ 17 other gift options

Valid until

31 July 2025

- Instant disbursement upon loan approval*

- The loan amount is up to 12 times of the monthly salary or HK$3,500,000, whichever is lower

- Repayment term up to 60 months, HK$0 handling fee

- No hidden terms and conditions

Gift Options

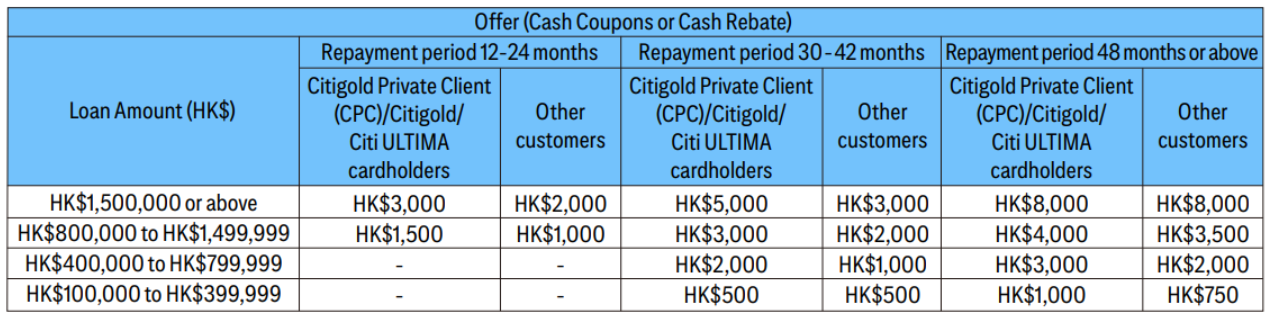

Repayment period from 48 months above + loan amount HK$1,500,000 or above

Repayment period from 48 months above + loan amount from HK$800,000 to HK$1,499,999

Repayment period from 48 months above + loan amount from HK$400,000 to HK$799,999

Repayment period from 48 months above + loan amount from HK$100,000 to HK$399,999

Repayment period from 30 months to 42 months + loan amount HK$1,500,000 or above

Repayment period from 30 months to 42 months + loan amount from HK$800,000 to HK$1,499,999

Repayment period from 30 months to 42 months + loan amount from HK$400,000 to HK$799,999

Repayment period from 30 months to 42 months + loan amount from HK$100,000 to HK$399,999

Repayment period from 12 months to 24 months + loan amount from HK$1,500,000 or above

Repayment period from 12 months to 24 months + loan amount from HK$800,000 to HK$1,499,999

- The application of Citi Speedy Cash Personal Loan or Citi Debt Consolidation Loan must be successfully applied on or before 31 July 2025, and loan must be drawn down on or before 14 August 2025

The application date is subject to Citibank’s system records

- The Offer for Citigold Private Client/ Citigold Client / Citi ULTIMA cardholder is only applicable to the applicant who fulfill the following requirement from the date of application to the issue date of redemption letter (both dates inclusive):

Citigold Private Client should maintain the account balance at HK$8,000,000 or above, Citigold Client should maintain the account balance at HK$1,500,000 or above, and Citi ULTIMA cardholder needs to hold the Citi ULTIMA card.

A cash coupon redemption letter will be mailed to the eligible customers’ Hong Kong correspondence address according to Citibank’s record

For more details about the promotion, please see Terms and Conditions

- The Offer for Citigold Private Client/ Citigold Client / Citi ULTIMA cardholder is only applicable to the applicant who fulfill the following requirement from the date of application to the issue date of redemption letter (both dates inclusive):

- Citigold Private Client should maintain the account balance at HK$8,000,000 or above, Citigold Client should maintain the account balance at HK$1,500,000 or above, and Citi ULTIMA cardholder needs to hold the Citi ULTIMA card.

- Offers are only applicable to customers who do not hold any Personal Loan account offered by Citibank (Hong Kong) Limited at the time of application

- A cash coupon redemption letter will be mailed to the eligible customers’ Hong Kong correspondence address according to Citibank’s record

- Each eligible customer can enjoy the Reward once during the promotion period

- *“Instant Disbursement Upon Loan Approval” is only applicable for disbursement to participating banks of Faster Payment System (FPS), and is subject to Citi’s loan approval and availability of FPS, while the crediting to the recipient’s account is subject to the recipient bank’s handling. Processing time may vary in some cases depending on the actual circumstances of individual applications.

- APR is calculated based on the guidelines as set out in the Code of Banking Practice and rounded up to the nearest two decimal places. Interest is calculated on the basis of 365 days per year. The actual APR applicable may differ, which is to be considered on a case-by-case basis in accordance with customer’s profile. is as low as 1.40% (including a HK$3,000 cash rebate) or 1.56% (excluding any cash rebate), based on a monthly flat rate of 0.07%, a loan amount of HK$3,500,000, and a repayment period of 12 months. The above example is for reference only.

- To borrow or not to borrow? Borrow only if you can repay!

1. Fill in the application form and submit it together with the required documents.

2. Wait for the loan approval result

3. Disburse the loan

1. HK Identity Card

2. Income proof,

e.g. latest month's payroll slip, latest salary tax demand note, latest MPF contribution proof or latest three months' payroll account bank statement/account passbook (with first page showing your name and account number)

3. Latest three months' full set of main bank statement/account passbook (with first page showing your name and account number)

4. Latest residential address proof (e.g. electricity bill or bank statement)

5. Any other documents or certificates deemed appropriate.

Citi Card Debt Consolidation Loan

2 Offer Available

+ 35 other gift options

Valid until

31 July 2025

+ 17 other gift options

Valid until

31 July 2025

- Repayment term up to 72 months, HK$0 handling fee

- Loan amount of Citi Card Debt Consolidation Loans is up to 21 times of your monthly salary or HK$1,200,000, whichever is lower

- No hidden terms and conditions

【MoneyHero Exclusive Offer】From 30 June 2025 6 p.m. to 31 July 2025 6 p.m., successfully apply for Citi Speedy Cash Personal Loan or Citi Card Debt Consolidation Loan on MoneyHero, choose a repayment period of 12 months or above, and drawdown the loan within 1 month to enjoy the MoneyHero exclusive offer.

✍🏻Remember to complete the "MoneyHero Reward Redemption Form" after loan application within 7 days

Gift Options

Loan amount HK$2,000,000 or above + repayment period from 12 months to 42 months

Loan amount HK$2,000,000 or above + repayment period from 48 months or above

Loan amount from HK$800,000 to HK$1,999,999 + repayment period from 12 months to 42 months

Loan amount from HK$800,000 to HK$1,999,999 + repayment period from 48 months or above

Repayment period from 12 months to 42 months + loan amount from HK$500,000 to HK$799,999

Repayment period from 48 months or above + loan amount from HK$500,000 to HK$799,999

Repayment period from 12 months to 42 months + loan amount from HK$300,000 to HK$499,999

Repayment period from 48 months or above + loan amount from HK$300,000 to HK$499,999

Repayment period from 12 months to 42 months + loan amount from HK$200,000 to HK$299,999

Repayment period from 48 months or above + loan amount from HK$200,000 to HK$299,999

Repayment period from 12 months to 42 months + loan amount from HK$100,000 to HK$199,999

Repayment period from 48 months or above + loan amount from HK$100,000 to HK$199,999

MoneyHero Exclusive Offer :

Loan amount Repayment period from 12months-42months Repayment period from 48months or above Loan amount HK$2,000,000 or above HK$11,000 Apple Store Gift Card;OR

HK$11,000 Wellcome Shopping Voucher ;OR

HK$10,000 Cash Rebate(Deposited via FPS Account)HK$13,000 Apple Store Gift Card;OR HK$13,000 Wellcome Shopping Voucher;OR

HK$10,000 Cash Rebate(Deposited via FPS Account)Loan amount from HK$800,000 to HK$1,999,999 HK$8,500 Apple Store Gift Card;OR HK$8,500 Wellcome Shopping Voucher;OR

HK$7,200 Cash Rebate(Deposited via FPS Account)HK$9,000 Apple Store Gift Card;OR HK$9,000 Wellcome Shopping Voucher ;OR

HK$7,200 Cash Rebate(Deposited via FPS Account)Loan amount from HK$500,000 to HK$799,999 HK$7,500 Apple Store Gift Card;OR HK$7,500 Wellcome Shopping Voucher;OR

HK$6,200 Cash Rebate(Deposited via FPS Account)HK$8,000 Apple Store Gift Card;OR HK$8,000 Wellcome Shopping Voucher;OR

HK$6,200 Cash Rebate(Deposited via FPS Account)Loan amount from HK$300,000 to HK$499,999 HK$6,000 Apple Store Gift Card;OR HK$6,000 Wellcome Shopping Voucher ;OR

HK$5,500 Cash Rebate(Deposited via FPS Account)HK$7,500 Apple Store Gift Card;OR HK$7,500 Wellcome Shopping Voucher;OR

HK$5,500 Cash Rebate(Deposited via FPS Account)Loan amount from HK$200,000 to HK$299,999 HK$4,000 Apple Store Gift Card;OR HK$4,000 Wellcome Shopping Voucher;OR

HK$3,500 Cash Rebate(Deposited via FPS Account)HK$4,500 Apple Store Gift Card;OR HK$4,500 Wellcome Shopping Voucher;OR

HK$3,500 Cash Rebate(Deposited via FPS Account)Loan amount from HK$100,000 to HK$199,999 HK$2,000 Apple Store Gift Card;OR HK$2,000 Wellcome Shopping Voucher ;OR

HK$1,500 Cash Rebate(Deposited via FPS Account)HK$2,500 Apple Store Gift Card;OR HK$2,500 Wellcome Shopping Voucher;OR

HK$1,500 Cash Rebate(Deposited via FPS Account)- All of the Rewards will be issued randomly in colour

- For more details about the promotion, please see Terms and Conditions

- The redemption process may take at least 16 weeks upon campaign period ends, depending on the actual situation regarding user approval and transaction status or other factors that may affect eligibility for the Promotion Reward

Gift Options

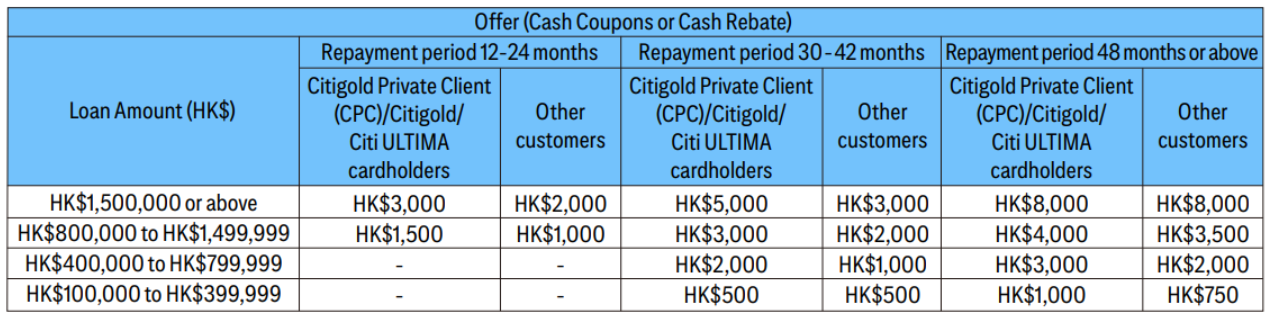

Repayment period from 48 months above + loan amount HK$1,500,000 or above

Repayment period from 48 months above + loan amount from HK$800,000 to HK$1,499,999

Repayment period from 48 months above + loan amount from HK$400,000 to HK$799,999

Repayment period from 48 months above + loan amount from HK$100,000 to HK$399,999

Repayment period from 30 months to 42 months + loan amount HK$1,500,000 or above

Repayment period from 30 months to 42 months + loan amount from HK$800,000 to HK$1,499,999

Repayment period from 30 months to 42 months + loan amount from HK$400,000 to HK$799,999

Repayment period from 30 months to 42 months + loan amount from HK$100,000 to HK$399,999

Repayment period from 12 months to 24 months + loan amount from HK$1,500,000 or above

Repayment period from 12 months to 24 months + loan amount from HK$800,000 to HK$1,499,999

- The application of Citi Speedy Cash Personal Loan or Citi Debt Consolidation Loan must be successfully applied on or before 31 July 2025, and loan must be drawn down on or before 14 August 2025

The application date is subject to Citibank’s system records

- The Offer for Citigold Private Client/ Citigold Client / Citi ULTIMA cardholder is only applicable to the applicant who fulfill the following requirement from the date of application to the issue date of redemption letter (both dates inclusive):

Citigold Private Client should maintain the account balance at HK$8,000,000 or above, Citigold Client should maintain the account balance at HK$1,500,000 or above, and Citi ULTIMA cardholder needs to hold the Citi ULTIMA card.

A cash coupon redemption letter will be mailed to the eligible customers’ Hong Kong correspondence address according to Citibank’s record

For more details about the promotion, please see Terms and Conditions

- Offers are only applicable to customers who do not hold any Personal Loan account offered by Citibank (Hong Kong) Limited at the time of application

- Each eligible customer can enjoy the Reward once during the promotion period

- The annualized percentage rate (“APR”) ranges from 5.16% to 35.78%, with repayment period of 6 to 72 months.

- The Annualized Percentage Rate ("APR") of as low as 5.16% (taking into account HK$1,500 cash rebate) or 5.40% is calculated based on the monthly flat rate 0.24% with loan amount of HK$1,200,000 and repayment tenor of 12 months.

The Annualized Percentage Rate ("APR") of as low as 35.78% is calculated based on the monthly flat rate 1.46% with loan amount of HK$100,000 and repayment tenor of 18 months.

- APR is calculated based on the guidelines as set out in the Code of Banking Practice and rounded up to the nearest two decimal places. Interest is calculated on the basis of 365 days per year. The actual APR applicable may differ, which is to be considered on a case-by-case basis in accordance with customer’s profile. An APR is a reference rate which includes the basic interest rate and other fees and charges of a product expressed as an annualized rate. The maximum APR will change and subject to monthly flat rate amendment. The Bank reserve the right to amend the monthly flat rate and APR. The loan application is subject to the Bank’s approval. For a loan amount of HKD1,200,000 with 12 months repayment period, the monthly flat rate is 0.5% (APR 11.46%), and the total loan repayment amount is HK$212,004 (including full handling fee waiver). The above example is for reference only.

- To borrow or not to borrow? Borrow only if you can repay!

1. Fill in the application form and submit it together with the required documents.

2. Wait for the loan approval result

3. Disburse the loan

1. HK Identity Card

2. Income proof,

e.g. latest month's payroll slip, latest salary tax demand note, latest MPF contribution proof or latest three months' payroll account bank statement/account passbook (with first page showing your name and account number)

3. Latest three months' full set of main bank statement/account passbook (with first page showing your name and account number)

4. Latest residential address proof (e.g. electricity bill or bank statement)

5. Any other documents or certificates deemed appropriate.

Citi Bank Personal Loan Features

Annualized Percentage Rate (APR) as low as 1.78%

- Citibank Tax Season Loan

- Citibank Speedy Cash Loan

Quick Facts for Citi Personal Loans:

Citibank Tax Season Loan

The tax loan offered by Citibank in 2024 features an Annualized Percentage Rate (APR) as low as 1.78%, without any hidden terms and conditions or handling fee. You can access the funds you need without delay thanks to potential same-day approval and loan disbursement, providing relief from your financial burden during the tax season.

Citibank Speedy Cash Loan

With Citi Speedy Cash, you can potentially obtain an approval, receive cash or have the loan deposited into your designated Citibank account as quickly as the very same day. It offers an APR as low as 1.78%, and a maximum loan of HK$3.5 million or 12 times your monthly salary. There are no handling fees for loan application, and you can enjoy a repayment period of up to 60 months. Residents of Hong Kong aged 18 or above are eligible to apply.

Citibank Card Debt Consolidation Loan

Citi Card Debt Consolidation Loan allows customers to consolidate and settle all their debts in one go by borrowing up to a maximum of HK$1.2 million or 21 times their monthly salary. The loan amount will be directly used to settle borrowers’ outstanding credit card balances or loans from other financial institutions. Any remaining balance will be deposited into their designated bank account. Borrowers of Citi Card Debt Consolidation Loan enjoy an APR as low as 8.64%, with a repayment period of up to 72 months.

Citibank Personal Loan FAQ

How long is the repayment period for Citibank's personal loan programs?

The repayment period for Citi Speedy Cash ranges from 6 to 60 months, while Citi Card Debt Consolidation Loan provides a choice between 6 to 72 months.

Will Citibank check TU records or credit scores?

Yes, applying for a Citi personal loan involves a review of applicants’ credit records, including information about their credit accounts, overdue accounts, credit inquiry records, past repayment details, etc.

What is the Citibank loan hotline?

You can call the Citibank loan hotline at (852) 2963 6477 to apply for a loan from Monday to Friday, between 9:00 a.m. and 7:00 p.m. Applying through MoneyHero will net you more rewards versus applying through phone.

Interest rates of Citibank’s loans

Citi Tax Season Loan boasts a competitive APR as low as 1.78%. This rate stands out as one of the lowest among bank loans, significantly lower than Standard Chartered's personal loan at 1.85%, HSBC's Personal Instalment Loan at 2.25%, and Bank of East Asia's Tax Season Loan at 5.63%.

Citi Card Debt Consolidation Loan is available at APRs starting from 8.64%, which is higher than most other debt consolidation loans offered in the market. For instance, this rate is higher than Hang Seng Bank's Debt Consolidation Instalment Loan at 4.65% and Bank of China's Express Cash Instalment Loan Balance Transfer at 5.93%, but lower than the 7.19% offered by China CITIC Bank International’s $mart Plus Personal Instalment Loan.

Approval time for Citibank’s personal loans

Upon submission of the required documents for a loan application, whether it is done online, through the loan hotline, or in person at Citibank, customers can expect a dedicated loan officer to follow up on their application within 1 to 3 business days. This will be regardless of the application’s outcome. The loan officer will then initiate a telephone confirmation process and assist with the loan disbursement procedures.

For applications and document submissions completed before 10:00 a.m. on a business day (Monday to Friday), it is possible to get same-day approval and disbursement of loan.

Use of Citi’s loans

There are no restrictions on how to use the personal loans offered by Citibank. Customers can consider Citi Speedy Cash for those who require cash flow for marriage, investments, car purchase, home renovations, further education, medical expenses, and more. For consolidating debts and settling credit card balances, Citi Card Debt Consolidation Loan is a suitable option. While customers can choose the Citibank loan programs based on their individual needs, it should be noted that the monthly flat rate and APR may vary depending on individual financial circumstances.

How to apply for Citibank personal loan?

- Click on MoneyHero’s “Apply Now” button, enter your email to get started on your reward journey and go through to the Citibank website

- Click on "Apply Now" and provide your personal information, including your name, mobile phone number, and email address

- Select the loan amount and repayment period

- Submit the required supporting documents

- After submitting the application, the loan can be approved and disbursed as quickly as the same day.

Application requirements and documents needed for Citibank’s loan application

Citibank personal loans have relatively little application requirements. Applicants only need to be permanent residents of Hong Kong aged 18 or above, employed for a minimum of 3 months in their current job, and have a monthly salary of HK$6,000 or above to qualify for the loans.

To complete the application for a Citibank loan, applicants are required to provide the following documents: Hong Kong permanent identity card, proof of address, income proof such as the most recent month's pay slip or the past 3 months' bank statements. Additionally, for the Citi Tax Season Loan, tax demand notes will also need to be submitted.

Citibank loan fees

Handling fee

Applying for a Citibank personal loan incurs no handling fees, and there are no hidden terms or conditions.

Early repayment fee

If a customer opts for an early repayment, a fee of typically 1.5% (depending on the remaining repayment period) will be charged based on the loan amount and the early repayment date.

Extension fee

If a customer wishes to change the loan's due date or extend the repayment term, an extension fee will be charged. If the request for an extension is made before the loan is disbursed, the fee will be calculated based on the number of days, loan interest, and the outstanding loan amount. The extension period cannot exceed 45 days. As for a request made after the loan has been disbursed, the customer will be charged the aforementioned "extension fee" as well as an additional HK$100 (in the event the desired new due date is more than 1 month away from the original date).